Final Countdown

As we move into the final quarter of the year, it’s a good time to review your contributions year to date and ensure you are on track to do what you set out to do in contributions this year. I’ve seen it many times that participants in 401ks think they picked a certain amount of contribution and when they look at the end of the year that did not make the contributions they thought they did. At that stage, it’s too late.

In 2017, you can defer $18,000 from your salary with an additional $6,000 if you are over 50. Now that’s your contribution plus whatever match your employer offers. So, look, determine if you are on track to defer the amount that you set out at the start of the year, and if your financial situation can handle it, lift your contribution amount.

Now as for the markets, if you’ve been invested in the stock market some of you probably have a big smile on your face, looking at this years returns. By far the most asked question I get is “Is the market expensive?” closely followed by “How much longer can the market run last?”. I will put in writing that I believe we are in the midst of a secular bull market that has many years left to run. I think the market is slightly expensive at the moment when you consider long term averages however company earnings have been strong this year and we expect that to continue in the future. Ultimately this is what drives the markets.

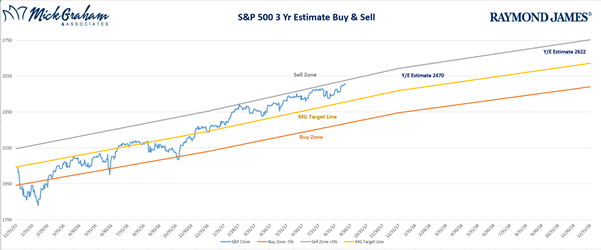

On my website, we have what we call the Buy/Sell sheet. It highlights our forecasts for he year end for the markets and shows where we are compared to that forecast. I’ve attached a copy of the graph below however it’s uploaded each month to the website and you can review it at any time by clicking here.

Source: MG&A

Lastly, to review your returns I always add the index returns so you can compare your returns against your respective index. You can use this to measure if you are performing to the extent that you should be. We have highlighted these Conservative, Moderate and Growth.

If you have a question regarding to your allocation or risk tolerances there are many tools provided through your 401k provider to help you get a handle on where you should be, or you can always call our office.

Regards,

Mick Graham, CPM®

Branch Manager

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The S&P 500 Value is a market-capitalization-weighted index developed by Standard and Poor’s consisting of those stocks within the S&P 500 Index that exhibit strong value characteristics. The S&P 500/Citigroup Value Index uses a numerical ranking system based on four value factors and three growth factors to determine the constituents and their weightings.

Barclays Capital US Aggregate is an unmanaged market value weighted performance benchmark for investment-grade fixed rate debt issues, including government, corporate, asset backed, mortgage backed securities with a maturity of at least 1 year.

A total return index is a type of equity index that tracks both the capital gains of a group stock over time, and assumes that any cash distribution, such as dividends, are reinvested back into the index.

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Mick Graham and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected.