Effect of International Conflicts on Stock Markets

A couple of weeks ago I highlighted how low volatility has been recently, meaning we have not seen the swings in the market one way or the other of 1% or greater for some time. In fact, a look at the volatility index shows that the Index has been historically low since the election. Low volatility when markets are going up can feel good, natural however they can leave us vulnerable for when volatility returns.

This past week we’ve seen the index tick up over the 15 level. If you go back to the financial crisis, the index sat above 40 for a long period of time, however in more recent times it jumped based on some news from either home or abroad. The spike in June of last year was related to Brexit and in November was election related as the market digested the news that we would have a President Trump. Through the election night the Dow futures showed down 700 and ended up opening the next day at 9.30 up. That’s volatility…

Given our strike on Syrian air base in response to suspected chemical attacks, and as I watched Secretary of State Tillerson’s press conference after meeting with the Russian President and Foreign Minister, it got me digging through Google looking for market reactions to international conflicts.

What I found is that a discussion of a conflict has a general negative effect on stock markets and a subsequent action has been positive. Measuring conflicts including WWII, Korea, Vietnam and Afghanistan the markets ended substantially up from when the conflicts started. The two weeks in October (16th – 28th 1962) during the Cuban missile crisis the Dow Jones surprisingly only dropped 1.2%, and ended up gaining 10% through the remainder of that year.

The exceptions to the above, include WWI and the Gulf War, which had the markets down during the conflicts, however both of those occurred during recessions/depressions. The stock market was closed for six months during WWI, liquidity dried up and the market dropped 30% in 1914. The next year however the Dow was up 88% and ended up 43% from when the conflict started or an annualized 8.7%.

How do you play this?

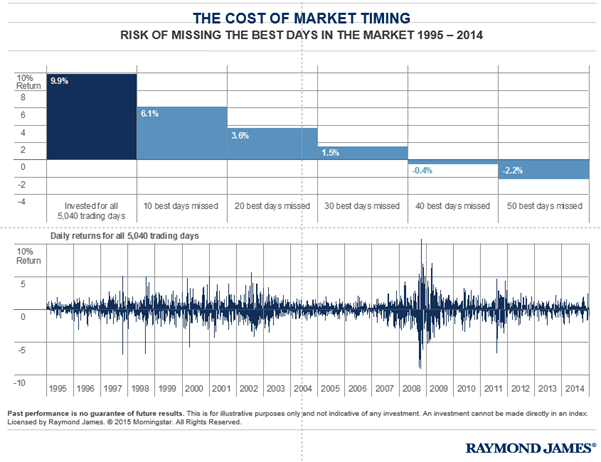

First, I’ll tell you how what not to do. “Get out”, or as we like to call it, time the market. I think the above has given evidence that it’s impossible to determine how the market will react to any given circumstance. What I feel is appropriate is to have a little cash on hand to take advantage of any move backwards. I like highlighting the graph below that highlights how your returns differ if you missed out on some of the better market days.

As I keep saying, “Ultimately it comes back to earnings”, a timely quote as we kicked off 1st Q earnings this past week. We’re expecting some strong quarter over quarter results, and I’m looking for this quarter to confirm our longer-term thoughts of a fiscal driven bull market.

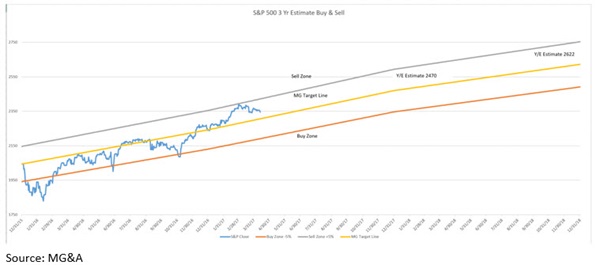

Here is the buy/sell for last week

Source: MG&A

Have a great week,

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Holding stocks for the long-term does not insure a profitable outcome. Investing in stocks always involves risk, including the possibility of losing one's entire investment. There is no guarantee that any statements, opinions or forecasts provided herein will prove to be correct. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal.