Dysfunctional Swamp 2022

This is very important: regardless of what your TV or the internet tell you, politics only play a small part in stock market movement. Stocks move based on millions of pieces of information, and politics represent only a small fraction of that data.

It can be maddening, because stock market returns are so random. As humans and investors, our brains crave some kind of “If X happens, then Y will occur” formula to try to explain how stocks move. It makes us feel better. But it doesn’t help us navigate the markets successfully.

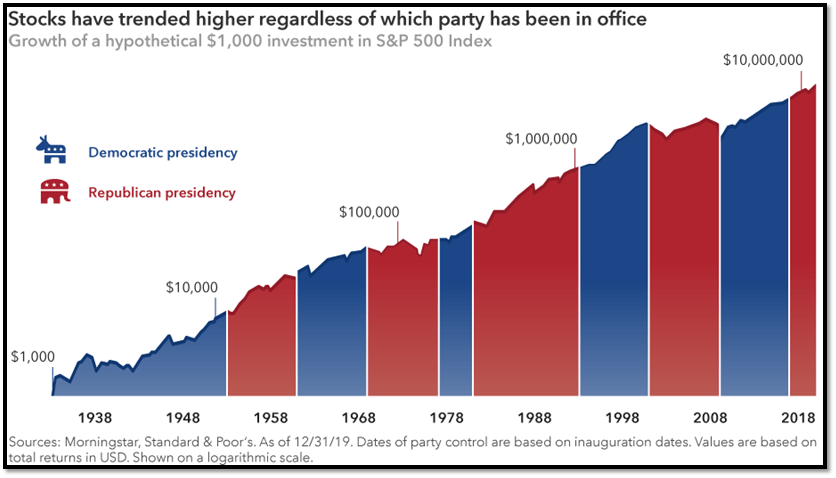

Has it mattered if a Democrat or a Republican was in the White House? Not really. Witness the chart below, which shows growth over time in the stock market through all the various White House occupants from 1938 to the start of 2020.

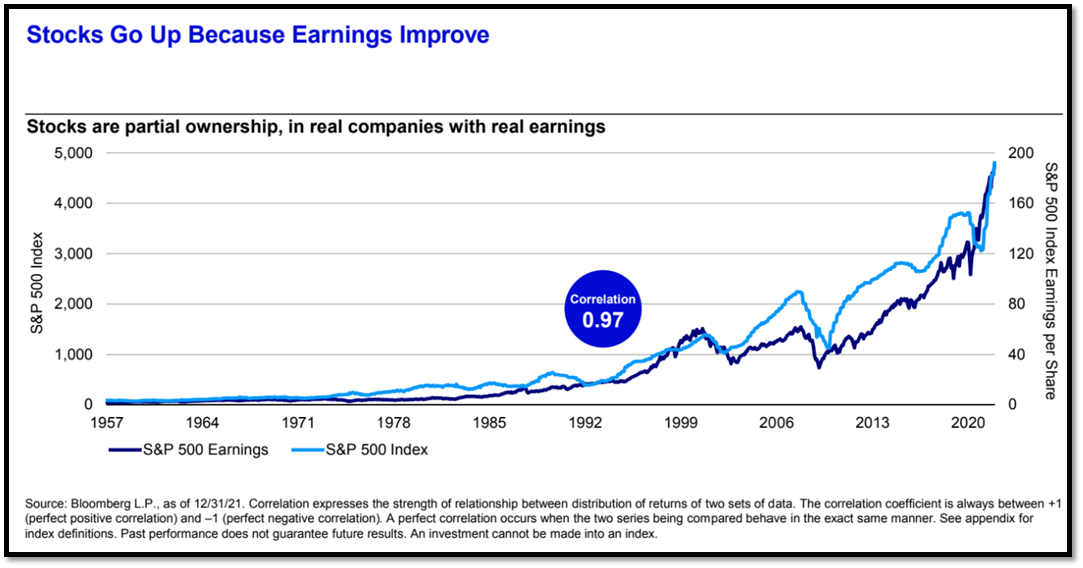

In fact, company earnings are much more influential on stock prices than politics...

(Source: Invesco)

Don't let Washington sway your investment decisions. Many would agree that it has been a dysfunctional swamp of disappointment since 1789, and stocks have done well since.

Read last election's market predictions and you'll never again take this election's market predictions seriously.………

MARCH 2009

It’s probably hard to recall this fact, but the pundits repeatedly questioned Obama’s policies with regards to the markets. Michael Boskin of Stanford’s Hoover Institution wrote an article in the Wall Street Journal on March 6, 2009 titled: “Obama’s Radicalism Is Killing the Dow.”

Inside he opined……

It’s hard not to see the continued sell-off on Wall Street and the growing fear on Main Street as a product, at least in part, of the realization that our new president’s policies are designed to radically re-engineer the market-based U.S. economy…

Amazingly, this and many articles like it, were published within a week or two of stocks beginning a decade-plus of sustained gains. The Dow was at about 7,000 when Boskin’s piece was published, and the Dow was at about 19,000 when Obama’s presidency ended. (source: FactSet)

FEBRUARY 2016

In early 2016, the S&P 500 got hit pretty hard, touching new 52-week lows in January and February. Business TV flooded the air with bearish pundits saying this was evidence that the market was going much lower.

Near the market’s lows in February, the Barron’s cover here started stoking the fear of politics. Barron’s headline read “Trump, Sanders: Are They Killing The Market?”

The talking heads suggested that political risk was high, and investors would do well to sit out the year and wait for the “uncertainty” to abate. But by the end of 2016, the stock market was up +12%. (S&P 500 Index. Source: FactSet)

NOVEMBER 2016

When the world realized Donald Trump would beat Hilary Clinton on election night 2016, the overnight stock futures market got smoked. The Dow was down 750 points (about -4%) overnight.

The next day Paul Krugman from the New York Times made the following prediction:

Still, I guess people want an answer: If the question is when markets will recover, a first-pass answer is never. The disaster for America and the world has so many aspects that the economic ramifications are way down my list of things to fear.

Dallas Mavericks owner Mark Cuban said the following here before Trump was elected:

In the event Donald wins, I have no doubt in my mind the market tanks. If the polls look like there’s a decent chance that Donald could win, I’ll put a huge hedge on that’s over 100% of my equity positions… that protects me just in case he wins.

What happened? Stocks popped right back up within a day. And since that day in 2016, the Dow Jones Industrial Average has plodded higher from about 19,000 to over 29,000. (source: FactSet)

Our team at Wagner Wealth Management is here to help you whenever you need us.

The views expressed herein are those of the author and do not necessarily reflect the views of Raymond James & Associates or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

The Standard & Poor's 500 Index is a market capitalization weighted index of the 500 largest U.S. publicly traded companies by market value.

The Dow Jones Industrial Average is a price-weighted index that tracks 30 large, publicly-owned companies trading on the New York Stock Exchange and the NASDAQ. An investment cannot be made directly in a market index.

The investments listed may not be suitable for all investors. Raymond James & Associates recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize, or sponsor, any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members.