Roth IRA vs Traditional IRA – What Is Right For You?

An individual retirement account (IRA) is a personal retirement savings plan that offers specific tax benefits. In fact, IRAs are one of the most powerful retirement savings tools available to you. Even if you're contributing to a 401(k) or other plan at work, you might also consider investing in an IRA.

Contributions

Both allow you to make annual combined contributions of up to $6,000 in 2022 (unchanged from 2021). Generally, you must have at least as much taxable compensation as the amount of your IRA contribution. But if you are married filing jointly, your spouse can also contribute to an IRA, even if he or she does not have taxable compensation. Also, taxpayers aged 50 and older are allowed to make additional "catch-up" contributions. These folks can put up to an additional $1,000 in their IRAs in 2022 (unchanged from 2021).

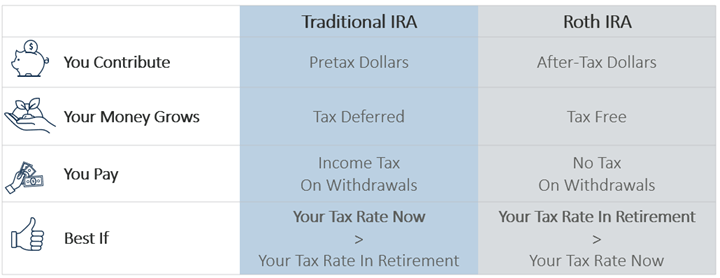

Both traditional and Roth IRAs feature tax-sheltered growth of earnings. And both typically offer a wide range of investment choices. However, there are important differences between these two types of IRAs. You must understand these differences before you can choose the type of IRA that may be appropriate for your needs.

Traditional IRAs

Fast Facts

- Individuals with taxable income can contribute with no age restriction

- $6,000 in 2022

- Earnings grow tax-deferred and are not taxed until distributed from the account

- Yearly contribution limits apply as determined by the Internal Revenue Service (IRS)

- Contributions must be made by April 15 tax filing deadline for prior year contributions

- Contributions maybe tax deductible based on participation in an Employer Sponsored Plan

- Penalties may apply for early withdrawal – prior to age 59½

- Yearly Required Minimum Distributions (RMDs) must begin at age 72

Practically anyone can open and contribute to a traditional IRA. The only requirement is that you must have taxable compensation. You can contribute the maximum allowed each year as long as your taxable compensation for the year is at least that amount. If your taxable compensation for the year is below the maximum contribution allowed, you can contribute only up to the amount you earned – example: if you made $4000 in taxable income this year, you could only contribute $4000 to your IRA for this year.

Your contributions to a traditional IRA may be tax deductible on your federal income tax return. This is important because tax-deductible (pre-tax) contributions lower your taxable income for the year, saving you money in taxes.

- What if neither you nor your spouse is covered by a 401(k) or other employer-sponsored plan?

- You can generally deduct the full amount of your annual IRA contribution.

- What if one of you is covered by such a plan?

- Your ability to deduct your contributions depends on your annual income (modified adjusted gross income, or MAGI) and your income tax filing status. You may qualify for a full deduction, a partial deduction, or no deduction at all.

|

Traditional IRAs - Tax Year 2022 |

||

|

Individuals Covered by an Employer Plan |

||

|

Filing status |

Deduction is limited if MAGI is between: |

No deduction if MAGI is over: |

|

Single/Head of household |

$68,000 - $78,000 |

$78,000 |

|

Married joint* |

$109,000 - $129,000 |

$129,000 |

|

Married separate |

$0 - $10,000 |

$10,000 |

|

* If you're not covered by an employer plan but your spouse is, your deduction is limited if your MAGI is $204,000 to $214,000 and eliminated if your MAGI exceeds $214,000. |

||

What happens when you start taking money from your traditional IRA? Any portion of a distribution that represents deductible contributions is subject to income tax because those contributions were not taxed when you made them. Any portion that represents investment earnings is also subject to income tax because those earnings were not previously taxed either. Only the portion that represents nondeductible, after-tax contributions (if any) is not subject to income tax. In addition to income tax, you may have to pay a 10% early-withdrawal penalty if you're under age 59½, unless you meet one of the exceptions. For details on these exceptions, please visit the IRS website.

If you wish to defer taxes, you can leave your funds in the traditional IRA, but only until April 1 of the year following the year you reach age 72. That's when you have to take your first required minimum distribution (RMD) from the IRA. After that, you must take a distribution by the end of every calendar year until your funds are exhausted or you die. The annual distribution amounts are based on a standard life expectancy table. You can always withdraw more than you're required to in any year. However, if you withdraw less, you'll be hit with a 50% penalty on the difference between the required minimum and the amount you actually withdrew. (Note: If you reached age 72 before July 1, 2021, you will need to take an RMD by December 31, 2021.)

Roth IRAs

Fast Facts

- Eligibility based on taxable income within certain limits

- Earnings grow tax-deferred

- No age limit for contributions

- Contributions made with post-tax dollars so contributions are not tax deductible

- Contribution must be made by April 15 tax filing deadline for prior year contributions

- Contribution amounts always distributed tax free and penalty free

- Qualified Distributions are tax-free if certain requirements are met

- Penalties may apply for early withdrawal (prior to age 59½)

- No Required Minimum Distributions (RMDs)

Not everyone can set up a Roth IRA. Even if you can, you may not qualify to take full advantage of it. The first requirement is that you must have taxable compensation. If your taxable compensation is at least $6,000 in 2022, you may be able to contribute the full amount. But it gets more complicated. Your ability to contribute to a Roth IRA in any year depends on your MAGI and your income tax filing status. Your allowable contribution may be less than the maximum possible, or nothing at all.

|

Roth IRAs — Tax Year 2022 |

||

|

Filing status |

Contribution is limited if MAGI is between: |

No contribution if MAGI is over: |

|

Single/Head of household |

$129,000 - $144,000 |

$144,000 |

|

Married joint |

$204,000 - $214,000 |

$214,000 |

|

Married separate |

$0 - $10,000 |

$10,000 |

Your contributions to a Roth IRA are not tax deductible. You can invest only after-tax dollars in a Roth IRA. The good news is that if you meet certain conditions, your withdrawals from a Roth IRA will be completely free of federal income tax, including both contributions and investment earnings. To be eligible for these qualifying distributions, you must meet a five-year holding period requirement. In addition, one of the following must apply:

- You have reached age 59½ by the time of the withdrawal

- The withdrawal is made because of disability

- The withdrawal is made to pay first-time homebuyer expenses ($10,000 lifetime limit from all IRAs)

- The withdrawal is made by your beneficiary or estate after your death

Qualified distributions will also avoid the 10% early withdrawal penalty. This ability to withdraw your funds with no taxes or penalty is a key strength of the Roth IRA. And remember, even nonqualified distributions will be taxed (and possibly penalized) only on the investment earnings portion of the distribution, and then only to the extent that your distribution exceeds the total amount of all contributions that you have made.

Another advantage of the Roth IRA is that there are no required distributions after age 72 or at any time during your life. You can put off taking distributions until you really need the income or you can leave the entire balance to your beneficiary without ever taking a single distribution.

Making the choice

Assuming you qualify to use both, which type of IRA might be appropriate for your needs? The Roth IRA might be a more effective tool if you don't qualify for tax-deductible contributions to a traditional IRA or if you want to help reduce taxes during retirement and preserve assets for your beneficiaries. But a traditional deductible IRA may be a better tool if you want to lower your yearly tax bill while you're still working and possibly in a higher tax bracket than you'll be in during retirement. If you are struggling to decide, we’d be happy to help. Schedule your appointment here

You can have both a traditional IRA and a Roth IRA, but your total annual contribution to all of the IRAs that you own cannot exceed the annual contribution limit.

Jake Kopczyk, AAMS®

Financial Advisor

| Schedule Your Appointment Today