Should I Give $ To Charity?

“Should I give money to charity?”

This is another frequently-asked-question we field here at WWM.

Remember, before you give $ away, keep these 2 important rules in mind:

Never give a gift which….

- You cannot afford

- Will do more harm than good

Should you gift Cash or Securities?

GIFT CASH: Per the IRS, you can give cash to charity in any given year and deduct up to 60% of your gift from your income taxes. Your tax deduction will range between 20% and 60%, depending on the type of contribution, and the organization to which you are giving the money.

GIFT SECURITIES: Instead of gifting cash, you could gift highly appreciated securities. Did you buy Apple stock in 1985 in a taxable account, and hold it until today? Boom. You likely are able to donate some of the Apple shares to charity, take the tax deduction, and avoid the capital gains tax hit on selling the shares.

How Can I Make Charitable Giving Easy?

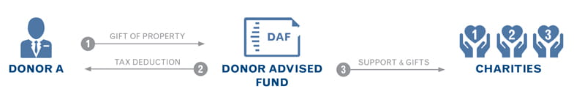

Ask us to open your Donor Advised Fund (DAF). Our clients use DAFs because they are simple, enable super easy tracking of contributions, and offer a massive list of charities for donations. They look and feel a lot like an IRA account.

Here's how it works:

- You make a contribution to the DAF (once a contribution is made, it cannot be reversed back out). You can contribute once, multiple times, this year and next, skip a year, whatever. Contributions are made whenever you desire.

- You are eligible for the tax deduction immediately, in the year you made the contribution to the DAF

- Your contribution can be invested and grow for the future, and the growth is tax-free

- Then you can make grants to qualified charities whenever you like. And the list of qualified charities is absolutely gigantic.

Many business owners facing a liquidity event (i.e. selling their business) will leverage a Donor Advised Fund. They will do so by donating some of the highly appreciated equity from their business ahead of the sale, so they can avoid the capital gains tax….and get a tax deduction against their income.

There are many other more complex strategies for charitable giving. Here are just a few….

- Charitable Remainder Trusts

- Charitable Remainder UniTrusts

- Charitable Lead Trusts

- Private Foundations

The topic of charitable giving is vast. If you wish to explore charitable giving more deeply, we will be happy to schedule a call or meeting with you and your tax professional.

Authors: Rick Wagner & Keith Wagner

Source: The Internal Revenue Service.

The views expressed herein are those of the author and do not necessarily reflect the views of Raymond James & Associates or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

The investments listed may not be suitable for all investors. Raymond James & Associates recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.

Raymond James & Associates and its affiliates do not provide tax or legal advice. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.