Resilience

Happy Labor Day…this year sure is going by fast…

The effects of Hurricane Harvey again shows how little we can control, and the power of mother nature. With the death toll standing at 30 and counting (as reported by the New York Times), 6 straight days of rain with over 50 inches, 1,800 square miles flooded, and the number of rescues over 3,500 just by the Houston Police Department according to the Police Chief Art Acevedo.

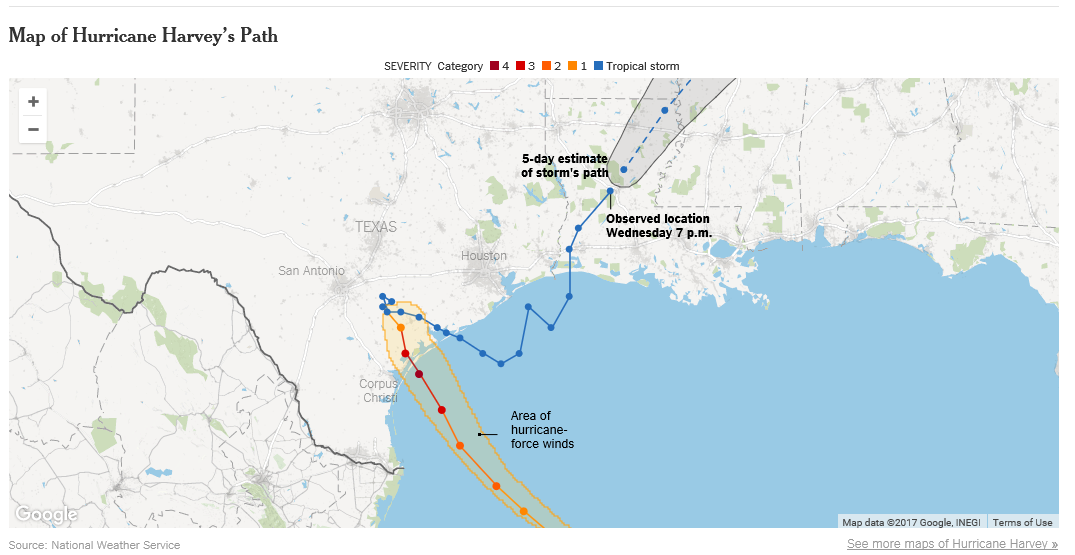

The path of the storm as you look from the image released by the National Weather Service looks like it targeted Houston, with the path crossing the coast on the west of the city then made a U-turn and went south to eventually pass on the east side of the city, and produce the most rain ever reported. Surpassing the previous total of 48 inches according to Jeffrey Lindner a meteorologist in Harris County. Lindner said that the amount of water dumped on the county was enough to run Niagara Falls for 15 days.

As I read the stories both devastating and inspirational, what stands out to me is how quickly the rest of the nation comes together to assist, and the resilience of those affected. As I write this, I’m hearing about the massive amount of support that is on its way to Texas. We see it over and over again. When our neighbors are knocked down, the rest of us rally together to lend a hand. Although it may take many years, I have no doubt that Houston will come back just like Florida did in ‘04, and New Orleans in ‘05. Here’s a link to an article with inspiring acts of heroism: http://www.telegraph.co.uk/news/2017/08/29/inspiring-acts-heroism-kindness-emerge-hurricane-harvey/

How is this related to the markets? Apart from some of the businesses affected in the area, delays in deliveries and some refinery closures, I prefer to use this as an example of how no matter what is thrown at us, whether it be natural or manmade, that as a nation and as an economy we will eventually overcome and prosper.

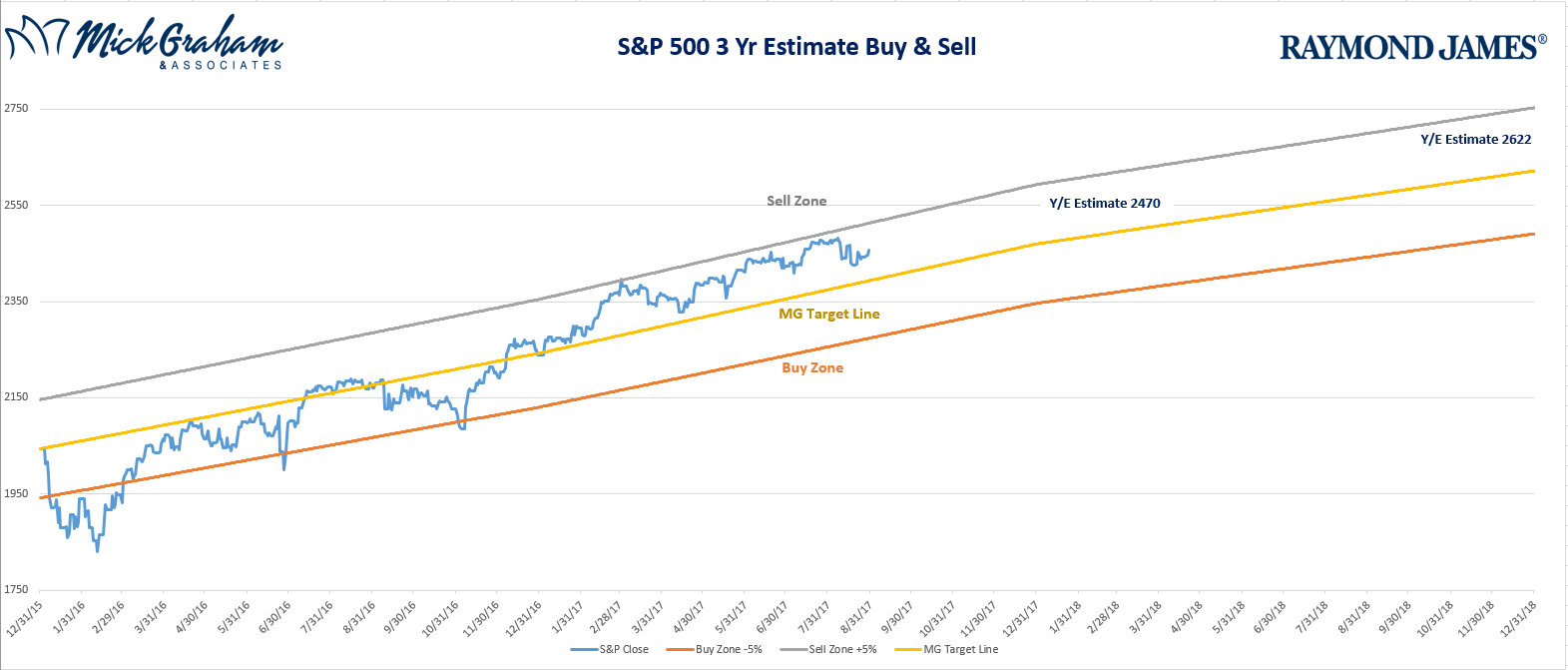

The buy/sell this week is still in the slightly overbought range but still within our 5% target. Resilience…

As always please feel free to call with any questions,

Mick Graham, CPM®

Branch Manager

Raymond James is not affiliated with and does not endorse any of the entities or individuals listed above. All opinions expressed are those of Mick Graham and not necessarily those of Raymond James. Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. It has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. This information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. The S&P 500 is an unmanaged index of 500 widely held stocks that's generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index.