November Effect

November is without a doubt my favorite month of the year. Living in Florida, you break out the sweaters from the back of the closet and you can be outside without being drenched in sweat. My utilities bill should come back down to earth. The kids come off their sugar highs, and we get to celebrate one of my favorite holidays of the year…Thanksgiving. I’m a big fan of any holiday that is centered around food and lets you celebrate with family and friends and watch football. Lastly, it’s my birthday month, and I intend on milking that all month long, although I have no interest in adding another number to my age.

November is also the month that I will encourage all of you to review your expected 2017 taxes and look for ideas on reducing your effective tax rate, if possible. As I’ve always said, “I don’t think they spend our money that wisely that we need to give them any more than necessary.”

Although I acknowledge that everyone’s circumstances are different, what I can tell you is that come December 31st, your ability to tax plan substantially reduces, if not completely goes away. And while there are many different things to review, here are just a few ideas:

- Income Tax Planning

- Accelerate or Defer Income.

- Know the tax scales. Know your effective tax rate.

- Determine what investments are taxed as income (corporate bonds) and what are long term gains (Qualified Dividends).

- Be careful of the wash sale rule……

- Investment Tax Planning

- Offset gains/losses.

- Determine what investments will be subject to long term v short term gains/losses.

- Trustees consider income distribution. Trusts have a lower threshold for 3.8% surtax than individuals.

- Discuss tax friendly investments. (Municipal Bonds etc.) Do they make sense for you in 2018?

- Life insurance generally passes tax free to beneficiaries, annuities and IRAs do not.

- Retirement Planning

- Maximize contributions to tax deferred accounts.

- RMD distributions. Don’t get penalized—ensure they’re taken.

- If you’re charitably inclined and over 70.5 years old, you can donate up to $100,000 of an RMD to a charity.

- Roth conversions. If your income was low in 2017 and you have an IRA or old 401K, you may be able to take advantage of the lower tax scales and get tax free growth in the future.

There is a great year end tax planning worksheet on my website that will give you some greater ideas. Click here to access.

I know it feels like the year has flown past and it’s too early to be thinking of this, however with all the chaos of the holiday season, it will be here before you know it.

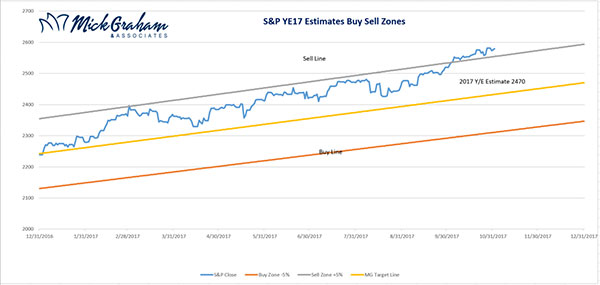

Now for the markets. What a month October was, what a year it has been so far and what a rolling 12 months we’ve had. Of course, when it feels this good, my personality type is cautious, however none of the economic figures coming through have changed any of our longer-term thoughts. We are in the second leg of a secular bull market; the markets are ultimately driven by fundamentals (aka Earnings) and earnings have been stellar, and the effects on the consumer numbers from the hurricanes seem to be short lived as was predicted. Our buy/sell still has the market a little ahead of itself however on current earnings growth forecast, it’s only a matter of months till that is caught up. All in all, we are still very positive. That said having a small amount of cash to take advantage of opportunities I feel is prudent, even though that type of opportunity has been extremely difficult to come by. In a CNBC interview I heard an analyst from LPL financial state that historically the major indexes have moves of 1% either way in a day around 30% of the time. So far this year, it has happened 8 times and this is making the market on track for the fewest moves since 1995.

Source: MG&A

Lastly, congrats to the Houston Astros for their win in the 2017 World Series. A great result for a city devastated by flooding just a few short months ago.

As always should you have any questions please feel free to give us a call.

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person’s situation. While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of RJFS, we are not qualified to render advice on tax or legal matters. You should discuss tax or legal matters with the appropriate professional. The S&P 500 is an unmanaged index of 500 widely held stocks. It is not possible to invest directly in any index.