Stocks Inch Up on Meeting Minutes was the headline in the business section of the Wall Street Journal Business section last Thursday. The article referring to the release of the Federal Reserve Minutes from their July meeting. I can’t tell you how over this I am. I long for the days that what drove markets was the results of earnings and growth prospects from companies inside the major indexes.

As we now go into year 8 of government interference, that essentially placed a “security blanket” under the market and no doubt stopped the massive amounts of bleeding from organizations back in the financial crisis, the Fed still is able to move markets based on their commentary. Believe it or not, this is not the norm.

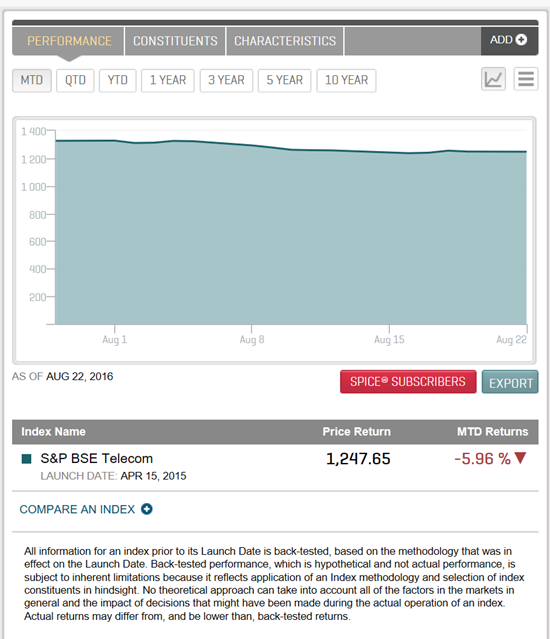

Last week we started to see the volatility that I would expect to see in the higher yielding sector of the markets. Telecom indexes took a hit early last week, (see graph below of the S&P Telecom Index). The only explanation I could find written by any analysts was that it was profit taking. Although I think there is probably some truth to that, I see it as exactly what happens to an index prior to a breakdown. The overall market during the same period was relatively flat.

What this reiterates to me is that keeping the focus on “total return” is key, rather than a focus on income orientated stocks. Total Return, meaning obtaining a return from both the growth of a stock as well as income from dividends, rather than just focusing on stocks that pay a high income. As you can see from the graph, when these things move, they move quickly. If you bought this stock on Monday for the dividend, you would have lost half of that dividend on Tuesday.

This does not mean I’ve turned negative, rather that it’s definitely possible, and I actually think we will see a swift and harsh pullback of these sectors at some time through the year. The key now is to ensure that you don’t have over exposure to these sectors and hold a little cash to grab opportunities when they present themselves. AT&T as of 8/18 showed a Price to Book value of 2.08 times as opposed to Bank of America 0.64 according to the Wall Street Journal. When I see these types of spreads it tends to grab my attention.

The expectation now is that we will only see one rate rise this year instead of the two previously discussed by the Fed earlier in the year. This probably means that we will see these inflated prices for the higher yielding names for longer. I maintain that we are in a long term secular bull market that has many years to go. My point for bringing this to your attention is that it’s unlikely to be a straight line and the volatility that we may see from movements I highlighted above are both normal and expected.

As always should you have any questions please don’t hesitate to call.

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Dividends are not guaranteed and will fluctuate. Inclusion of this index is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Raymond James & Associates, Inc., member New York Stock Exchange, makes a market in AT&T Corporation (T) and Bank of America Corporation (BAC). T and BAC are followed by the Raymond James & Associates Equities Research Department.