Summer Quarterly Commentary

Dear Clients and Friends,

We hope everyone is staying safe and healthy. As Summer comes to an end, we thought this would be a good time for an update. The markets have been very resilient through 2021. While news on Covid and inflation are concerning, the markets have proved quite resilient.

With the reopening of the US and global economies, economic growth has accelerated. Capital markets continue to move up as corporate revenue and earnings continue to surprise to the upside.

The S&P is now up 19.04%, the Dow Jones Industrials up 15.85%, International stocks MSCI EAFA up 11.86%, and the Barclays Bond Aggregate up -1.26% (thru Aug 9th 2021).

Energy, Financials, and Real Estate are outperforming, while Consumer Staples and Utilities have underperformed early in 2021.

MARKET OUTLOOK

From last quarter:

While markets have moved up early in 2021, we continue to remain constructive on our outlook. As additional vaccines become available, we believe the economic recovery will take hold. Improving economic conditions should help corporate earnings improve. We continue to buy into market weakness. We currently favor overweighting Technology, Healthcare, and Financials

For this quarter:

The S&P 500 continues to perform as record highs have been reached several times this month. While the COVID Delta Variant and higher inflation have caused recent volatility, we still see positive signs for the overall market. Positive technical trends and robust earnings growth reflect a growing economy. In this environment, we continue to remain constructive long term even if short term volatility might arrive for the Fall season.

Market Disturbance are fact of life for Investors

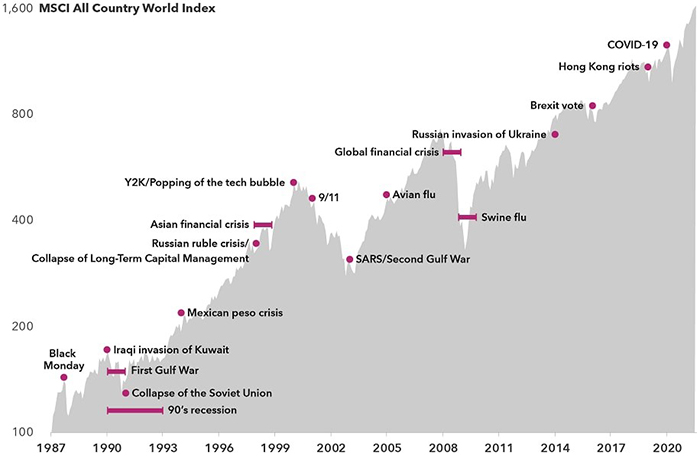

The old saying “the market climbs a wall of worry” certainly has proven correct. This chart reflects major market disruptions over the last 30 years. As shown, the market has recovered each and every time, always to emerge stronger on the other side.

THE TEAM

After a long 18 months of social distancing and Zoom meetings, Team Legacy was able to get out and let off a little steam. We visited Rage RVA and experienced the thrill of smashing stuff up!

Iris’s dog Chester is one of our many Legacy Mascots. He is now in retirement. Chester is 16 ½ and loves to relax around the house and enjoys mom’s cuddles!

DID YOU KNOW TRIVIA

According to Fidelity, the average 401k balance as of 1st quarter 2021 was $123,900. This is an increase of 36% from the prior year!

We have listed a link to the most recent quarterly market data for your review. Raymond James’ Capital Markets Review reflects current market and economic conditions. You can access the report by clicking on the link http://www.raymondjames.com/pdfs/capital_markets_review.pdf.

Thank you for your interest and as always please do not hesitate to contact us if you have any questions or comments.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal. The MSCI is an index of stocks compiled by Morgan Stanley Capital International. The index consists of more than 1,000 companies in 22 developed markets. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise. Investing involves risk and you may incur a profit or loss regardless of strategy selected. One cannot invest directly in an annex. Past performance is not indicative of future results.