Are you Harnessing the Power of a Health Savings Account (HSA)?

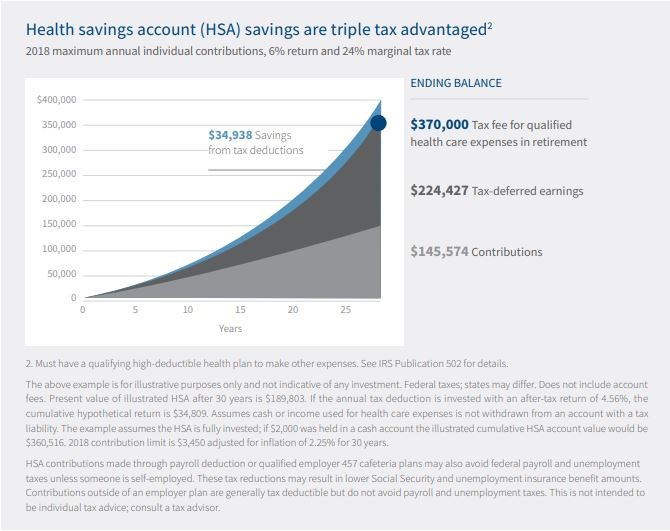

If you could have an investment vehicle reduce your taxable income by $3,450 each year while building a balance of $370,000 free of tax for qualified health care expenses in retirement, why would you not take advantage of that?1 (see disclaimer and chart at the end of the article).

- What is a Health Savings Account (HSA)?

- Why should I be using one if I’m eligible?

- How do I properly use it to receive the most benefits?

The ultimate answer: a Health Savings Account (HSA) is an investment account that when used appropriately can help an individual ($3,650) or a family ($7,300) reduce their taxable income by fully contributing to a HSA, while addressing their health care needs.

What is an HSA? An HSA is an account designated to save/invest money to use towards health care expenses. These accounts can be used tax free to pay for Medical Expenses. Many people have heard of a Flexible Spending Account (FSA), but an HSA is NOT an FSA. One key difference is that an HSA is yours, and the account will always be yours. No matter if you leave the employer who was offering the HSA. An HSA account can invest monies in a number of mutual funds and other broad investment options. Here are some of the key eligibility features:

- Anyone with an HSA qualified High-Deductible Health Policy (HDHP) is eligible. It is not dependent on an employer offering an HSA or not.

- In 2022, a qualified HDHP for an individual must have an annual deductible of at least $1,400 and require that out-of-pocket expenses not to exceed $7,050.

- For a family the annual deductible must be at least $2,800 with required out-of-pocket not to exceed $14,100.

- There are no income limits affecting eligibility.

- HSA belongs to the individual, not the employer.

- As long as an individual has not enrolled in Medicare Part A or B, they are eligible and may contribute to an HSA. Once an individual enrolls in Medicare, they may no longer contribute to an HSA.

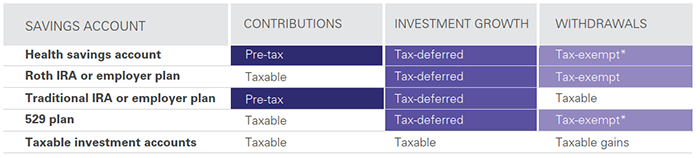

Why should I use an HSA? HSA’s have a triple tax advantage.

- Contributions are tax deductible.

- Investment growth is tax-deferred.

- Qualified withdrawals are tax-free.

If applicable, we would advise you to use an HSA over other options like a Flexible Savings Account because an HSA does not expire at year end like an FSA does. A Health Savings Account is owned by the individual no matter how many times they change jobs.

Source: https://advisors.vanguard.com/insights/article/showclientsthemassivesavingspotentialofhsas

This table is for illustration purposes only.

Everyone’s needs are different, but how can an HSA account be used?

- An HSA account can be used on any qualified medical expenses at any time.

- If you have the cash flow, you should fully fund your HSA each year.

- Invest your HSA account in any number of mutual funds and other broad investment options.

- SAVE ALL OF YOUR HEALTH CARE RECEIPTS – whether using your HSA account or paying out of pocket for the health care expense.

- If possible, use non-HSA monies to pay for health care expenses before retiring. This way, your HSA account can be used in retirement when many people experience increased healthcare costs.

Maxing out your contributions to your HSA account and investing it in a number of mutual funds and other broad investment options will allow you the most tax savings as well as account growth potential. During this accumulation stage, SAVE ALL OF YOUR RECEIPTS. At any point in the future, you can submit your qualified health expense receipts, and be reimbursed for that money from your HSA without owing any taxes.

Contribution limits for 2022 include:

- $3,650 for an individual

- $7,300 for a family

- Catch-up contribution if you are over 55 is $1,000

- A spouse who is 55 or older is also eligible for a catch-up contribution into their own HSA

- Any employer contribution will count toward these limits

We would love to help guide you through the options a Health Savings Account can provide you if you meet the eligibility requirements. Please reach out to us with any questions, comments or concerns you might have.

As always, thank you for the introduction of your friends and family that so many of you have made. We are honored to serve you! As a service to our clients, we are happy to act as a sounding board for your friends and family. If any of them should need a second opinion on their financial situation, introduce them to www.striblingwhalen.com or call us at 678-989-0048.

1 – Example given assumes an individual contributes the 2018 maximum of $3,450 each year for 30 years, with a 2.25% inflation rate for the contribution amount. The assumed rate of return is 6%. See chart below.

Regards,

Warren D. Stribling, IV, CFP®

Principal

warren.stribling@striblingwhalen.com

Brian E. Whalen, CFP®, CIMA®, AIF®

Principal

brian.whalen@striblingwhalen.com

Jacob Beauchamp, AAMS®

Financial Advisor

jacob.beauchamp@striblingwhalen.com

HSAs are never taxed at a federal income tax level when used appropriately for qualified medical expenses. Also, most states recognize HSA funds as tax deductible with very few exceptions.

Please consult a tax advisor regarding your state’s specific rules.

Spending HSA money is tax-free when used to pay for qualified medical expenses.

This material provided herein is for informational purposes only. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional.