Active vs. Passive

In last week’s note, apart from including a picture of Grizzly Adams, I touched on Active vs. Passive investing, and stated I would discuss this in more detail later, so here it is.

To provide an overview as described by Investopedia, passive investing is in for the long haul (buy and hold) and active is more related to what we do as an active Portfolio Manager. These descriptions in my opinion are very vague and not quite accurate. Passive investing in today’s age can be best described as buying an index through an ETF or a fund that attempts to mimic the index that it tracks. The argument for passive is that money managers underperform and considering most financial plans are based on historical returns then why wouldn’t you just buy the index. Great Question!!!

Here's my response:

First…what is left out of a lot of these conversations are the costs to purchase these funds. The costs of owning and holding these funds have come down to be very inexpensive, but that does not account for the cost of selecting, buying, providing custody or reporting. This is usually paid by clients to an advisor on top of the cost of the fund. In my experience, sometimes the total cost can be more than a traditional money manager.

Second…when you buy an index you are getting all the index. The good, the bad and the ugly. Now as a fundamental analyst there are companies that I would think would be impossible to own based on price, earnings and or growth expectations.

Third…although I believe one of the fundamental mistakes made by retail investors make is trying to time the market, there are times where caution is warranted and a reduction to risk can be the prudent move. Where an investor is drawing down from their portfolio what can be devastating is a major hit to their portfolio. When we consider the 2008 financial crisis, the S&P 500 was down as much as 49% through the year eventually finishing down 39%, according to JP Morgan. When you add on withdrawals from the portfolio this can magnify these losses.

Fourth…. Mutual Funds, even mutual funds designed to mimic an index have specific tax treatments that can mean you are issued with Capital Gains or Losses that you may not be prepared for. This is called “pass through”. ETFs receive better tax treatment than funds. At the end of the day you should be overall concerned with your net return, that includes taxes paid.

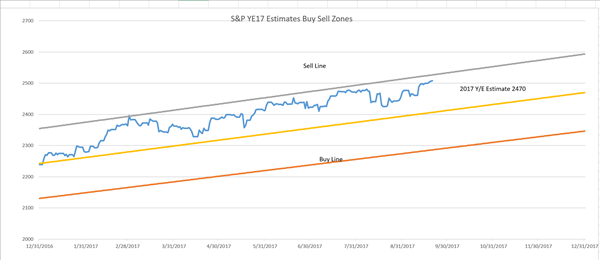

Lastly…. There are times when you can argue that passive investing outperforms active investing, and those times are usually when the overall market is undervalued, however when the market is fairly valued you can favor active. As you can see from our Buy/Sell we think the market is fairly valued. In 2016 according to the Wall Street Journal $429 Billion moved into major index passive funds while $285 Billion was taken from active funds. What this does is move the needle on the top 500 stocks as all this money is pumped into these names through index investing. With over 5,000 listed securities the top 9% of securities are having their prices inflated buy these transactions.

I’ve argued for years that by managing our portfolios in house, I can tell you what's in the portfolio and why, and what we are doing about it in the future.

Buy/Sell

We went through 2500 on the S&P 500 last week, through our year end forecast, but still within our range.

Source: MG&A

Have a great week, and as always should you have any questions please feel free to give us a call.

Regards

All opinions expressed are those of Mick Graham and not necessarily those of Raymond James. Links are being provided for information purposes only. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. It has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. This information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The S&P 500 is an unmanaged index of 500 widely held stocks that's generally considered representative of the U.S. stock market. ETF shareholders should be aware that the general level of stock or bond prices may decline, thus affecting the value of an exchange-traded fund. Although exchange- traded funds are designed to provide investment results that generally correspond to the price and yield performance of their respective underlying indexes, the funds may not be able to exactly replicate the performance of the indexes because of fund expenses and other factors.