Building a Diversified Investment Portfolio: Exploring the 60/40 Strategy

This investment profile is hypothetical, and the asset allocations are presented only as examples and are not intended as investment advice.

Investing in the right mix of assets is crucial for achieving your financial goals. One approach that financial advisors often recommend is the 60/40 portfolio. This strategy involves allocating 60% of your portfolio to equities and 40% to bonds. While the 60/40 portfolio is a popular choice, it may not be suitable for everyone. In this article, we will explore the concept of the 60/40 portfolio, its advantages, disadvantages, and alternative strategies to consider.

Understanding the 60/40 Portfolio

The 60/40 strategy aims to strike a balance between risk and return by diversifying investments across different asset classes. By allocating 60% to equities, investors can benefit from the growth potential of stocks, while the 40% allocation to bonds helps mitigate risk to the portfolio.

According to Tom Desmond, Chief Financial Officer at Ally Invest, a simple implementation of the 60/40 strategy would involve investing in the S&P 500 and U.S. Treasuries. This approach primarily focuses on U.S. investments, but it is also possible to build a globally diversified 60/40 portfolio by including international stocks and bonds.

Advantages of a 60/40 Portfolio

The main advantage of a 60/40 portfolio is its ability to moderate the risk of the overall portfolio. By including bonds, investors can maintain confidence in their portfolio, even during periods of market volatility. This allocation is designed to provide a consistent rate of return over time while seeking to minimize the impact of market fluctuations.

Robert R. Johnson, a professor of finance at Heider College of Business at Creighton University, highlights the importance of the bond allocation in reducing portfolio risk. The 60/40 mix allows investors to strike a balance between growth potential and lower volatility, making it an attractive option for those with a moderate risk tolerance.

Building a 60/40 Portfolio

When constructing a 60/40 portfolio, the approach may vary depending on your investing style. For do-it-yourself (DIY) investors comfortable with a self-directed approach, low-cost exchange-traded funds (ETFs) can be an excellent choice. ETFs offer streamlined diversification, tax efficiency, and the ability to take advantage of market movements.

In addition to ETFs, there are other investment options to consider. Dividend-paying stocks and real estate investment trusts (REITs) can be beneficial for equity allocations, especially for investors seeking current income. Municipal bonds can provide tax-exempt interest, making them attractive for fixed-income allocations. High-yield bonds, although riskier, may offer higher yields.

While individual stock picking is an option, it comes with higher risk. Relying on diversified funds instead of trying to pick winners can be a more prudent approach. When investing in mutual funds or ETFs, pay attention to the fees, specifically the expense ratio, as higher fees can eat into your investment earnings.

Downsides of the 60/40 Portfolio

Despite its advantages, the 60/40 portfolio has some downsides to consider. One major disadvantage is its potential underperformance compared to an all-equity portfolio over the long term. The influence of compounding interest can significantly impact returns, with large-cap stocks historically outperforming bonds.

According to Morningstar data from 1926 to 2017, the annual compounded return for large-cap stocks was 10.20%, while long-term corporate bonds returned 6.10% and long-term government bonds returned 5.50%. By sticking to a straight 60/40 mix, investors may miss out on the higher returns offered by a higher allocation to stocks.

Who Should Consider a 60/40 Approach?

I believe the 60/40 portfolio is best suited for investors with a moderate risk tolerance who value stability but still want growth potential. Younger investors with a longer time horizon may be able to tolerate more risk and allocate a higher percentage of their portfolio to stocks. On the other hand, individuals closer to retirement may prefer reducing exposure to stocks and increasing bonds or fixed-income holdings for more stable returns.

Psychological factors also play a role in determining the suitability of a 60/40 portfolio. Some investors may not be comfortable with the volatility of the equity market, despite their ability to bear the risk. The rules-based nature of the 60/40 strategy can provide the investor with confidence by potentially removing the need to make allocation decisions during market instability.

Creating Your Investment Plan

If you are considering a 60/40 portfolio, it is essential to lay some ground rules for your investment approach. Define your time frame, goals, risk tolerance, liquidity needs, and tax efficiency preferences. These rules will help shape your target asset allocation and help guide you in maintaining a disciplined investment plan.

One of the key advantages of having a plan is that it helps prevent emotional decision-making during market fluctuations. Your asset allocation should remain consistent, regardless of short-term market movements. By adhering to your plan, you can navigate volatile conditions with confidence.

Exploring Alternative Strategies

While a 60/40 portfolio can help provide lower risk, it may not offer the same level of returns as other strategies. If you are open to alternative approaches, several options can help you tailor your asset allocation to your specific objectives.

Using age as a guide for asset allocation is one alternative rule of thumb. Subtracting your age from 110 can determine the percentage of assets to allocate to equities and bonds. This approach adjusts your allocation based on your risk tolerance as you grow older.

Another strategy is to utilize online tools like SmartAsset's asset allocation calculator. These calculators consider your risk tolerance and provide a recommended asset allocation based on your preferences. Consulting a financial advisor can also provide valuable insights and personalized advice for your portfolio.

Conclusion

In conclusion, the 60/40 portfolio offers a balanced approach to investing, combining the growth potential of equities with less volatile bonds. While it may underperform an all-equity portfolio over the long term, it can be suitable for investors with a moderate risk tolerance who value stability and growth potential. By understanding your own financial goals, risk tolerance, and time horizon, you can determine the best asset allocation strategy for your investment portfolio.

Remember, building a diversified investment portfolio is a crucial step towards achieving your financial objectives. Whether you choose the 60/40 strategy or explore alternative approaches, it is important to consult with a financial advisor who can provide personalized guidance and help you navigate the complex world of investing.

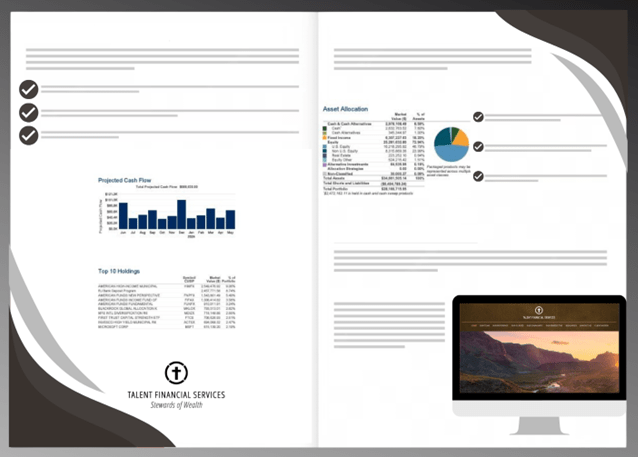

For additional information and resources, call to schedule an appointment with one of our financial advisors at Talent Financial Services.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Russell Riggan and not necessarily those of RJFS or Raymond James. Investments mentioned may not be suitable for all investors. Please note that the portfolios provided above are general and investment decisions should only be made after a discussion with the appropriate professional about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Diversification and asset allocation does not ensure a profit or protect against a loss.

Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices rise. Municipal bonds typically provide a lower yield than comparably rated taxable investments in consideration of their tax- advantaged status. Investments in municipal securities may not be appropriate for all investors, particularly those who do not stand to benefit from the tax status of the investment. Please consult an income tax professional to assess the impact of holding such securities on your tax liability.

Dividends are not guaranteed and must be authorized by the company's board of directors. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index. Past performance does not guarantee future results. Raymond James is not affiliated with SmartAsset.

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund or exchange traded fund carefully before investing. The prospectus contains this and other information and should be read carefully before investing. The prospectus is available from your investment professional.