Our investment planning process

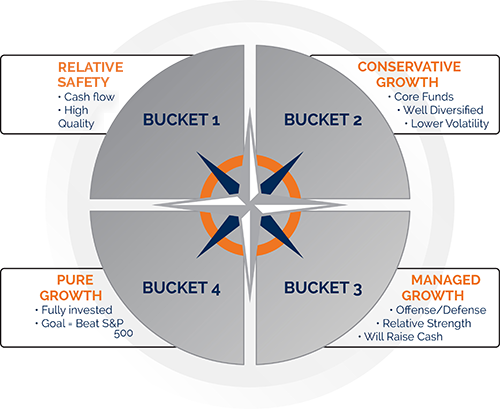

Our goals are to help match your investment choices with the rate of return you need to accomplish your financial goals and to fit within a level of risk with which you feel the most comfortable. To help explain the expected growth for different investments at different levels of risk, we created what we call the “Four Buckets of Investments.”

Bucket one – lower risk

This bucket is used for cash flow with investments made in high-quality, lower-risk instruments. These types of investments include CDs and municipal bonds.

Bucket two – conservative growth

In this bucket we invest in a group of mutual funds that are very well diversified. We understand we are giving up the potential for greater returns for the advantage of owning a historically less-volatile portfolio.

Bucket three – managed growth

We use non-correlating asset classes – so that an economic factor that affects one has less chance of affecting another – to attempt to reduce overall volatility. We believe it is important to be fully invested at times as well as raise cash at times. In this bucket, we invest in US stocks, international stocks, fixed income products, currencies, commodities and cash.

Bucket four – pure growth

Investments in this bucket are meant to compete with the return of the S&P 500. We invest in individual stocks in this bucket.

Past performance may not be indicative of future results. Investing involves risk including the potential loss of capital. Diversification and asset allocation do not guarantee a profit nor protect against loss. Holding bonds to maturity allows redemption at par value. However, if bonds are sold prior to maturity, proceeds may be more or less than your initial investment. The S&P 500 is an unmanaged index of 500 widely held stocks. Investments cannot be made directly in the index.

There is no assurance any investment strategy will be able to meet its objectives.