Market Update

Over the last five years, investors have experienced a pandemic, unprecedented fiscal stimulus, the highest inflation in 40 years, the Fed causing a market bust to fight inflation and, over the last 2 years, a remarkably strong recovery. In short, the general feeling of discombobulation is justified. Despite the market’s manic behavior, taken as a whole, returns for moderate investors over the past 5 years have been strikingly average1. While it certainly feels like “normal” conditions are something that only exist as a memory, the past few years are proof of the of need to remain stubbornly invested and the market’s ability to yield predictable long-term results despite extreme short-term volatility.

As we look to next year, and the back half of this decade, major investment firms (Vanguard, BlackRock, Schwab, Fidelity)2,3,4,5 are all projecting the sources of investment returns to shift dramatically. Over the last decade, US stocks, particularly growth oriented stocks in the tech sector, have done the bulk of the heavy lifting for portfolios. All the while bonds, conservative stocks, and international exposure have lagged by historic margins6,7,8. Keeping Keynes’ quote of “markets can remain irrational longer than [investors] can remain solvent” in mind, investors can look to history to know that the rubber-band of valuations can only stretch so far before snapping back to equilibrium. That being said, market excesses always persist for longer than expected, which is why equal measures of humility and diversification are prerequisites for staying afloat in financial markets. While we are taking steps to address this potential change in market leadership, the good news is that the total return expectations for diversified moderate investors is projected to remain fairly steady2.

If what is past is prologue, we know 2025 will likely confound most attempts at prediction, but we look forward to navigating whatever comes our way together. Thank you for another year of entrusting us with your financial well-being. We wish you yours a happy and prosperous New Year!

-Didier, Eric, Shirley, Jaci & Tom

Below is more detail on our thoughts and various investor concerns we are monitoring.

- Policy Tug-of-War: after a largely successful war on inflation, the Fed used its December meeting to signal caution in cutting rates too quickly, lest they inadvertently reignite inflation. They are also making some pre-judgements that Trump administration policy will be inflationary. The Fed appears to be being overly cautious as there are signs that, even with the recent rate cuts, economic activity is slowing, and the disinflationary trend remains in place. There is also substantial policy uncertainty given a razor thin house majority9. More detail on the upcoming policy tug-of-wars we anticipate for next year can be found in our post-election market update (attached).

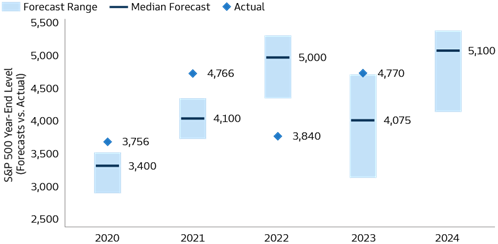

- Forecasting or Guessing: as the below table shows, the market, and subsequent policy reactions, over the last 5 years have proven so unpredictable that the S&P 500 finished outside of the entire forecasted range given by major bank analysts each year. Our conclusion is that short-term forecasting is mostly guesswork, which is why the emphasis should be on sounds rationale, and portfolio stress-testing vs goals, rather than attempting to extrapolate short-term trends. Once averaged out, market returns over the last 5 years on the S&P were about 1% above their long-term average.

Source: Bloomberg and Goldman Sachs Asset Management. As of May 9, 2024. - Valuations: while it is true that the weighted average valuation in the US stock market is uncomfortably high, if we exclude the top 10 largest stocks in the S&P 500, valuations are not much of a concern. The concentration of the S&P 500 in the top 10 stocks is now about 10% higher than during the peak of the DotCom era10. While these companies are incredibly profitable and are the biggest investors in R&D, they are priced to perfection and compose nearly 40% of the S&P 50010. This makes indexes vulnerable to correction should just a handful of names run into any issues with their growth forecasts.

- Feast or Famine: although the S&P 500 has averaged roughly 10% returns over the last century, the return stream is incredibly choppy. The most frequent annual return for the S&P is actually over 20% (38 years in the last 100), and one of the least frequent returns is between 8-12% (only 6 years in the last 100)11.

- Roadmaps: Raymond James’ “year ahead” newsletter provides 10 themes to look out for, while JP Morgan’s goes into a bit more detail. Both are attached.

1: https://www.spglobal.com/spdji/en/indices/multi-asset/dow-jones-moderate-portfolio-index/#overview

2: https://corporate.vanguard.com/content/corporatesite/us/en/corp/vemo/vemo-return-forecasts.html

3: https://www.blackrock.com/ca/institutional/en/insights/charts/capital-market-assumptions

4: https://www.schwab.com/learn/story/schwabs-long-term-capital-market-expectations

5: https://institutional.fidelity.com/app/item/RD_9902221/capital-market-assumptions.html

6: https://www.hartfordfunds.com/dam/en/docs/pub/whitepapers/CCWP014.pdf

7: https://www.morningstar.com/bonds/bond-market-faces-4-big-risks

8: https://www.morningstar.com/markets/can-value-stocks-really-make-comeback

9: https://www.wsj.com/politics/republican-small-house-majority-problems-2025-04108694

10: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

11: https://wealth.amg.com/research-and-insights/keep-calm-and-remain-diversified/feast_or_famine/

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an ivnestment decision, and it does not constitute a recommendation.

Any opinions are those of the members of the Stoneman Dalton Group and not necessarily those of Raymond James. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Past performance does not guarantee future results. Keep in mind that individuals cannot invest directly in any index. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.