PCE, CPI? Oh my! | Decoding inflation measures

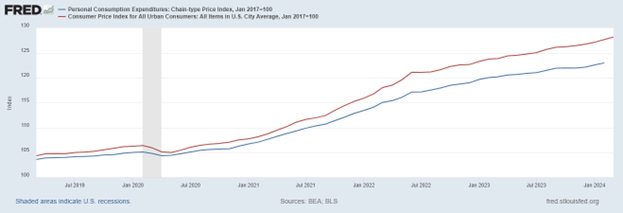

The CPI and PCE plotted against each other, indexed to 2017 prices. Created in FRED.

There are several measures of inflation, but two of the most commonly reported are the CPI (Consumer Price Index) and the PCE (Personal Consumption Expenditures Price Index.) Each index contains two separate measures: headline inflation and “core” inflation.

So, since they both report inflation and are similar in composition, are the CPI and PCE interchangeable?

The short answer is “no.” The long answer is, “they measure different things.” To make matters more confusing, the Federal Reserve typically reports the PCE, while media outlets often use the CPI. With inflation in the news again this month, we thought we would walk you through these two indexes and what they do.

Consumer Price Index (CPI)

The Consumer Price Index (CPI) is compiled by the Bureau of Labor Statistics. Each month, the BLS collects roughly 94,000 prices for consumer goods and services and 8,000 rental housing quotes each month from across the country in their CPI survey. Then, they weight each item according to its relative importance. The result is a “bundle of goods” representative of US consumer spending, and the percentage change in price of that bundle is reported as the rate of inflation.

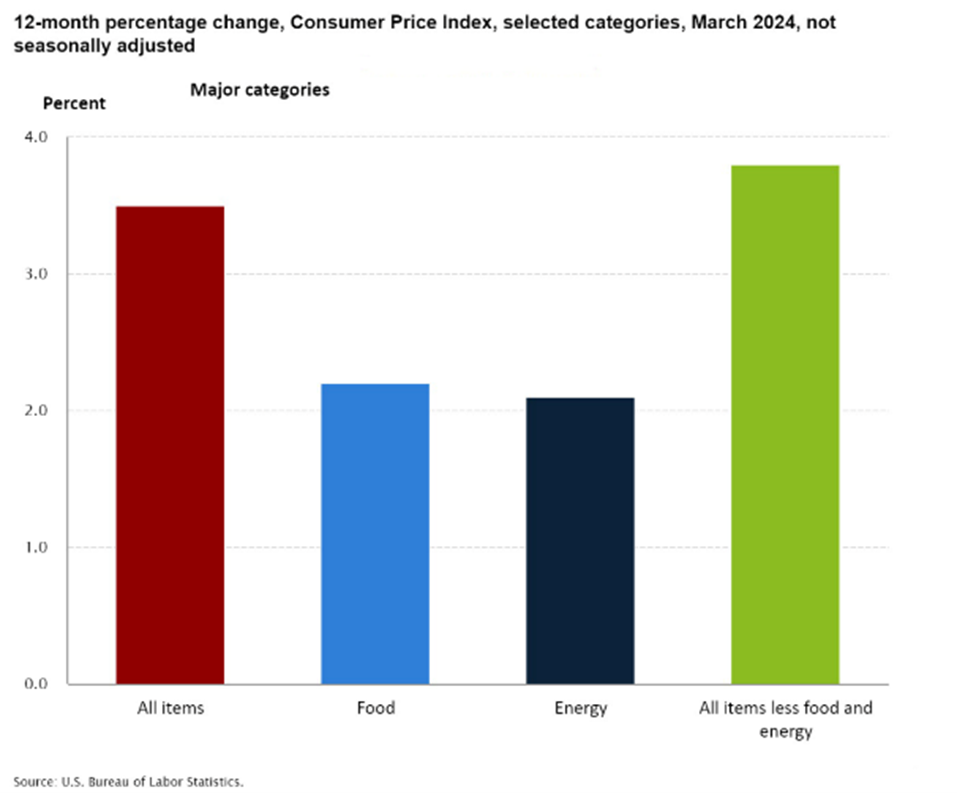

The CPI is reported in two different ways: core CPI, and “headline” or “overall” CPI. The core CPI removes food and energy prices, which tend to be volatile. The core CPI is easier for policymakers to use as a gauge. Headline CPI unadjusted and inclusive of most aspects of the economy which may be affected by inflation, making it more reflective of what consumers experience. Headline CPI is typically reported year-over-year and tends to be above core CPI.

The CPI is often used in fiscal policy, i.e. policy related to taxes and expenditures. For example, Social Security is adjusted for inflation using CPI figures.

Personal Consumption Expenditures Price Index (PCE)

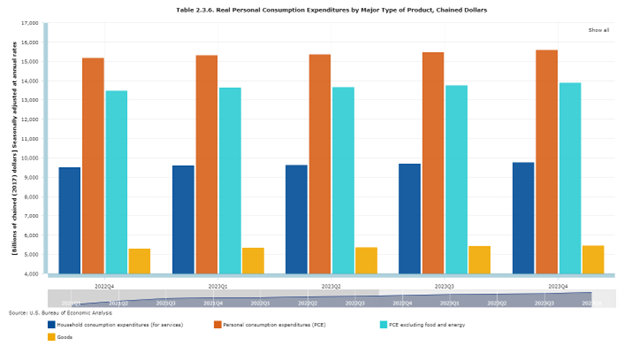

The PCE measures actual purchases by US residents for personal use, and the price changes in those goods and services. The PCE allows the weights it assigns to certain goods and services to fluctuate based on spending in that category. For example, if the price of beef goes up and people begin substituting chicken instead, the PCE is reweighted to reflect that shift. PCE data is gathered from a survey of US businesses.

The PCE is the inflation measure used most heavily in monetary policy. It’s the figure the Fed uses in its quarterly summary of economic projections, and the inflation rate the Fed uses in its inflation targeting. The PCE also has a core and headline interpretation; the Fed typically uses the core in short-term contexts and headline (or overall) PCE in its long-term policymaking.

Which one you should pay attention to and when

Well, it depends on what you are looking at. If you are interested in which way the Federal Funds Rate may track, you’d pay closer attention to the PCE. On the other hand, if you are a Social Security recipient or curious about an inflation adjustment to your federal benefits or taxes, the CPI is probably better for your purposes.

The bottom line

The CPI and PCE both measure inflation, but they differ in how the underlying information is gathered and in what circumstances they are used. The CPI surveys prices of goods and services from around the country, while the PCE measures the actual spending on those categories and how that spending changes over time. Each measure has a “core” version which removes food and energy due to their volatility, and a “headline” version which is inclusive of those elements. Generally speaking, the CPI is used in federal taxation and spending decisions, while the PCE is used when the Federal Reserve sets interest rates.

We hope this helps make some sense of headlines (whether the news variety or the inflation indicator!) As always, if you have any questions, please feel free to reach out.

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Tomblin Diego Porter Investment Group of Raymond James, and not necessarily those of Raymond James.

Raymond James & Associates, Inc., member New York Stock Exchange/SIPC