Rising Interest Rates and Bonds

Interest rates have been rising for almost 2 years now. If you bought a 10-year US Government Bond in March 2020, that bond would pay you interest of 0.4%/year. Today that same bond pays about 1.7%/year. (source: Thomson, Inc.)

If you own bonds as a part of your portfolio, the tough part about rising interest rates is they can make your existing bond values sag a bit. This is a natural part of the process, but it can be temporarily uncomfortable.

Bonds are essential for many portfolios. They pay interest, and historically have acted as partial stabilizers when stocks have gone through a rough patch.

When interest rates are going up, bond returns may be low or even slightly negative, but their low volatility and diversification benefits endure.

In fact, multi-year returns on bonds can actually be enhanced by rising rates…..simply because you have the ability to start collecting more interest on your bonds.

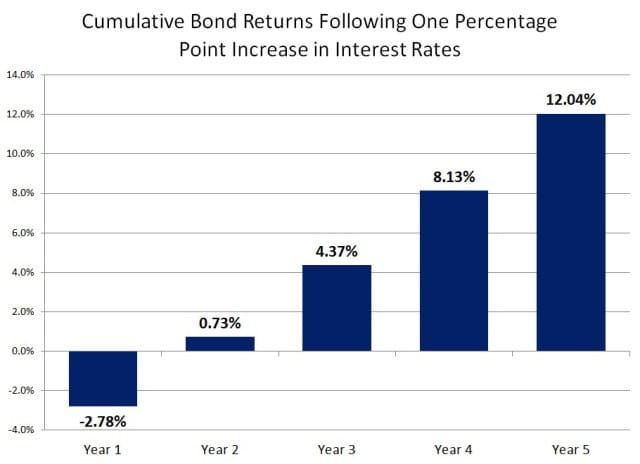

The image below shows the impact of interest rates rising 1% on the Bloomberg U.S. Aggregate Bond Index:

(source: Bespoke, Inc.)

Yes, the one percentage point increase in interest rates results in a small temporary decline for Year 1. But in this example by Year 2 the cumulative return goes positive because interest and principal are being reinvested at higher rates. Over time, the cumulative return grows even more as the benefit of higher interest rates compounds.

Think of it this way: would you rather own a bond that pays you 3%/year or a bond that pays you 5% or 6%/year? The temporary short-term sag in bond values is the small frustration we endure to eventually get to that higher longer-term interest we receive.

The views expressed herein are those of the author and do not necessarily reflect the views of Raymond James & Associates or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

The investments listed may not be suitable for all investors. Raymond James & Associates recommends that investors independently evaluate particular investments, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment will depend upon an investor's individual circumstances and objectives.

The Bloomberg U.S. Aggregate Bond index is a measure of the investment grade, fixed-rate, taxable bond market of roughly 6,000 SEC-registered securities with intermediate maturities averaging approximately 10 years. The index includes bonds from the Treasury, Government-Related, Corporate, MBS, ABS, and CMBS sectors. It is unmanaged and cannot be invested into directly.

Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.