Uncle Sam: Stop Spending

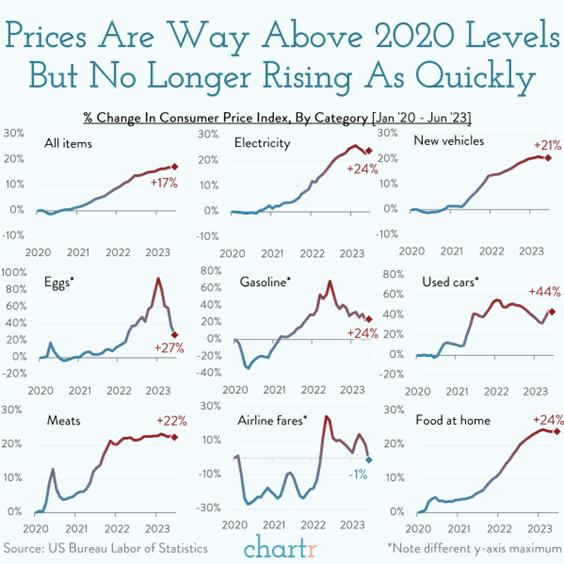

“Prices of most of the things we buy are much higher than where they were 3 years ago” – Captain Obvious

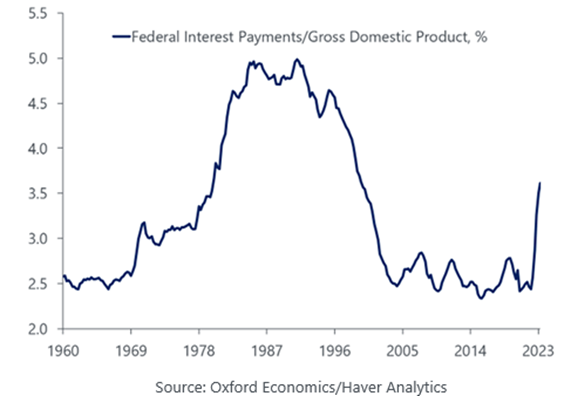

And as prices have risen (inflation), the Federal Reserve has increased interest rates in an effort to avoid runaway inflation. This is normal monetary policy.

What has not been normal has been our nation’s fiscal policy. Our government continues to overspend ridiculously. And make no mistake, the overspending has been a problem regardless of what political party controlled the White House or Congress. This behavior has created an issue where the interest our government is paying (out of your tax dollars) on the debt has spiked in a big way….

Right now, approximately 1 out of every 10 dollars the US government collects in taxes is used to pay interest on the debt. While frustrating, it is manageable.

But if inflation doesn’t recede, and/or the politicians keep spending like drunks, it’s possible in the next 20 years that 4 out of every 10 dollars of your tax money gets spent to pay the interest owed on the debt. If that happens, there are only 2 main ways to fix the problem.

- Raise taxes dramatically

- Cut government spending in a slash and burn style

Or both.

It will never happen, but it sure would be nice to have Warren Buffett’s Debt-To-GDP Law enacted:

“I could end the deficit in 5 minutes. You just pass a law that says that anytime there is a deficit of more than 3% of GDP all sitting members of congress are ineligible for reelection. Then the politicians would have a strong incentive to behave better.” – Warren Buffett

Authors: Rick Wagner & Keith Wagner