Huge Week–Earnings, Analysts & the Dollar

A large week of earnings which means a rash of conference calls, and a number of the analysts I respect and follow closely on wall street, published white papers this week.

I read with delight that the focus of a lot of the articles related to corporate profits, and not only their importance to the direction of the market but how little politics play in the long-term market movements. My old colleague Rich Bernstein published a white paper this week titled “The Three Ps” where he highlighted “P”rofits. “P”olitics and “P”robability. Rich who now runs his own Advisory firm, has always been a highly credible source on macro market issues. He argues that Politics is about what should be and Investing is about what is. I thought that was a good summary. I still prefer the Washington insider Andy Friedman who gives the following explanation of the word politics being Poly (meaning multi or many) and Ticks (which are small blood sucking pests).

I also had the opportunity to dial into a call he hosted last week where he reemphasized how crucially important profits are. My favorite saying is “it’s all about Earnings” is finally getting some ink.

On that note, Bob Doll (another of my ex Merrill colleagues – now at Nuveen) stated that “with nearly 20% of the S&P 500 companies reporting second quarter results, revenues have exceeded expectations by 1.3% and earnings per share have beaten expectations by 5.4%.

The US Dollar recent weakness has also got some headlines in the past week. As the dollar weakens it helps US based companies who have sales overseas. According to Morgan Stanley analyst Michael Wilson, the US Dollar is down 8% this year and he feels that it can drop down to 13%. If that happens Michael believes that there could be a 6.5% boost to earnings in the final quarter.

I’ll finish the way I started with Rich, who stated his biggest fear right now is in long dated bonds. The “P”robability, is that rates will rise. He stated that the Barclays Aggregate index, (which is an index that is a representation of US investment grade bonds ex Municipals and Treasury Inflation-Protected Securities) now has the longest duration in the history of the index. This means that investors have had to buy longer dated bonds to get yield. It shows the investors’ appetite for yield and this is a huge red flag for Rich. To add to Rich’s thoughts, I see that Argentina was able to issue a 100-year bond (WHAAAT) yes Argentina issued a 100-year bond, and it was oversubscribed. According to Forbes, Argentina defaults on its debt every 8 years. Go figure!!!

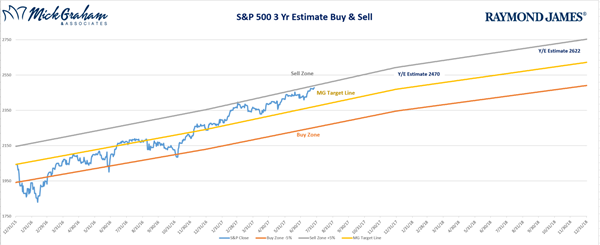

As for the Buy/Sell, still at the top end of our range, and I’m still comfortable with it.

Source: MG&A

Have a great week and feel free to call with any questions.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. Past performance does not guarantee future results. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Raymond James is not affiliated with and does not endorse the services of Richard Bernstein Advisors, Nuveen Asset Management or any of the individuals quoted.