Tax Time Update

Dear Friends & Clients,

We hope 2025 is treating you all well so far.

With tax time soon upon us, we wanted to send out some reminders and important dates. As always, please don’t hesitate to reach out to us with any questions.

- Secure Act 2.0 RMD Reminder: if born from 1951 – 1959, you don’t have to take RMDs until you turn 73; if born after 1960, you will not have to take RMDs until age 75. If you are subject to taking RMDs, we will calculate this for you and bug you throughout the year to make sure the required minimum distribution is met.

- Tax Reporting Season: You will begin receiving your 1099s from RJ over the next 2-3 weeks. We always caution against being in too much of a rush to file as we sometimes get notification of supplemental or corrected tax reporting. We are typically notified of impacted accounts towards the end of February and will be sure to let you know if applicable.

- January 31: Form 1099-Q and retirement account reporting and Raymond James Bank year-end bank tax packets

- February 15: Original Form 1099s

- February 28: Delayed and amended Form 1099s

- March 15: Any remaining delayed original Form 1099s

- Accessing Tax Documents Via RJ Client Access: log in to your Raymond James Account.

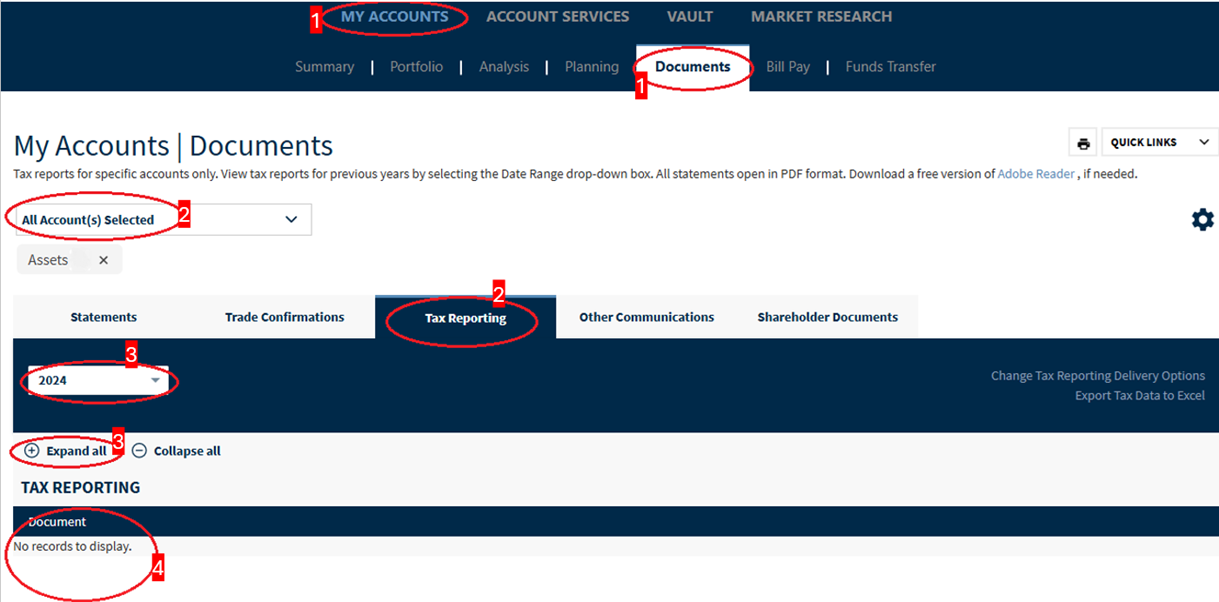

- From your My Accounts screen, select Documents in the main navigation. Please see Step 1 below for example.

- On the Documents tab, select Tax Reporting. All accounts will be selected by default. If you wish to select a specific account, use the dropdown menu to select. Please see Step 2 below for example.

- Most recent documents will be displayed by default. If you wish to select a specific year, select the Year in the drop-down menu. Select Expand All to view all documents. Please see Step 3 below for example.

- Select the document you wish to view. To download, use the download button in your browser.