Income to Wealth to Income

What you focus on expands. If you focus on being optimistic, your optimism will expand. Conversely, if you focus on your problems, your problems will expand. What you focus on expands. Sometimes the expansion of what you focus on will take years to unfold. That is the beauty of discipline, patience, and planning.

For most folks, creating wealth is something that takes years and decades to unfold. However, if you focus on wealth creation, it will expand. Now a couple of points of clarification here. I am not advocating one to be obsessed with money. Second point is that wealth is not the end all. You may have heard the saying, he or she who dies with the most money wins. I would argue, rather, he or she that has the proper balance between wealth, health, and time wins! Wealth is no more than a means to be able to carry out a work optional lifestyle or tip one over to financial independence. Therefore, giving one more of an opportunity to enjoy their personal time and good health, along with their wealth.

What you focus on expands. Ultimately, most of us would like to create enough wealth to make work an option. To get there in the first place, you need to create a plan and have the discipline to stick to it. And, most importantly, have the patience to know the plan will work through time.

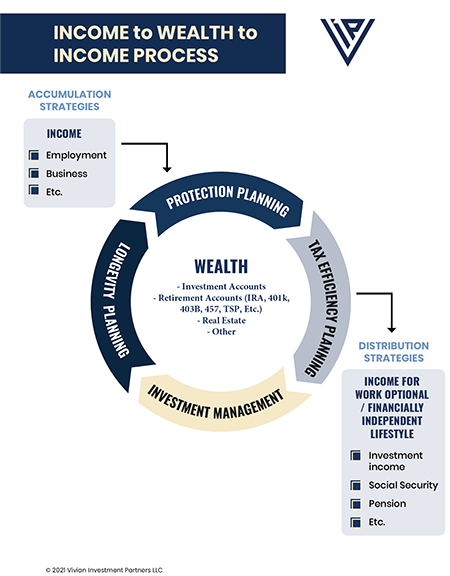

Wealth creation is the process of directing the appropriate amount of income and applying the right strategies to build wealth. Examples of wealth accumulation strategies include funding a retirement account, investing in real estate, buying stocks in a brokerage account, knowing what your number is (your target wealth point, by when AND why), leveraging tax efficient opportunities, etc.

Taken as whole in a well thought out and strategic plan, wealth for a work optional lifestyle and/or financial independence can be created. The planning and strategic thinking does not stop once enough wealth is achieved to make work optional. At this stage, you are no longer working for your money. Your money is now working for you. Now you should direct your attention toward wealth protection plans, continue to become more tax efficient, decide upon proper investment management processes moving forward and income planning for the long haul.

This leads us to the distribution stage of your wealth. The specialized set of strategies, planning, and thought that goes into replacing employment income with your wealth are entirely different than that of using income to create wealth during the accumulation stage. The thought process must pivot to protecting income, accounting for inflation, eliminating down turns in the value of your wealth, health care costs, and other “blind spot” occurrences that can compromise your work optional status and/or financial independence. During the distribution stage, it’s not about what you make, it’s about what you keep and protect.

No matter the stage you are currently in, whether it be the accumulation or distribution stage, applying the right thought process and strategies can bring you closer to or even preserve your work optional lifestyle status and financial independence. What you focus on expands.

Any opinions are those of Mark Vivian and not necessarily those of Raymond James. Investing involves risk and you may incur a profit or loss regardless of strategy selected.