Looking Through the Volatility

Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

Volatility across financial markets has become a persistent theme in 2025. The recent volatility has stemmed from a range of factors, including:

Headlines out of Washington – as the new administration looks to move their agenda forward, a seemingly endless barrage of news is flowing out of Washington. Executive orders… tariff announcements… Department of Government Efficiency headlines… tariff delays… meetings with foreign leaders… Congressional wheels turning… press conferences… and so on. Each headline has the opportunity to shift markets one way or the other and trying to predict both the next headline as well as the market’s reaction to it is near impossible. Uncertainty creates volatility.

Economic data releases – recent data releases have varied but many data points indicate a souring outlook for the economy for the rest of 2025 relative to the general outlook at the end of last year. Consumer confidence and sentiment indicators point to a less rosy outlook going forward, employment data came in slightly weaker than expected, but the most recent inflation reading was in line with expectations. These factors have worked to push yields lower over the past month.

FOMC expectations – the economic data points mentioned above have worked to push market expectations for FOMC rate cuts to the Fed Funds rate by the end of the year from 25 basis points about a month ago to current expectations of 75 basis points.

A wide range of headlines from around the globe – highlighted by the war in Ukraine and attempts to reach a truce as well as a range of other events out of Europe. Notably, Germany announced their intent to loosen their restrictions on government borrowing to enable spending on defense and infrastructure. This potential increase in borrowing has pushed the 10-year German bund yield higher by over 40 basis points over the past week.

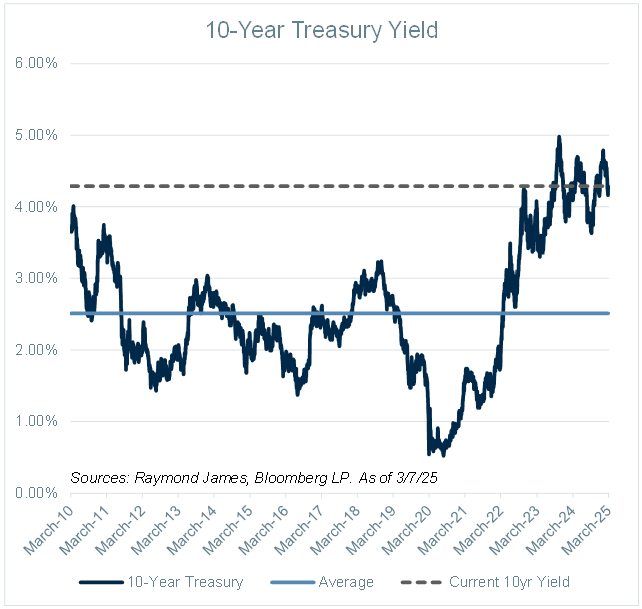

While volatility is likely to persist, it is important for fixed income investors to stay focused on the opportunity at hand. Attractive yields remain available across the fixed income universe. Avoiding the barrage of headlines is nearly impossible in the world we live in today, but locking in yields today for longer periods of time will help to avoid getting caught up in the day-to-day fluctuations of the market. When thinking about long-term investment time horizons, a long-term perspective can help to frame the current environment. To provide some high-level market context, the chart above shows the 10-year Treasury yield over the past 15 years.

The takeaway is clear: current yield levels, while bouncing around in a ~50 basis point range over the past few years, are at some of the most attractive levels of the past 15 years. The 10-year yield is currently at ~4.29% which is over 175 basis point higher than the average over that timeframe. Don’t get too caught up in the day-to-day and month-to-month volatility. Taking a step back highlights the opportunity that is currently available to lock in yields for longer periods of time which will allow you to ignore the volatility that has been pervasive across financial markets so far in 2025.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.