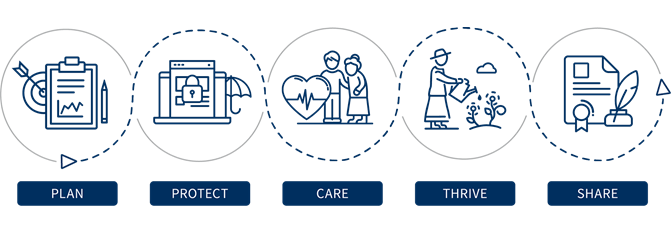

Your quality of life— carefully considered

Life is full of big questions: How are you building toward your long-term goals while meeting your short-term needs? How can you share what you've accomplished with your loved ones? How will you lead and prepare for the lifestyle you envision?

Explore how our approach to longevity planning helps you answer tomorrow's big questions today.

Holistic planning - for your financial life

With sound planning, we can all get a little more out of life – spending more time focused on what’s important to us and less time worrying about finances.

Goal Planning & Monitoring

This sophisticated software program shows your full financial picture. It takes into account your specific goals, investment strategy, risk tolerance, spending and saving rates – and tells you the probability of achieving your goals.

IMPORTANT: The projections or other information generated by Goal Planning & Monitoring regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results may vary with each use and over time.

Your health and your finances are intertwined in complex ways. Plan ahead and consider the care you and your loved ones might need.

PinnacleCare

A concierge health service, PinnacleCare helps you manage a healthcare episode. PinnacleCare maintains relationships with top-ranked medical centers across the country and works with you to find the best treatment, schedule appointments, coordinate seeking a second opinion – even ensure an accurate diagnosis.

Broadspire

Broadspire helps you plan for the largest financial factors in retirement: housing and healthcare. Broadspire will assess, recommend and facilitate strategies for staying in your home as you age and other care needs associated with aging, from minor home modifications to finding the best memory care facility.

You’re working hard to achieve success. Safeguarding your health and wealth is critical to ensure your quality of life in retirement.

EverSafe

EverSafe seeks to protect you from financial fraud by using a proprietary algorithm to monitor your accounts for unusual activity. Alerts are sent to you and those designated as trusted contacts.

Leaving a legacy entails much more than leaving an inheritance or charitable gift – it’s important to pass along celebrated traditions and cherished values to those you love.

Everplans

Everplans enables you to organize important information – from a will to a favorite family recipe – and end-of-life wishes, which can be shared with trusted family and friends. Everplans guides you through the step-by-step process, helping ensure your family has a full understanding of your life and wishes.

Raymond James is not affiliated with any of the companies mentioned.