And Now for Earnings

Firstly…. Happy Birthday Mum!!…. Don’t worry Im not saying the number!!!

It all comes back to Earnings……. I know I say it a lot, it’s my way of trying to explain daily movements in the markets. It hard to balance something heavy at the end of a thin stick. It moves a lot both up and down and left and right, this movement I compare to the market volatility. The market trying to make sense of what earnings will be 6 months or so in advance, and move on many things, but ultimately as earnings come out we can confirm or reject any predictions we have made on what we expect our companies to earn.

Last week started the reporting period for the 4th quarter of 2016. The financial sector is generally the first sector to report each quarter, and given the recent run since the election has been predominantly driven by financials, it will be an interesting read.

Aside from these companies reporting their earnings, a lot of analysts look for guidance or language from the CEO or company representative in the earnings call. If you’ve never listened to an earnings call before, it can be very interesting. Goldman Sachs is set to report before the bell on Wednesday, and in today’s world you can join the presentation via your computer. A day or so before they will put up a link to join the conference. In most occasions, you go through the company’s website and click on the investor relations tab. In the case of GS click on this link and it will take you to the company’s presentation page. http://www.goldmansachs.com/investor-relations/presentations/index.html

Earnings forecasts have been pulled back by Analysts through the year each of the last 8 years. Meaning at the start of the year Analysts have had a higher expectation of earnings and closer to earnings being reported they adjust these numbers. I read a recent report published by our research department and I calculated that earnings expectations contracted on average around 15% each year during that time. This highlights the slooooow economic growth that we have experienced. What we are experiencing so far this quarter, is the rate of earnings reduction estimates has slowed, which is a nice trend to have.

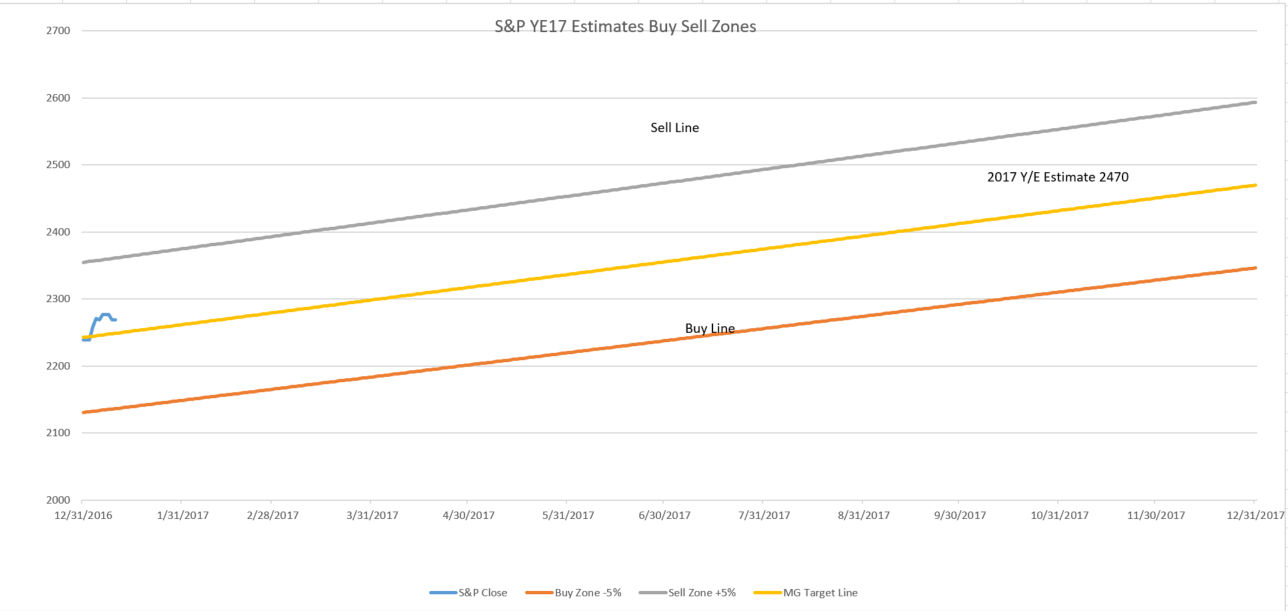

This year we have forecast $130 of earnings for the S&P 500, and as I review all other analysts from across Wall Street firms, we are pretty much the mean. The difference is on what multiple you are willing to out on the market. We are more bullish given the pro-growth stance of the administration. I believe companies will make money in any political environment, however if you can give CEO’s certainty on what the fiscal landscape will look like, they will have the confidence to reinvest capital and ultimately grow earnings.

Source: Mick Graham & Associates

As always should you have any questions or concerns, please don’t hesitate to give us a call.

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance.

Individual investor's results will vary. Past performance does not guarantee future results. Holding stocks for the long-term does not insure a profitable outcome. Investing in stocks always involves risk, including the possibility of losing one's entire investment. There is no guarantee that any statements, opinions or forecasts provided herein will prove to be correct. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Forward-looking statements are subject to uncertainties that could cause actual developments and results to differ materially from the expectations expressed. The website provided is for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor the Goldman Sach's website or its respective sponsors. Raymond James is not responsible for the content of the website or the collection or use of information regarding the websites users and/or members.