You Can Never Be Too SAFE

Back in April we sent out an email to all of our Weiss Wealth Strategies clients introducing a complimentary membership to EverSafe. Having personally been the attempted victim of two credit card frauds in the past few months, I thought I would write about how EverSafe alerted me to the activity and how I was able to easily stop the fraud before it happened.

From our earlier email…

Identity theft, financial fraud and persistent scamming are as prevalent as ever. Contending with these risks and safeguarding your hard-earned assets is challenging in its own right. If you have adult children or aging parents to keep an eye on, your financial caregiving responsibilities can be both stressful and time-consuming.

We are excited to introduce you to EverSafe, an easy-to-use tool designed to help protect your family’s financial health. EverSafe monitors more than just credit. It analyzes bank, investment, retirement, credit card and credit bureau activity daily, and alerts you and your designated trusted contacts to any unusual activity.

EverSafe’s proprietary technology provides:

- Financial account preservation (savings, checking, investment, retirement, credit cards)

- Credit protection (credit bureau and credit data)

- Daily scans of the dark web

- Consolidated view of financial transactions and statements

- Family support – exclusive alerts are sent to you and your designated contacts

With round-the-clock protection, EverSafe identifies unusual financial transactions suggestive of scams or fraud, erratic investment activity, potential account takeover, changes in spending, upcoming unpaid bills, missing deposits and much more.

EverSafe’s exclusive trusted contact feature supports the designation of one or more individuals to act as an “extra set of eyes” in monitoring your accounts, no matter where the individuals are located.

In the past few months, I have experienced someone try to open a credit card in my name at Bank of America (I have no relationship there) and even more recently at Nordstrom (my wife shops there occasionally and has her precious points account there, but I do not). In both cases, EverSafe alerted me via email that I had a credit inquiry from each institution and provided me the phone number to contact them if was not initiated by me. Both of these attempts were squashed within minutes of me making the phone call. While this process is aggravating and felt invasive, it is comforting to know that I have a “lifeguard watching my pool,” and blowing the whistle when bad behavior appears.

EverSafe alerts will need to be customized so you do not get an overwhelming number of emails, but after a few adjustments, they are not problematic and are, for me, a nice reminder that someone is watching out for my financial well-being.

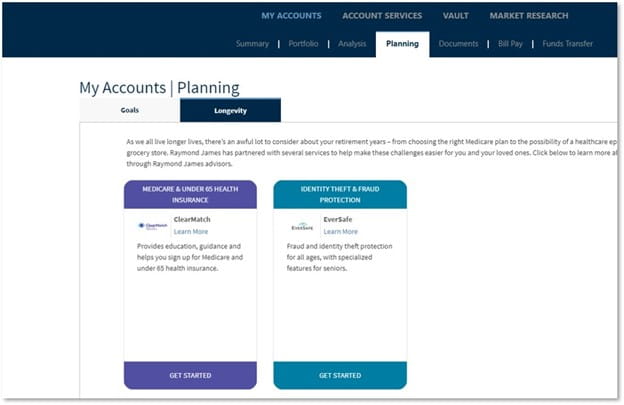

If you are interested in having the complimentary offer sent to you again, please contact anyone on our team and we will send you the introductory email…it has a link to click on to get started and a toll-free concierge number if you need assistance. This service is not a “one year” membership; we have purchased this for our clients for the foreseeable future (we see it as a nice “value-add”). We also added a link to the Client Access website under the MY ACCOUNTS/PLANNING tab:

I highly recommend you take advantage of this offer…it has saved me a lot of anguish already!

My entire team at WWS wishes all of you a joyous holiday season and a healthy and happy 2025!

-Gary Weiss, December 2024

The website links are provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any third-party web site or their respective sponsors. Raymond James is not responsible for the content of any web site or the collection or use of information regarding any web site's users and/or members.