Half A Baseball Season

“Stocks wouldn’t offer such wonderful long-term returns if you didn’t hate yourself for owning them at least some of the time.”

Ben Carlson

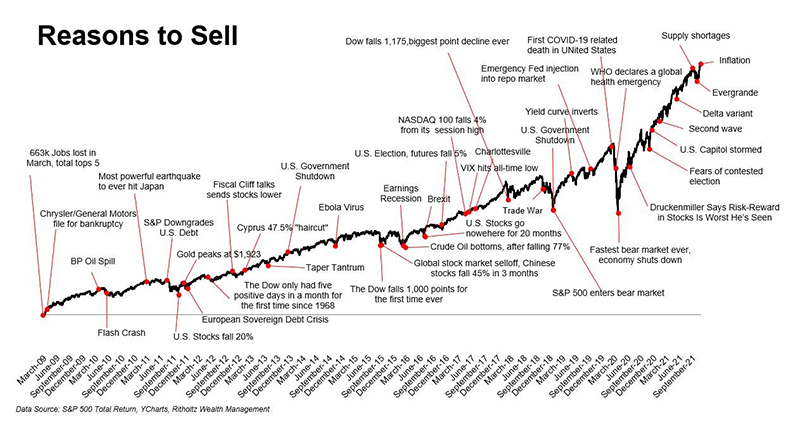

Almost 2 years ago, the markets forced us to endure the brutal pandemic-related down cycle. It was rapid and deep, and the up cycle which followed arrived lightning fast. Here we are today, navigating another selloff (albeit one which, so far, has been more mild).

And each time, it is super easy to dig through the news and rationalize why it makes sense to “sell everything and wait ‘til things feel better”….

Large-Cap US Stocks, as measured by the S&P 500 Index, have fallen about -6% from their recent highs set on December 27th, 2021.

Even after this -6% decline from the recent high, the S&P 500 stock index is still up about +270% over the last 10 years.

A -6% temporary decline from the recent high like the one we are in is very common, but never fun.

Going back to 1928, we have seen this happen about every 4 months, on average. That’s about one-half as long as a baseball season. (source for all above data: Thomson, Inc.)

Again, going back to 1928, when we have previously seen -6% declines, 93% of the time stocks were up 1 year later. With a median gain of +9.1%. While nobody at all can predict exactly what will happen or when, we do know that temporary miserable down cycles in stocks have historically eventually been followed by gains. (source: Bespoke, Inc.)

An important item of note: for many of our clients, times like these are exactly why we have a portion of your portfolio in highly-rated bonds. Often bonds have acted as partial stabilizers when stocks experienced a down cycle. Don’t forget that your portfolio likely has an allocation to bonds, by design.

As always, we are here to help you when you need us.

The views expressed herein are those of the author and do not necessarily reflect the views of Raymond James & Associates or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

The Standard & Poor's 500 Index is a market capitalization weighted index of the 500 largest U.S. publicly traded companies by market value. An investment cannot be made directly in a market index.

The investments listed may not be suitable for all investors. Raymond James & Associates recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.