Unprecedented

Earnings season is upon us, and it’s usually the time I look forward to, as it either confirms expected profitability or sends warning signs. This time around however, there is not much that can be taken from the numbers. The massive stimulus that we have witnessed to date, along with what we expect to come in the next few weeks, provides a backdrop to this market that we have never seen before. The word “unprecedented” is being used with unprecedented frequency.

I’m starting to pay more attention to what’s beyond the next round of stimulus and that’s an election and a huge debt burden that will ultimately need to be dealt with all the while the economy recovers.

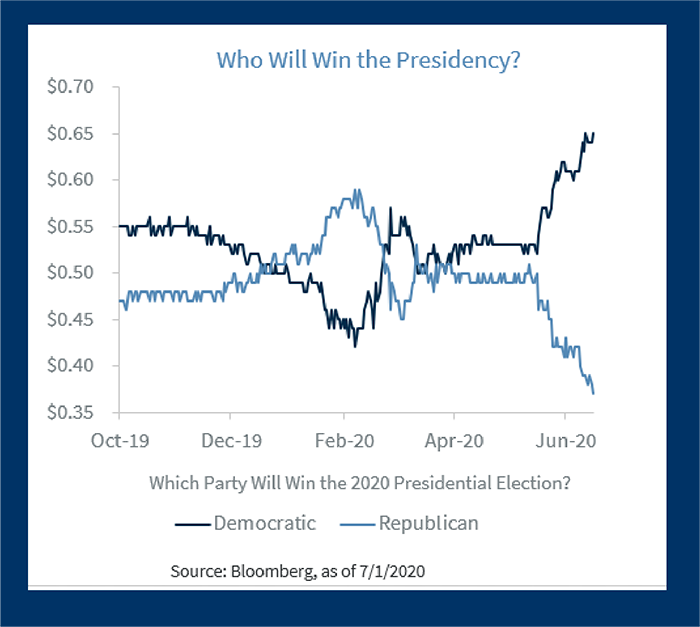

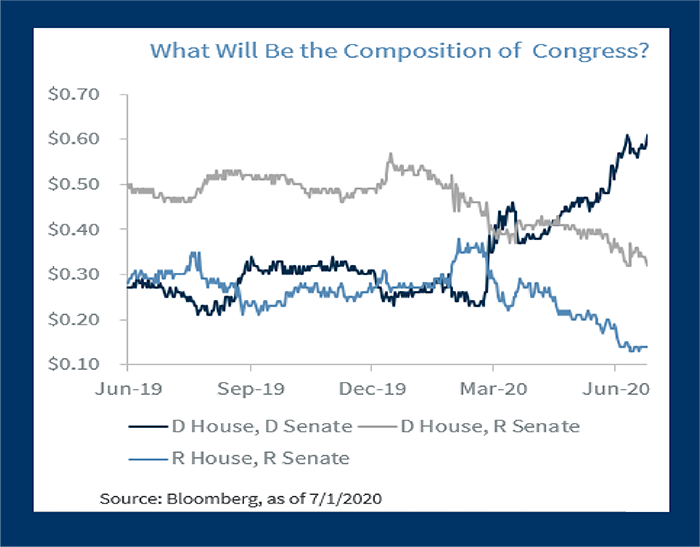

The polls and the money are all leaning towards a democratic sweep in November.

If the last election is anything of a guide, then the betting markets are a good guide of where the race is today, but does a terrible job on where the race will be on election day. These same markets gave Sanders and Warren the Democratic nomination before Biden won South Carolina.

Our job as investors, however, is to model out different circumstances. So, what will it mean if there is a blue sweep? It’s hard to imagine a circumstance where taxes would not rise in that scenario, which in the short term would be negative for market sentiment. Longer term, I argue that it really doesn’t matter who is in office. Uncertainty is a bigger negative for the markets than who sits in the White House. I wrote a piece before mid-terms in 2018 showing market returns under different political landscapes, and surprisingly there are better returns (on average) under Democratic leadership.

To date, the market has not paid much attention to these polls. I don’t expect it to come much into play till after the conventions in mid-August. From that point, I think the risk will outweigh the potential returns till we get some certainty on the outcome.

We’ve had a few data points of interest recently.

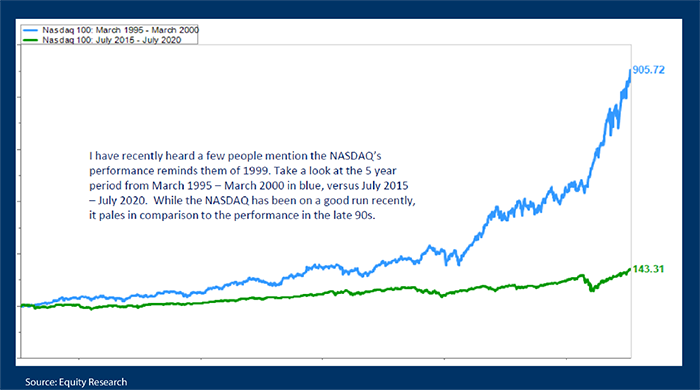

- Nasdaq went to all-time highs and I’ve heard from a few people that it feels like the late 90s when the tech stocks ran up. The chart below puts things in perspective.

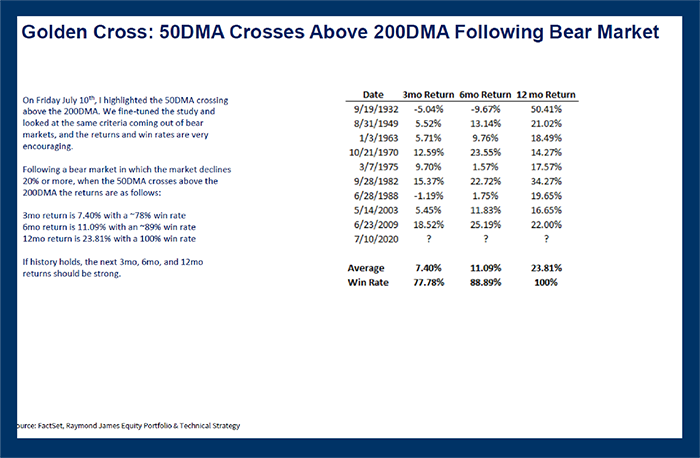

- When the 50-day moving average crosses the 200 day on the way up it’s called a Golden Cross. A Golden Cross is generally known as a bullish sentiment. They don’t happen all that often, but when they do its generally provided some nice returns.

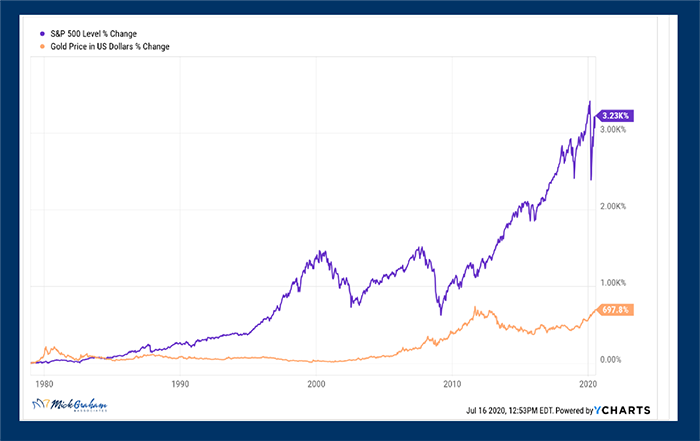

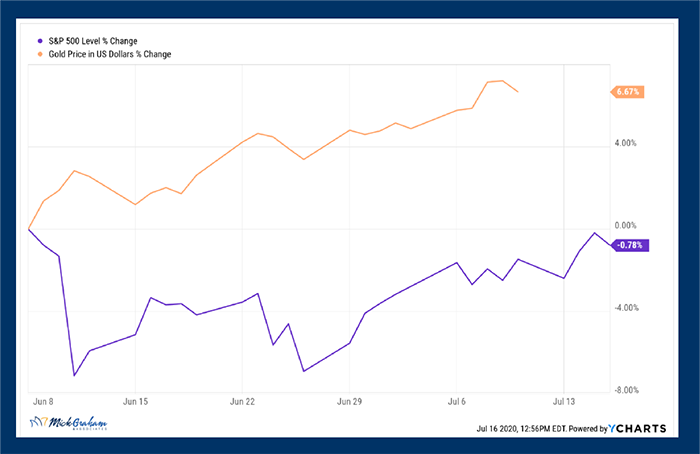

- Gold is up 19% for the year, as the Fed Balance Sheet expands to over $7T. It’s been a long time since Gold had a better year than the equity markets. However, if there is ever an environment where you would expect Gold to outperform, this is it. The recent downturns in the stock market was meant with some strength in the Gold Spot Price. This is what we are looking for, non-correlating assets.

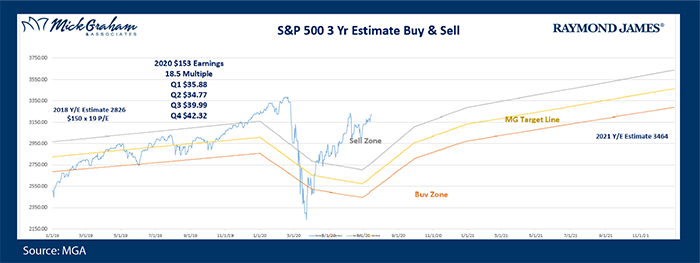

That’s all for this week. With all that said, here’s the buy sell.

This market commentary is provided for information purposes only and is not a complete description of the securities, markets, or developments referred to in this material. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. The NASDAQ composite is an unmanaged index of securities traded on the NASDAQ system. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Diversification and asset allocation do not ensure a profit or protect against a loss.

Moving Average (MA) is a widely used indicator in technical analysis that helps smooth out price action by filtering out the “noise” from random price fluctuations. A moving average (MA) is a trend-following or lagging indicator because it is based on past prices. Moving Averages are commonly used to identify trend direction and to determine support and resistance levels. Technical Analysis is a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volume. Technical analysts do not attempt to measure a security's intrinsic value, but instead use charts and other tools to identify patterns that can suggest future activity. There is no guarantee that this method will be successful or that predictions will be accurate.

Investing in commodities is generally considered speculative because of the significant potential for investment loss. Their markets are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising. Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.