5% Moves

We got our second view in 2018 of what a 5% pullback looks like. The market leaders of the past year or more got hammered and dragged the overall market with it. The blame is being attributed to bond yield increases, China negotiations and some general uncertainty about the election.

Here are a few points that I want to leave you with this week as we start to get the first of 3Q earnings:

- Bond yields. I’m not sure if there could’ve been a more telegraphed moment in history on what the Fed is doing with rates. We’ve been so low for so long, and with strong economic numbers including unemployment, the Fed by not raising rates would risk dramatic inflation numbers. The long rates started moving up (finally) in response. I’ve written previously about the risks of rising rates, and how to position yourselves for it. As a reminder, when rates go up, bond prices go down. To help protect yourself, you may want to consider owning individual bonds. Owning an individual bond gives you the ability to say, “Hey, I don’t care what rates do, I know that as long as I hold this bond (and it doesn’t default), I will receive X% each year and my money back at maturity.” Second, another potentially prudent strategy is to ensure your duration is not long, meaning only a few years to maturity. This will give you the opportunity to buy a higher yield when your bond matures.

- 5% Pullbacks. 5% pullbacks are normal, and a part of a sustained bull market. We’ve grown accustomed to low volatility and that is not normal. Now that rates are moving we will need to learn to accept market swings of 3% in a day, no matter how painful it is. These moves do not mean an end to anything, rather are part of normal market cycles.

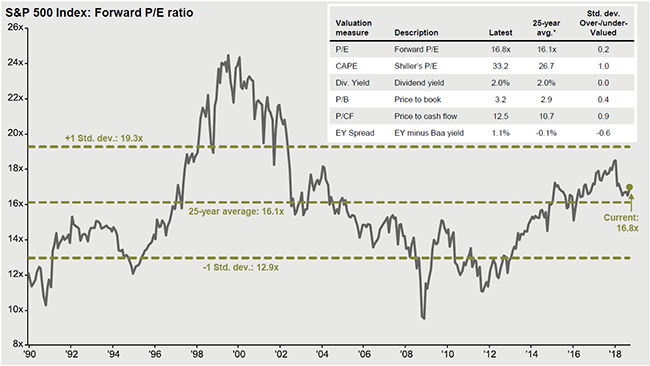

- Multiples. Multiples have come down and are now back to levels of historic average. Price to Earnings (P/E Ratios), or the multiple you pay for the market peaked after the tax reform bill passed based on expectations of greater profits, which is exactly what we’ve seen. Expectations of 25% Quarter over quarter earnings increases, were solidified and as we look to 2019 numbers future growth is somewhat subdued. Although this sounds a little glum, what I want you to take away from this is that stocks are no longer historically expensive.

Source: JP Morgan

As the above chart details, after tax reform forward P/Es (even under my expectations) were at 19 times earnings. Now the rubber has hit the road, and 2019 earnings won’t get a tax reform kick, forward P/Es should come back to just above long-term averages. I’ve written before why P/Es should be higher.

The question I am asking myself is given the recent move in the tech stocks, particularly the FANGs, is this a change of leadership? With a steeper yield curve, banks should benefit more than the major growth stocks.

In summary, in my view, this is not the end of the bull run, we may be going into the 3rd and final leg. The 3rd and final leg of a secular bull market, has given the best results.

As always should you have any questions or concerns, please don’t hesitate to call.

Any opinions are those of the author and not necessarily those of RJFS or Raymond James. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

Raymond James makes a market in FB, AMZN, NFLX, GOOG.

Debt securities are subject to credit risk. A downgrade in an issuer's credit rating or other adverse news about an issuer can reduce the market value of that issuer's securities. When interest rates rise, the market value of these bonds will decline, and vice versa.