I've fielded more questions about Bitcoin in the last week than I've answered about the markets in the past month. As it went through $11,000 last week, grabbing headlines and crows from those that are early adaptors and jumped on board and own some.

My perspective, although somewhat jaded, is from a fundamental standpoint. If I don't understand it, I'm not investing in it. Yes, I struggle to get my head around the block chain component, which provides the protection against hacking. My research on the topic, (which is limited to talking with some programmers and software engineers) has informed me that although it is possible, a hack has not happened. I'm told that the computing power that would be needed to create the processing speeds to break this technology doesn't exist, YET. At $11,000 a Bitcoin, I imagine there is attention from crypto bad guys all over the world.

More importantly, although I see a common sense need to have a universal currency to reduce bank fees, I can't imagine worldwide governments willing to have financial transactions coming through their shores without some type of tracking, control and/or taxing authority.

So my answer to the question on Bitcoin is the same as to any speculative bet that you would want to make, and that includes heading to Vegas. I'm ok with the speculative bet, however go into it with a mindset of how much am I willing to lose, not as a part of an investment strategy. If you’re on the right side of the bet, take out what you went in with and play with the house money. I agree with Jamie Dimon in his comments that this could go to $100,000 and beyond, before it explodes, but a day of reckoning will come. I read in the Wall Street Journal last Thursday that a Florida programmer in May of 2010 paid 10,000 bitcoins for two pizzas, that today would have been pizzas at $55 Million each. I hope the pizza guy kept them!!

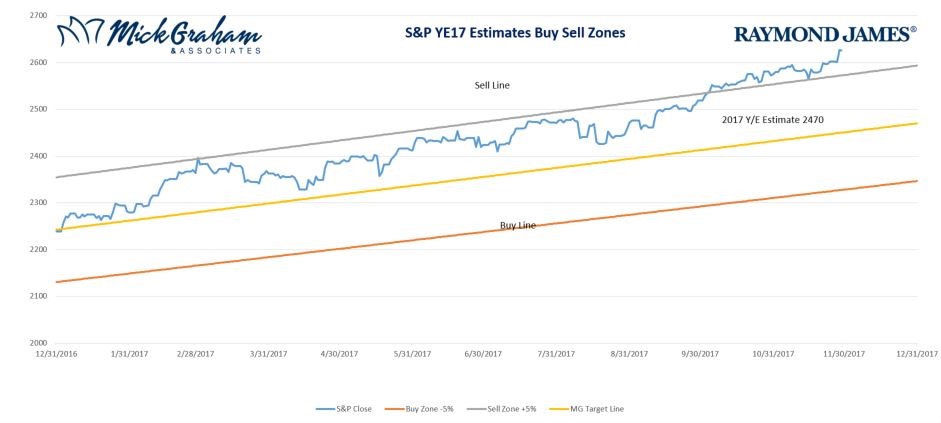

Here's the buy/sell for this week

As always should you have any questions feel free to give us a call

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Investors may not make direct investments into any index. Raymond James is not affiliated with any of the organizations or persons listed in this article.

Prior to making an investment decision, please consult with your financial advisor about your individual situation. The prominent underlying risk of using bitcoin as a medium of exchange is that it is not authorized or regulated by any central bank. Bitcoin issuers are not registered with the SEC, and the bitcoin marketplace is currently unregulated. Bitcoin and other cryptocurrencies are a very speculative investment and involves a high degree of risk. Investors must have the financial ability, sophistication/experience and willingness to bear the risks of an investment, and a potential total loss of their investment. Securities that have been classified as Bitcoin-related cannot be purchased or deposited in Raymond James client accounts.