How much does the average retiree spend each year?

According to the 2022 BLS Consumer Expenditure Survey, the average retiree has a pre-tax income of roughly $49,000 per year. Retirement income is typically from a combination of sources like Social Security benefits, asset income, retirement plans like 401(k)s, and pensions.

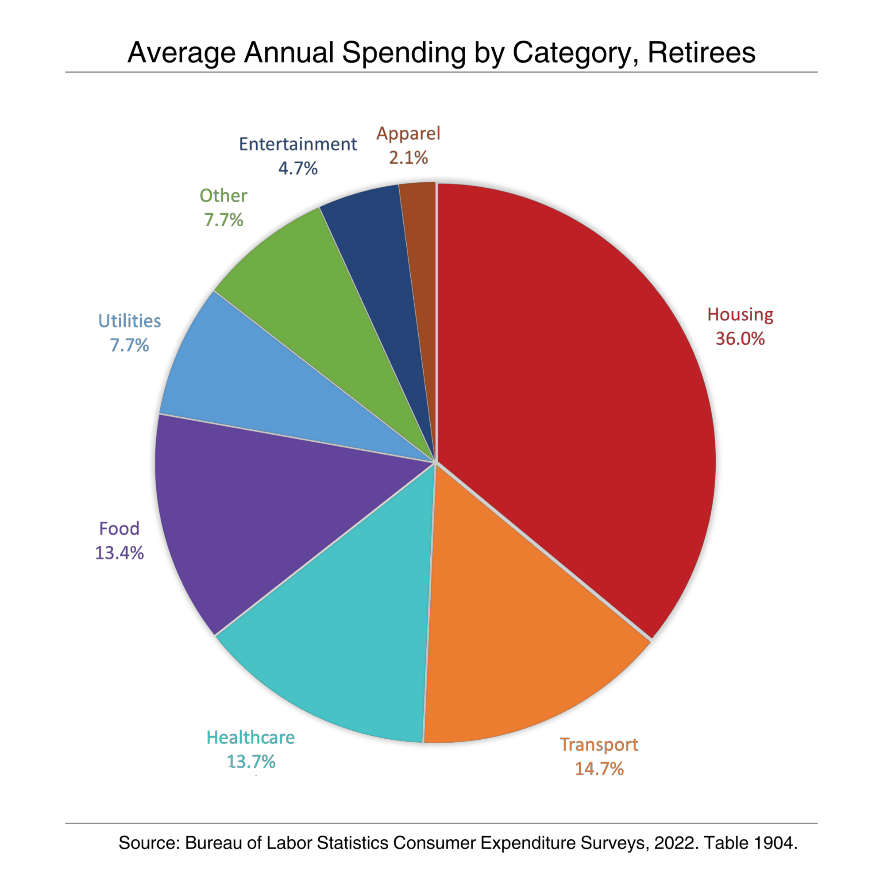

But how does the average retiree spend that income, and what areas make up the largest expenditures? Let’s take a look at the 2022 BLS report.

The average age of retirees surveyed was 73.7, with 44% of the sample composed of men and 56% composed of women, and average annual spending was around $55,000.

In 2022, housing composed the largest share of retirement spending at 35.6% (about $19,200) up slightly from 2021’s 34.9% (about $18,400.) The housing category is broad, including costs like rent and mortgage payments as well as other expenses like property taxes, housekeeping services and supplies, appliances, and furniture.

Transportation was the second largest expense for retirees, at 14.7% or roughly $8,000 for the year. This includes costs like vehicle purchases and maintenance, fuel, insurance, and public transportation.

Healthcare also makes it into the top three, coming in a tic below transportation at 13.7%, or about $7,500. The majority of that figure is health insurance ($5200), followed by medical services ($1200) and drug costs ($800.)

Now, it’s important to remember these are averages. Retirement income and spending can vary wildly from person to person, and your financial picture may look very different. However, it can be useful to get a picture of the proportions, especially for those still pre-retirement.

Above all, it’s critical to go into retirement with a plan. Life is notorious for throwing curveballs – no one can predict the future. But knowing where you stand relative to your goals and being informed about your options can make it much easier to weather the unexpected.

Disclosures:

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Tomblin Diego Porter Investment Group of Raymond James, and not necessarily those of Raymond James.

Raymond James & Associates, Inc., member New York Stock Exchange/SIPC