AMA Survey - When Doctor's Started Saving

Does it matter when I begin saving for retirement?

In our minds, it absolutely does. Retired Physicians may believe so too.

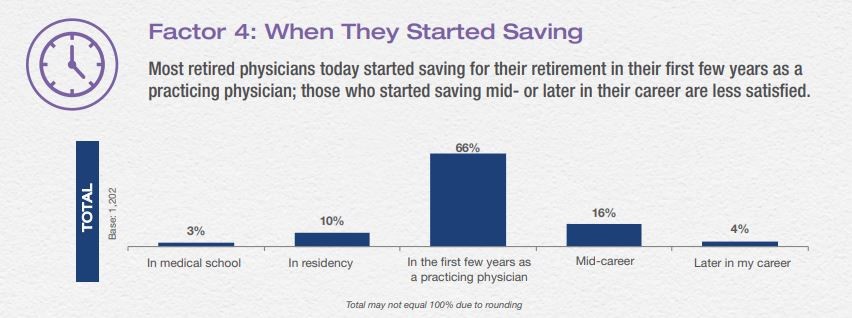

USE TIME TO YOUR ADVANTAGE. 80% of surveyed retired physicians are satisfied with retirement. When a physician started saving is one of the key factors to being satisfied. In fact, 79% of those physicians began saving for retirement shortly after going into practice.

Source: http://static.fmgsuite.com/media/documents/47c4e44d-a344-45b8-9f1d-85f692cc1ade.pdf

What is compound interest?

- Simply put, it is earning interest on interest. Lets use an example of a physician saving $1,000 / month for $12,000 a year:

|

|

Beg. of Year |

Interest |

End of Year |

|

Year 1 |

$12,000 |

10% or $1,200 |

$13,200 |

|

Year 2 |

$13,200 |

10% or $1,320 |

$14,520 |

|

Year 3 |

$14,520 |

10% or $1,452 |

$15,972 |

In the example, the money earned from interest after each year increases because your beginning principle rose from the previous year’s interest payment. The initial investment of $12,000 has increased to over $15,000 in only three years.

Beginning to save and invest in your early 30s would create 30 to 35 years for your investment to grow. Using the above example of $12,000 invested, after 30 years that money becomes $209,000.

Taking it to the next level, if you invested $1,000 each month for 30 years, you would have invested $360,000, and the value of the investment would be $2,080,292 at the end of 30 years!!! **

By having meaningful conversations, Stribling~Whalen Financial Group can help determine what financial confidence means, identify financial goals, and create a plan to help achieve both. Call us at 678-989-0048, or visit our website at www.striblingwhalen.com to begin a journey to financial confidence.

**Example uses a hypothetical investment with the assumption of a fixed interest rate of 10%. It should be noted that 10% is a very positive outlook on what to expect from the market. Markets can increase and decrease, and an outlook of 7% may be more realistic. The examples are for illustrative purposes only. Individual cases will vary. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making any investment decision, you should consult with your financial advisor about your individual situation. Any opinions are those of the author and not necessarily those of Raymond James.