Baobab Strong

Jerome Powell (our esteemed Fed Chair) testified in front of congress and said that the economy was as strong as a Baobab Tree. For those who don’t know, Baobab Trees are native to regions of the Madagascar and mainland Africa, as well as my homeland. The trunks are huge, and the branches spread at the top with a randomness that makes them look chaotic. They are no doubt solid, which I think was his point.

The Greek 10-year Bonds fell below 1% last week which was the first time this has happened. During the financial crisis these bonds were yielding 45%...now that’s a move. Not sure I’m comfortable with that risk. If you had the kahunas to buy these bonds 10 years ago, you made a nice return.

Bernie won the New Hampshire primary, and the Biden campaign has come under scrutiny, questioning his viability after running a distant fourth. Mike Bloomberg has spent over $250 million in TV ads so far and is still not in the Democratic Primaries as we move toward South Carolina and Nevada. Super Tuesday is March 3rd this year and Bloomberg has filed to be on the ballot at this stage.

The White House released a $4.8 Trillion budget last week that I expect will be ripped up by the Democrats quicker than Nancy Pelosi at the State of the Union. Let’s hope that Nancy can loan out her staff to the other Dems to get the process started.

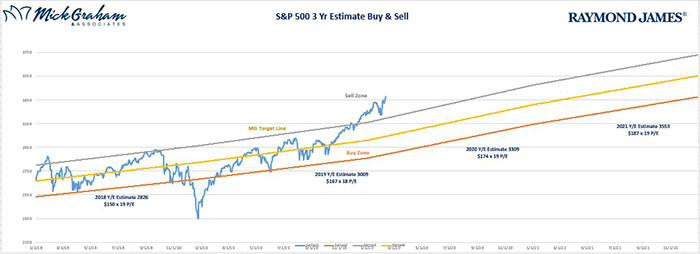

Ok, so let’s get back to reality. Markets continue to grind higher, despite some global concerns. Valuations continue to get stretched in the short term. As we charge higher, I’m getting a little bit more concerned…not in the long term but in the short to intermediate. The struggle here is that yes you want to be concerned as valuations increase, however markets overshoot to the downside and upside and you need to take advantage of the good times to counter the downside. With that said, I’m comfortable at this level to raise a little more cash.

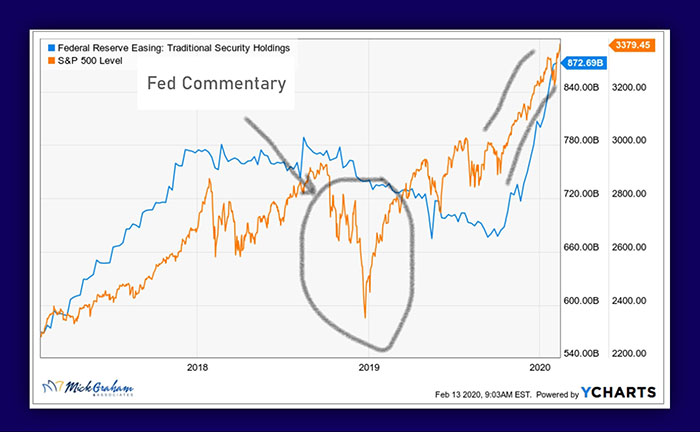

The chart I showed two weeks ago shows the story, in my view, of how and why this market has continued to rally. You hear the term “you can’t fight the fed”. When the fed increases its balance sheet by purchasing its own bonds, it floods the market with liquidity. When that happens, it’s a positive for the overall market, as there is more money to loan and inject into the economy. This as of right now is the #1 metric that I’m watching to provide some indication of where we go from here. This, on top of TINA (there is no alternative), could keep this market moving along.

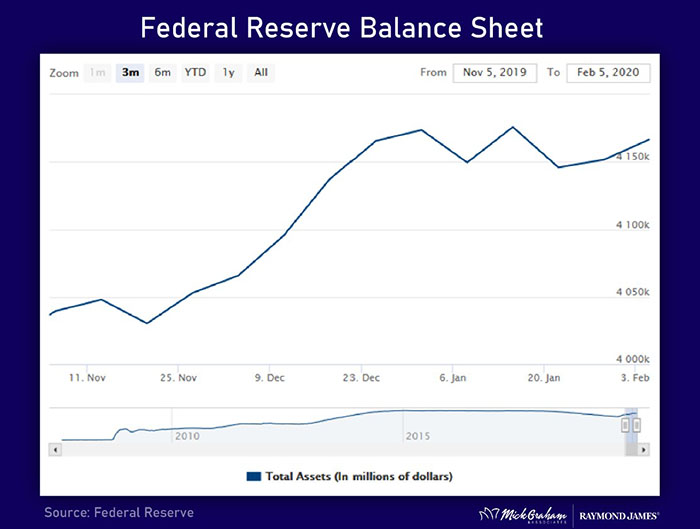

I’ll keep you updated weekly from this point on Fed Balance Sheet, as we move away from underlying fundamentals of the market driving returns. With all that said, here is the Buy/Sell.

Source MGA

Have a great week and feel free to call with any questions.