Global stock investments over time

By David Jackson, MBA, CFP®, C(K)P™

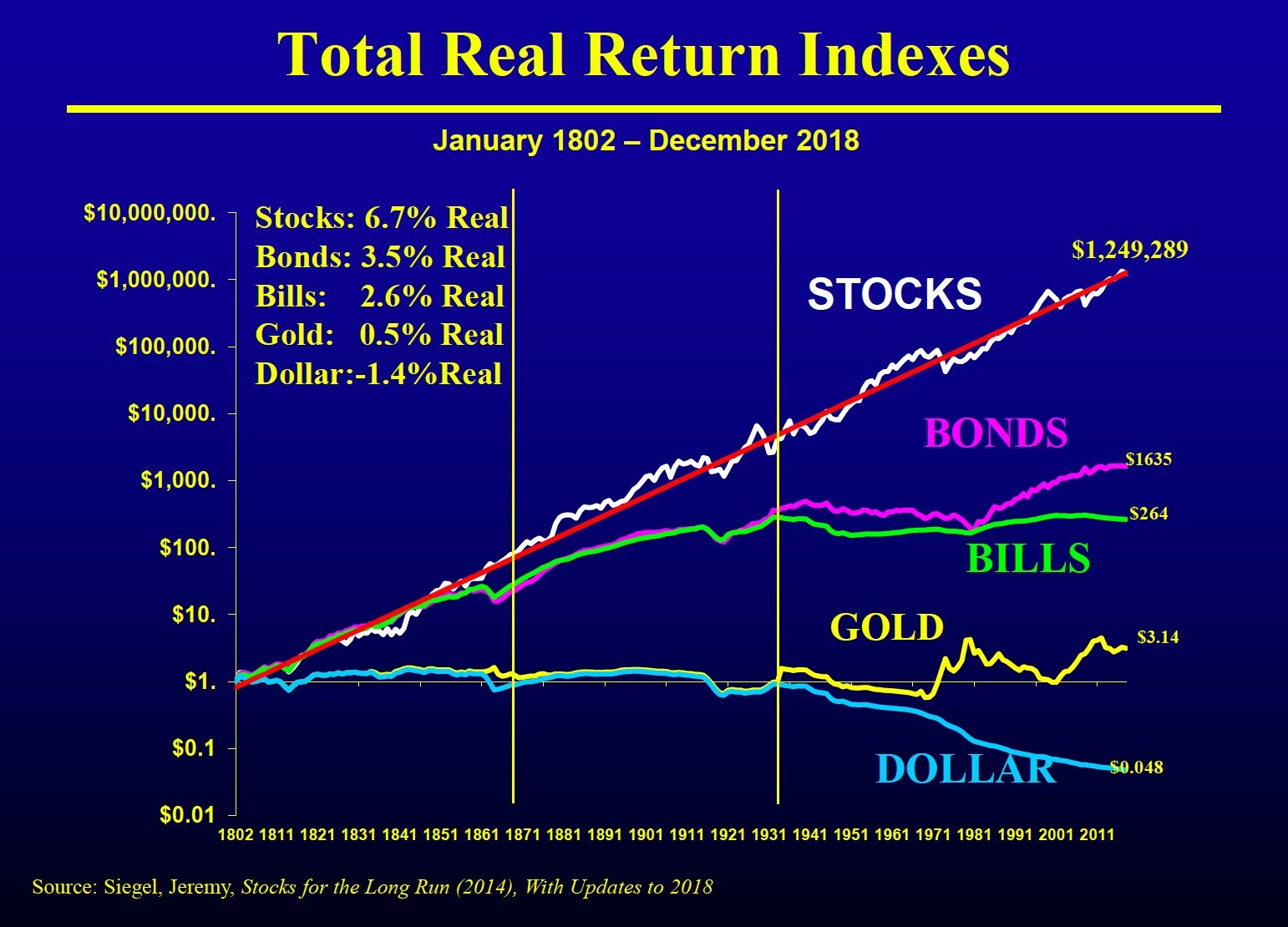

Recently, Martin and I had the chance to hear Dr. Jeremy Siegel, author of Stocks for the Long Run, at a professional conference. His presentation covered a variety of long-term investment strategies, including an analysis of how stocks outperform other asset classes on a real return (net of inflation) basis over long periods of time.

If you follow investments and the markets, you have likely seen charts similar to the first chart above that he shared with us.

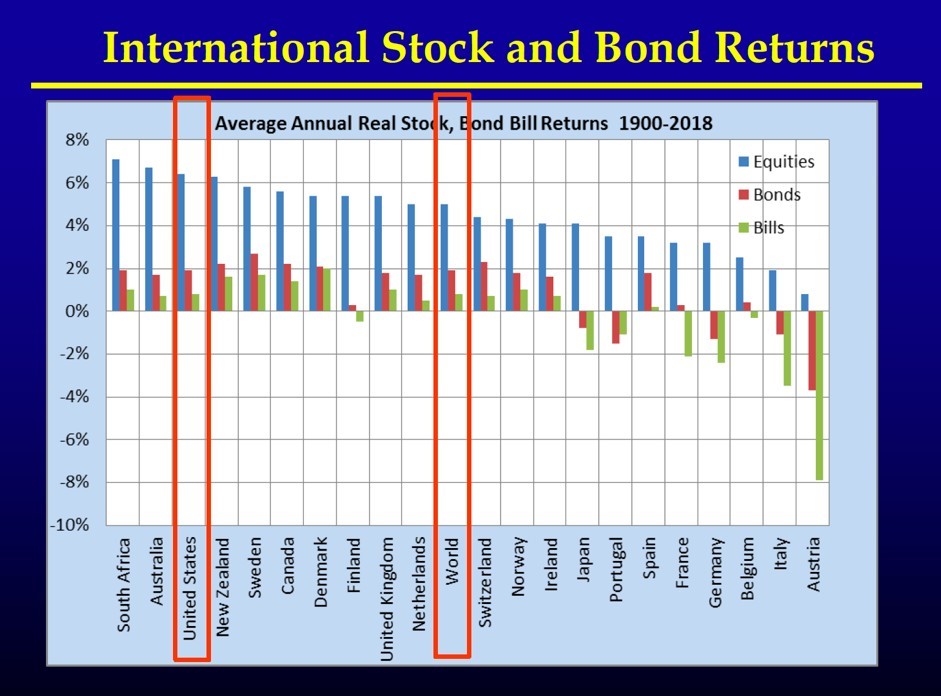

Siegel offered additional information on this trend that I found interesting. The second chart shows that stock returns outperforming other asset classes is a trend observed worldwide. While we might expect this in the United States where we have a strong free enterprise system, this was also seen in many other countries, where similar real rates of return were observed.

The lesson here is that for those who have a long-term investment horizon, stocks should probably comprise a significant part of a portfolio. In most cases, this makes sense regardless of whether you live in the United States or abroad. It also suggests that you should probably have some portion of your portfolio invested in global assets.

Everyone’s financial circumstances are different. If it’s been awhile since you have sat down to look at your asset allocation, please give us a call. Martin and I would be happy to speak with you about your financial situation.

For more information on our firm and our philosophy, check out the rest of our website at www.southernspringscapital.com.

David M Jackson, CFP®, C(k)P™

Managing Partner, SSCG

Senior Financial Advisor, RJFS

Charts are for illustration purposes only. Raymond James is not affiliated with and does not endorse Dr. Jeremy Siegel or "Stocks for the Long Run." Any opinions are those of the author and not necessarily those of Raymond James. This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. Investing involves risk and investors may incur a profit or a loss. Past performance is not a guarantee of future results.