I listened to a great discussion on the weekend that was filmed at the world economic forum last month, with a panel consisting of Technology company founders & CEOs. The focus of the discussion was the 4th Industrial Revolution.It was fascinating to listen to these entrepreneurs and thought leaders, touch on some of the amazing technology being worked on in labs around the world, and how that will not only interact to the ultimate consumer and the way we live, but how that will affect the workforce in the future.

Now if you don’t know about this term phrased by Professor Klaus Schwab (founder of the World Economic Forum) then I’ll give you the overview:

The first industrial revolution was the transition from an “agri culture” to rural/urban, with the textile and iron industries and the development of the steam train back in the 18th century.

The second industrial revolution took place between 1870 and 1914, which is described as a time of growth of pre-existing industries and expansion of new ones. Invention of the telephone, light bulb and internal combustion engine.

The third as mentioned was the digital revolution starting in 1980, with the advancement and mass production of the personal computer, internet and wireless communications.

The 4th represents a new way in which technology interacts with societies and the body. Inventions of Robotics, nanotechnology, quantum computing, 3D printing and autonomous vehicles, are all credited to this time.

Now whether you accept, believe or even want this next generation of growth, it’s happening and it’s showing through into investment markets as well. A few stats highlighted in our Investment Strategy Quarterly pushed this home:

- The five most valuable publicly traded companies today (Apple, Google, Microsoft, Amazon & Facebook), all of which you could argue are technology companies. These companies according to the report produced over $25 Billion of Net Profit in the 1st Quarter of 2017. $25 Billion of profit!!!!!

- Since the last recovery (March 2009) the S&P 500 is up 262% and the technology sector is up 333%.

- When the S&P 500 was created in 1957 industrial stocks made up 425 of the 500 stocks, today industrials are 10.2% of the index or 51 companies if you do the math.

The world of science fiction may well become science fact.

It’s a little daunting to think where this progression can stop. There is already a huge amount of data out there that is captured on each click of the mouse on your computer. A huge issue for governments around the world will be to determine what steps over the privacy line when compared to improved efficiencies.

What I look at, and will be focusing on moving forward is whether the future of these technological advances will be from start up companies or incubated from the labs of the already existing big 5 or larger companies like them. Just simply reviewing the time frames between these tagged “Industrial Revolutions” I notice the speed in which these companies will need to be able to adapt, will be as critical as the new technologies themselves. Yes these companies have plenty of cash to purchase up starts, but they come from nowhere and get there very quickly in this age.&

All the data leads me to take away that our secular bull market can benefit from this rapid progression over the next several years, and provides me the faith to continue to believe this run has plenty of time left.

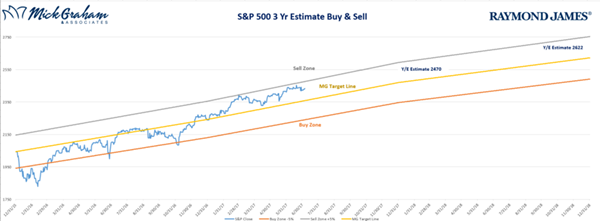

Here is our buy/sell for this week:

As always should you have any questions feel free to reach out.

Any opinions are those of Mick Graham and not necessarily those of Raymond James. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results. It is not possible to invest directly in any index. The S&P 500 is an unmanaged index of 500 widely held stocks. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification. Further information regarding these investments is available from your financial advisor. Price Earnings Ratio (P/E) is the price of the stock dividend by its earnings per share. Information provided is general in nature, and is not a recommendation or a solicitation to buy or sell any security. Investments and strategies mentioned may not be suitable for all investors. Investing in stocks involves risk, including the possibility of losing one’s entire investment. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Photos used by permission from Fotolia.com.