Reasons

Yep – no fun this year. The S&P 500 stock index is down about -23% from its high, which was set near the beginning of this year. And the EAFE international stock index is down about -30% from its high. (source: FactSet).

There is no way around it. Down cycles are painful. Every one is unique in its own way, and at the time makes lots of investors question their own beliefs. Or even worse, throw logic and discipline out the window. Let fear take over, and make a big mistake.

Have we seen this before? There have been 30 declines of -20% or more in the S&P 500 index since 1926 (source: Ned Davis Research). So historically, yes. We have seen this type of down cycle about 1 time every 3 years since 1926. It’s a miserable part of the process of seeking inflation-beating growth over time.

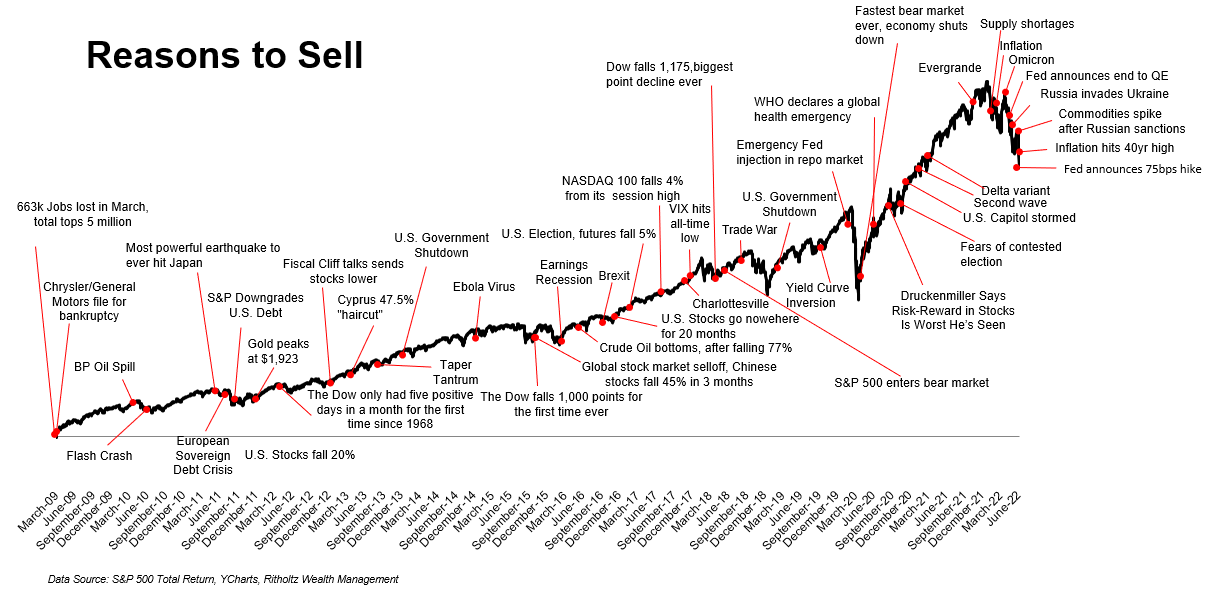

Each down cycle comes with its own “Reasons to Sell”, as the excellent graphic below from Michael Batnick illustrates. And yet the Dow Jones Industrial Average has plodded from 7,000 in 2009, to 15,000 in 2013, and to about 29,300 today.

If history is any guide, this down cycle will end well before the news-of-the-day tells us it should. And the next up cycle will begin in earnest while we are all still fearful and uncomfortable. The markets have done wonderful things in building wealth for so many, but they have never made it easy.

Our team is here to help you as always. Please reach out to us if you have any questions, or concerns.

The views expressed herein are those of the author and do not necessarily reflect the views of Raymond James & Associates or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Investing involves risk and investors make incur a profit or loss.

The Standard & Poor's 500 Index is a market capitalization weighted index of the 500 largest U.S. publicly traded companies by market value.

The Dow Jones Industrial Average is a price-weighted index that tracks 30 large, publicly-owned companies trading on the New York Stock Exchange and the NASDAQ.

The MSCI EAFE (Europe, Australasia, and Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the United States & Canada. The EAFE consists of the country indices of 22 developed nations.

Individuals cannot invest directly in an index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary.

The investments listed may not be suitable for all investors. Raymond James & Associates recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.