The Great Pre-Pricer

I got to spend a couple of days at our Regional Conference in Orlando (luckily only a short drive for me). Getting out of the office for a couple of days and getting to listen to some strategists that I respect in person, as well as a few new comers, is always time well spent for me. Last week started with ebbs and flows initially based on trade talks. Then mid-week the Fed announced that inflation numbers have reduced to the point that they do not see a need to increase rates through the rest of 2019. These conversations have been what’s driving market movements for the past few quarters, and what I still feel most investors and market “experts” miss. Anything that is commonly discussed in investing, has already been priced into the market.

You hear it all the time, things like “The Fed raised rates, let’s buy financial stocks”, or “Trump is adding tariffs, let’s sell industrial stocks”. Even some of the strategists last week gave some advice that involved making investment decisions based on headlines currently in the news.

Here are the two things that they are missing:

- It all comes back to earnings

- The market is the ultimate Pre-Pricer of all known things

- I’ve written about this numerous times. The “market” is the sum of its constituents. Its constituents are companies. The companies have earnings (profits or losses) and the market is ultimately priced as a multiple of those earnings. In high growth environments, you generally pay more for earnings, in low growth environments you pay less. I don’t want to spend too much time on this topic today as I know I sound like a broken record with this. But when market indexes move like they did in the last quarter, and earnings are as good or better than expected, that is a total mismatch, which creates opportunity.

- The focus of what I want to talk about today, is the market is unlike anything that feels natural to us. We are built to listen to experts, leverage your experience and make decisions. Almost anything we do this is done this way. Whether you’re managing your business, trying to pick your college basketball brackets, or trying to pick the next President, our decision-making process is the same.

Let’s look at your basketball brackets. You watch ESPN, listen to the experts, break down the head to head games, determine if any of the top players are out, injured or not playing at their top level, even review their records going into March. You then leverage your experience (and some bias) to make your picks. That system is rational, it feels normal.

Now let’s look at a political race. You’re bombarded with advertisements highlighting the weakness of the opponent. You read articles, watch debates, and then look at the polls. Now add in your experience and bias, and now you can make a prediction on who will win. It might be different from who you want to win, but nonetheless a rational strategy

Now let’s look at market predictions. E.g., the market will be up 12 months from now, or the market will be down 12 months from now, based on information that is currently being discussed in the news media. You listen to the analysis from your favorite TV host, neighbor who is “killing it” in the stock market, or Uber driver who just dropped off someone who works for this company that is about to release left handed screwdrivers, and it will change the whole market, and make your ultimate decision on whether to and/or how to invest.

OK let’s not make it so silly. Let’s say we analyze all the Wall Street analysts and average what they think the market will do. For example, the Dow Jones Industrial Average might range from say 25,000 to 28,000 at year end. Let’s just say the average at year end is 27,000, which from this point would give you a return of 12%. Sounds like a good strategy, right?? These people have done this stuff their whole life. They went to the best schools in the world, the letters after their name look like a math equation, wow they must be smart. You say, “I’m in, I’ll follow the smart money”. You just made the same mistake they did. They are making their decisions on commonly known information, and any commonly known information has already been pre-priced into the market.

If you’ve read it, heard it or watched it flash on the screen, then the market has pre-priced it, meaning the impact has already been felt. From this point a surprise one way or the other that has the potential to move the market. Another piece of news consistent with what we already expected shouldn’t move markets much further since investors’ money has bet that way.

A deal on trade and the Fed taking the foot off the pedal, was pretty much priced into the markets at this stage. Now don’t get me wrong, if we get a trade deal better than expected with some measures to enforce non-compliance, and protection for U.S. intellectual property, then that would be better than expected and you could see a short-term big jump in the markets. Also, I think removing barriers for global trade is a long-term huge benefit for the market. 10 years from now it will have aided the global markets by more than we can imagine, however the market doesn’t look further forward than around 24-30 months, so that impact won’t be seen for many years. The Fed has the ability to stall growth by raising to quickly or pulling liquidity from the market, so yes, they have an impact. But their transparency is like looking at the back of an Omega watch. The mistake the Fed made last year was stating that they were sticking to their previous “Dot Graph” and not stating what they actually do, which is review data and make recommendations. Sorry, I won’t go down this road any longer, I carried on enough last year.

My take away from all of this, is that short term, the market is a crap shoot, long term, it has some predictability. Anything you’ve read or heard that is commonly known has already been pre-priced in and as such should not move the markets that much. It’s a surprise one way or the other that will give it a short-term reaction. We are all playing the long game, and opportunities to outperform exist within maintaining your allocation, (regardless of what is being said on business channels), reversion to the mean and disproving commonly thought things. Taking the same side as everyone else has limited ability to outperform.

On a side note, for some clarity because I know it’s been on all the financial channels… “Dovish” pretty much means status quo, they don’t expect much to change. While Hawkish (opposite of Dovish), means you can expect some aggressive action. The Fed is currently Dovish is what your seeing on the news right now.

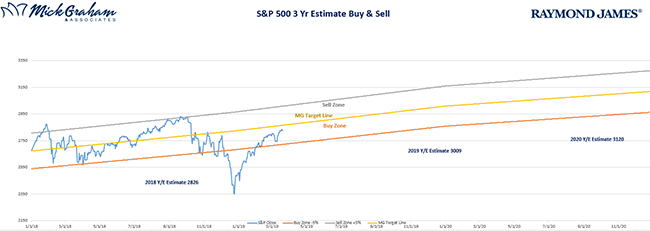

With that, here is the buy/sell

Source: MG&A

As always please feel free to call with any questions.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete, and is not a recommendation. Any opinions are those of Mick Graham and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. The Dow Jones Industrial Average (DJIA), commonly known as “The Dow”, is an index representing 30 stocks of companies maintained and reviewed by the editors of the Wall Street Journal. Forward looking data is subject to change at any time and there is no assurance that projections will be realized. All investments are subject to risk.