Activist Investing

There was a lot in the press last week around a big proxy fight at Procter & Gamble. Nelson Peltz (a long time Wall Street Fund Manager) now part owner in Trian Fund Management (an activist investing firm) is attempting to gain a seat on the Board. All the public fighting makes for great TV. Since I got into this business I’ve seen an increase in activism so it led me to do a little research about the history as well as the size of this industry.

First…What is Activism?

Activist investing is when an individual or group purchases "a large number of shares" and attempts to make some major change within an organization. You typically hear about the fights for board seats in the news, but activists will also attempt to:

- Change Corporate Governance

- Remove Officers/Directors

- Maximize Shareholder Value

Early activism dates back to 1926 when Ben Graham (who most consider the grandfather of value investing - myself included) wrote a letter to Northern Pipeline, a security that he owned a small amount of. In his letter Graham stated that the company owns Millions of Dollars in railway bonds and securities, and those assets serve no purpose for the operating of the company, and requested that those assets be sold and money returned to shareholders. At the time, receiving letters from shareholders especially those with advice on the running of a company was un heard of. In their response to Graham, the company wrote, "Running a pipeline is a complex and specialized business, about which you can know very little, but which we have done for a lifetime."

Unperturbed, Graham spoke to as many shareholders that owned 100 or more stocks and pleaded his case. He wrote, "The determination of whether capital not needed in the business is to remain there or to be withdrawn, should be made in the first instance by the owners of the capital rather than by those administering [it]." His lobbying efforts included the Rockefeller foundation, who at the time were one of the biggest shareholders. His efforts eventually got Graham his way and the activist investor was born.

How Wide Spread Is Activism?

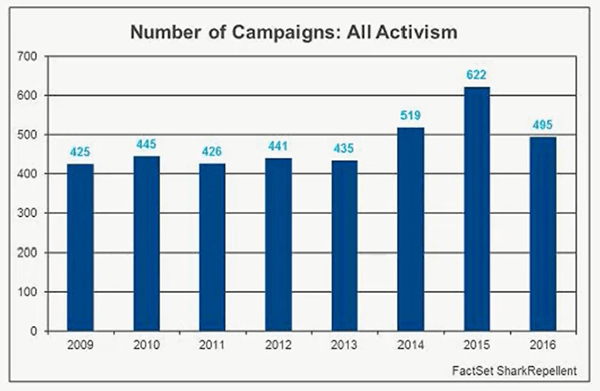

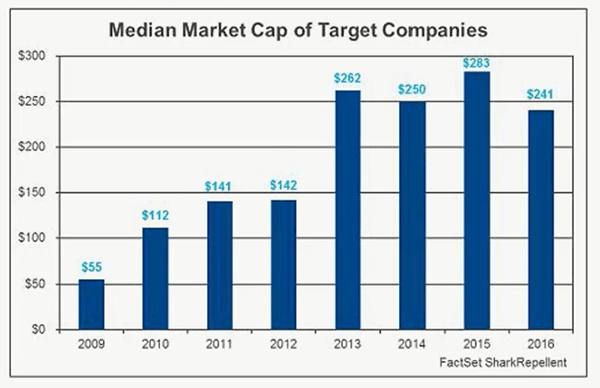

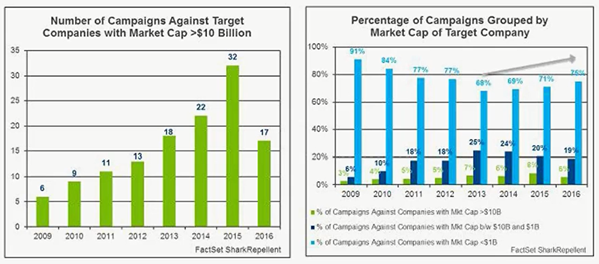

Traditionally activists targeted smaller companies. It took a lot less capital to affect change in some of these organizations. Also, smaller companies generally have little, if any research analyst's coverage, so companies could buy shares and examine the books themselves to determine if companies had hidden value. An increase in successful campaigns led to larger companies becoming targets. As the chart below shows, according to FactSet, campaigns against US incorporated companies were steady through 2009 – 2013 and increased in 14 & 15.

In the past year however, that trend is starting to reverse. There are fewer larger cap companies having to protect themselves against activist intervention. A sign that some consider that value is now not in the larger cap names. I look at it like some of the campaigns from the last few years are completed and we could see some value returned to shareholders.

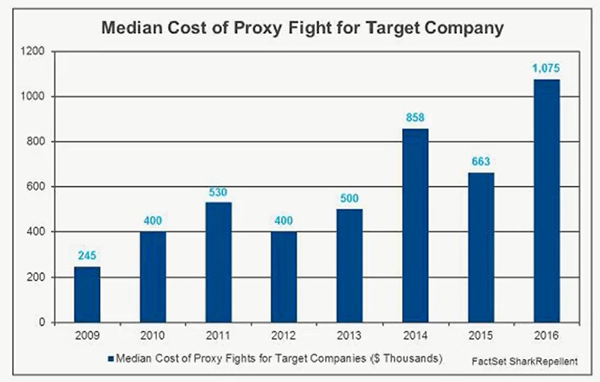

One of the major downsides for these fights is obviously cost. If the activist decides to force the company to create a vote for a certain issue (which can be done by the company receiving a request from a certain number of shareholders) then the company needs to schedule that and perfrom all the due diligence and legal paperwork. If the company opposes the request then the costs can go even higher.

Lastly…Why You Should Care

There are two schools of thought on this. Activists will tell you that their goal is to invest in very good companies that have lost their way, and with some additional resources they can maximize their return to shareholders. Others will tell you that an activist is looking for a short-term profit by affecting change and leaving.

Although I have not been able to find an exact figure the total dollars committed by activists, funds range into the hundreds of BILLIONS of dollars, and that’s just accounting for the assets of the top 10 funds. There is an underlying value these funds provide to the overall market, and if those funds were withdrawn and used for other purposes I’m sure the market overall would feel the impact.

From where I sit, even given the additional cost an activist investor can force a company to spend, I take confidence in the fact that there is some sunlight over the top of company CEOs and boards. It easy to get complacent and if the company is not looking to maximize the return to shareholders then they should have never gone public in the first place. With more and more index funds owning bigger and bigger shares of public companies, there is less and less investor engagement. As Ben Graham said, management is there to administer the capital, the owners of it should determine its best use.

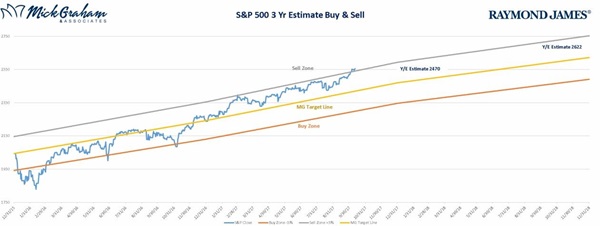

Buy/Sell

Take a look at this week’s buy sell…the market continues to charge higher.

Source: MG&A

Have a great week and as always, please don’t hesitate to call with any questions.

All opinions expressed are those of Mick Graham and not necessarily those of Raymond James. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. It has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. This information is not a complete summary of statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. Past performance does not guarantee future results. The S&P is an unmanaged index of 500 widely held stocks that’s generally considered representative of the U.S. stock market.