Relative strength investment strategies

One investing approach we believe can be effective in both rising and falling markets is point-and-figure methodology. Since the late 1800s, this technique has monitored supply and demand with an eye on developing trends. Charles Dow, the original editor of The Wall Street Journal, was the methodology's first proponent. Although he was a fundamentalist at heart, he still appreciated the merits of recording price action and understanding the supply and demand relationship in any investment. Despite being developed more than a century ago, this methodology — at its core remains a logical, organized way to record the supply and demand relationship in any investment vehicle.

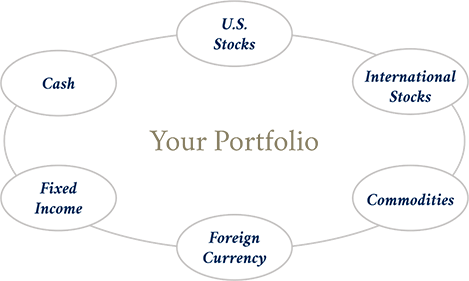

Many people consider investing to consist solely of buying stocks. Over the past 10 years, asset classes traditionally only accessed by large institutional investors have become available to a much wider audience. By broadening investment choices from only U.S. stocks to additional asset classes, including international stocks, commodities, currencies, fixed income and even cash alternatives, you have greater flexibility in your overall portfolio when U.S. equities are out of favor.

-

We do not rebalance on a systematic basis — as market leadership changes, so do our portfolio strategies.

- Growth

- Conservative Growth & Income

- Income

-

Our strategies are built around a targeted, proprietary asset allocation and invest in six broad asset classes.

- Domestic equity

- Foreign currency

- International equity

- Commodities

- Fixed income

- Cash