Journey Through the History of Interest Rates

Rates

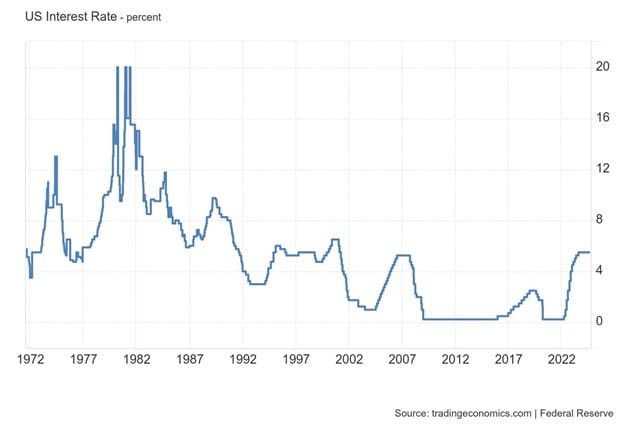

The trajectory of interest rates, orchestrated by the Federal Reserve, has been a captivating symphony, with each movement echoing the economic melodies of its time. From the crescendos of prosperity to the somber refrains of recession, this chronicle unveils the intricate tapestry woven by the Fed's monetary policy decisions. Join us as we embark on an immersive exploration, unraveling the threads that have shaped the financial landscape and left an indelible mark on the nation's economic fabric.

The Inflation Taming Era: 2022-2023

Combating Covid-19's Economic Fallout: 2020

The Mid-Cycle Adjustment of 2019

Returning to Normalcy: Fed Rate Hikes from 2015-2018

Navigating the Great Recession: 2008 Fed Rate Cuts

The Housing Market Crash: 2007-2008 Rate Reductions

The Housing Boom: Fed Rate Hikes from 2005-2006

Flagging Recovery and Low Inflation: 2002-2003 Rate Cuts

The Dot-Com Bust and 9/11: 2001 Rate Reductions

The Dot-Com Boom: Fed Rate Hikes in 1999-2000

Addressing the Global Currency Crisis: 1998 Rate Cuts

A Prudent Step: The 1997 Rate Hike

The Mid-Cycle Adjustment of the 1990s

The Soft Landing: Fed Rate Hikes from 1994-1995

Navigating the Gulf War Recession: 1990-1992 Rate Cuts

The Dual Mandate: Balancing Inflation and Employment

At the core of the Federal Reserve's interest rate decisions lies its dual mandate: maintaining price stability and maximizing employment. Like a skilled conductor, the Fed raises interest rates to cool an overheating economy and curb inflationary pressures. Conversely, it lowers rates to stimulate growth and foster job creation during economic downturns.

While this mandate serves as the guiding principle, the Fed's actions are informed by a multitude of economic indicators, including gross domestic product (GDP), consumer spending, industrial production, and significant events such as financial crises, pandemics, or geopolitical tensions. These variables collectively shape the Fed's monetary policy decisions, reflecting its responsiveness to the ever-changing economic landscape.

Decoding the Data: Understanding Basis Points and Rate Targets

To comprehend the intricacies of interest rate adjustments, it's crucial to understand the language of basis points and rate targets. Basis points, or bps, are the units used to measure interest rate changes. One basis point equals 0.01 percentage point, making it a convenient tool for expressing even the slightest rate adjustments.

The Federal Open Market Committee (FOMC), the Fed's monetary policy-making body, sets a target range for the federal funds rate, the interest rate at which banks lend to each other overnight. This rate serves as a benchmark for various consumer and business lending rates, influencing the cost of borrowing across the economy.

Taming Inflation: The Fed's Recent Rate Hikes (2022-2023)

In the wake of the COVID-19 pandemic and its economic fallout, the Fed held interest rates near zero to stimulate the economy. However, as inflationary pressures mounted, reaching 40-year highs, the central bank embarked on an aggressive rate-hiking cycle in 2022.

Over the course of 16 months, the FOMC raised the federal funds rate by more than five percentage points, a move aimed at curbing the erosion of Americans' purchasing power caused by soaring inflation. As Federal Reserve Chair Jerome Powell emphasized, "Without price stability, the economy does not work for anyone."

Navigating the COVID-19 Storm: Emergency Rate Cuts (2020)

The COVID-19 pandemic unleashed an unprecedented economic shock, prompting swift and decisive action from the Federal Reserve. In March 2020, as the virus spread globally and lockdowns were implemented, the FOMC delivered two substantial rate cuts at emergency meetings, slashing the federal funds rate to a target range of 0% to 0.25%.

While the economy technically rebounded by May 2020, marking the shortest recession on record, the ripple effects of the pandemic-induced economic measures continue to reverberate today, underscoring the Fed's crucial role in navigating uncharted waters.

Mid-Cycle Adjustments: Preemptive Rate Cuts (2019)

In 2019, the Fed's rate cuts were driven by concerns over the escalating trade tensions between the United States and China, a conflict dubbed the "trade war." Fearing potential harm to the economy and a rise in unemployment, the FOMC implemented three modest rate reductions in the second half of the year, a preemptive move termed a "mid-cycle adjustment."

With inflation running below the central bank's 2% target at the time, as measured by the core personal consumption expenditures price index (PCE), the Fed's preferred inflation gauge, these rate cuts aimed to provide a cushion against external economic pressures.

Returning to Normalcy: Gradual Rate Hikes (2015-2018)

Following the unprecedented rate cuts implemented during the 2008 global financial crisis, the Fed embarked on a path to normalize monetary policy as the economy recovered. In December 2015, under the leadership of former Chair Janet Yellen, the central bank initiated a series of gradual rate hikes, marking the first increase since the crisis.

Over the next three years, the FOMC raised rates in measured steps, aiming to sustain the low-inflation environment and prolong the economic expansion. This cautious approach reflected the Fed's commitment to supporting the labor market's steady improvement and ensuring that inflation remained anchored to its 2% objective.

Weathering the Great Recession: Drastic Rate Cuts (2008)

The Great Recession, which officially began in December 2007 and lasted until June 2009, represented one of the most challenging economic periods in recent history. As the global financial crisis unfolded, the Fed responded with a series of aggressive rate cuts, ultimately lowering the federal funds rate to a target range of 0% to 0.25% by December 2008.

Faced with deteriorating labor market conditions, declining consumer spending, and strained financial markets, the FOMC recognized the need for unprecedented monetary stimulus. After exhausting conventional rate-cutting measures, the Fed ventured into the realm of unconventional policies, such as quantitative easing, to support the economy and promote recovery.

Addressing the Housing Market Crash: Proactive Rate Cuts (2007-2008)

As the housing bubble burst in 2007, the Fed swiftly responded by initiating a series of rate cuts aimed at mitigating the economic fallout. Between September 2007 and April 2008, the FOMC slashed rates by a total of 2.75 percentage points, a proactive measure designed to foster market liquidity and promote moderate growth.

However, the magnitude of the impending global financial crisis was not yet fully realized, and the Fed temporarily paused its rate-cutting efforts in April 2008. This pause was short-lived, as the escalating crisis necessitated further monetary easing in the subsequent months.

Taming the Housing Boom: Preemptive Rate Hikes (2005-2006)

In the mid-2000s, the U.S. housing market experienced a remarkable boom, fueled by easy access to credit and speculative investments. Recognizing the potential risks of an overheating economy and the formation of a housing bubble, the Fed took preemptive action by raising interest rates 17 times between 2005 and 2006.

This aggressive tightening cycle, which increased the federal funds rate by a total of 4 percentage points, aimed to cool down the economy and prevent inflationary pressures from becoming entrenched. While inflation remained relatively subdued during this period, the Fed's proactive approach sought to ensure a soft landing and maintain price stability.

Stimulating Growth: Low Rates and Deflation Concerns (2002-2003)

In the aftermath of the dot-com recession, which lasted from March to November 2001, the Fed grappled with concerns over a sluggish economic recovery and the specter of deflation. With consumer confidence at nine-year lows and inflationary pressures waning, the FOMC implemented two rate cuts in 2002 and 2003, ultimately bringing the federal funds rate to its lowest level in 45 years.

These rate reductions were intended to provide additional support for the economy and address the risks posed by subdued inflationary expectations. The Fed's decisive actions underscored its commitment to fostering an environment conducive to sustained economic growth and price stability.

Navigating the Dot-Com Bust and 9/11: Aggressive Rate Cuts (2001)

The bursting of the dot-com bubble in 2001, coupled with the economic shockwaves from the 9/11 terrorist attacks, presented the Fed with a formidable challenge. In response, the FOMC embarked on an aggressive rate-cutting campaign, lowering the federal funds rate by a staggering 5.25 percentage points over the course of eight meetings.

These decisive moves aimed to cushion the economy from the effects of the stock market meltdown and the subsequent recession. By providing substantial monetary stimulus, the Fed sought to support the labor market, promote consumer spending, and mitigate the risks posed by the unprecedented events of that year.

Curbing Irrational Exuberance: Rate Hikes and the Dot-Com Boom (1999-2000)

As the dot-com boom reached its zenith in the late 1990s, the Fed recognized the potential risks posed by the frenzy of speculation and the inflated valuations of internet and technology stocks. To address these concerns and prevent inflationary pressures from taking hold, the FOMC initiated a series of rate hikes in June 1999, culminating in a 50-basis-point increase in May 2000.

While investors initially cheered the news, interpreting it as a signal of confidence in the economy, the Fed's actions were ultimately aimed at curbing the irrational exuberance that had gripped the markets. By taking a proactive stance, the central bank sought to maintain financial stability and prevent the formation of asset bubbles that could potentially destabilize the broader economy.

Navigating Global Turmoil: Rate Cuts and Currency Crises (1998)

The late 1990s witnessed a series of interconnected global financial crises, starting with the Asian currency crisis in 1997 and spreading to Latin America and Russia. These events had far-reaching consequences, even threatening the solvency of a prominent U.S. hedge fund, Long-Term Capital Management (LTCM).

In response to the increasing weakness in foreign economies and the tightening of domestic financial conditions, the Fed implemented three rate cuts in the fall of 1998. These measures were designed to cushion the potential impact on the U.S. economy and prevent the ripple effects of global turmoil from derailing the nation's economic growth.

Maintaining Stability: A Prudent Rate Hike (1997)

In March 1997, with inflation inching upward and the economy experiencing a prolonged expansion, the Fed took a prudent step by raising interest rates by 25 basis points. This modest adjustment was viewed as a necessary measure to sustain the low-inflation environment and prolong the economic expansion that had been underway for several years.

The Fed's decision reflected its commitment to maintaining price stability and ensuring that inflationary pressures remained well-anchored. By acting preemptively, the central bank aimed to provide greater assurance of continued economic growth and prosperity.

Mid-Cycle Adjustments: Rate Cuts in the Midst of Expansion (1995-1996)

Even during the prosperous economic climate of the 1990s, the Fed recognized the need for occasional course corrections. In a series of three rate cuts between July 1995 and January 1996, the FOMC implemented what it termed a "mid-cycle adjustment," a modest easing of monetary conditions amid a prolonged period of expansion.

These rate reductions were prompted by concerns over slowing inflationary pressures and weaker-than-expected retail sales data, signaling the need for additional economic stimulus. By fine-tuning its monetary policy stance, the Fed sought to maintain a delicate balance, supporting continued growth while keeping inflation in check.

The Soft Landing: Gradual Rate Hikes (1994-1995)

The Fed's monetary policy tightening cycle between 1994 and 1995 is widely regarded as a rare instance of a successful "soft landing" for the economy. Over the course of seven rate hikes, the FOMC nearly doubled the federal funds rate, raising it from 3% to 6% in an effort to sustain and enhance the ongoing economic expansion.

This gradual approach was driven by the recognition that the U.S. economy was booming, fueled by strong productivity rates, a thriving labor market, and the transformative power of new technologies. By carefully calibrating its rate hikes, the Fed aimed to cool the economy without triggering a recession, a delicate balancing act that required deft policymaking.

Navigating the Gulf War Recession: A Steady Drumbeat of Rate Cuts (1990-1992)

The Gulf War recession, which lasted from July 1990 to March 1991, presented the Fed with a formidable challenge. To combat the economic downturn and support the recovery, the FOMC implemented a series of rate cuts, lowering the federal funds rate by a total of 3.75 percentage points over the course of 16 meetings.

These rate reductions were designed to stimulate economic growth, foster job creation, and bolster consumer confidence in the face of geopolitical tensions and the accompanying economic uncertainties. The Fed's steady drumbeat of rate cuts underscored its commitment to supporting the economy during times of crisis and ensuring a smooth path to recovery.

As we reflect on the rhythmic dance of interest rates throughout history, one thing becomes clear: the Federal Reserve's monetary policy decisions are shaped by a multitude of economic factors, global events, and evolving challenges. By understanding the reasoning behind these decisions and the rhymes that echo through time, we gain a deeper appreciation for the intricate tapestry of monetary policy and its role in shaping the economic landscape. For additional information and resources, call to schedule an appointment with one of our financial advisors at Talent Financial Services.