Summer Quarterly Commentary

Dear Clients and Friends,

We hope everyone is staying safe and healthy. 2020 has certainly been one for the history books and we still have an election to go… We thought it would be timely to provide a market update and a few interesting graphs pertaining to Covid 19 and the upcoming presidential election.

Year to date the global stock markets have seen extreme volatility. Most global stock markets corrected between 25 – 35% within a very short timeframe in the Spring. The causes for the large downturn were the uncertainties surrounding Covid-19, oil price declines after OPEC failed to agree on cuts, recession fears due to mandated government shutdowns, and reduced market liquidity. Most global stock markets (including the US) bottomed at the end of March and we have seen a strong rebound in equity markets. The equity market rebound can be attributed to Federal Reserve monetary policy, US and Global fiscal response, and potential treatments and vaccines for Covid 19.

The S&P is now up 3.63%, the Dow Jones Industrials down - 1%, International stocks MSCI EAFA down -6.62%, and the Barclays Bond Aggregate up 6.24% (thru Aug 9th 2020).

Technology, Communications, and Healthcare are outperforming, while Energy, Industrials, and Financial sectors have underperformed in 2020.

Market Outlook

From last quarter (Pre-Covid):

For 2020, we are expecting global economic conditions to gradually improve. This should reaccelerate earnings growth to 5.5% (only 1.2% for 2019) . The market is currently sitting at an alltime high, so we feel some of the good news is already priced in. However, since 1929 whenever the market experience returns in excess of 20%, the following year has averaged 7.38%. Our base case for the S&P 500 returns will fall between 6% to 7%. We believe with the federal reserve still accommodative, trade wars on hold, jobs and consumer spending still strong, and the global environment improving, additional market gains could continue. Therefore, it will be important to buy on market pullbacks as they develop in 2020 to maximize gains.

For this quarter

While we could not have imagined a global pandemic while giving our last quarter projections, we still believe the markets are attractive over the next 12- 18 months. Volatility will likely remain elevated due to Covid 19 concerns, geopolitical concerns (China, Iran, etc), and the upcoming presidential election. With record low interest rates, government stimulus, and potential treatments for Covid 19 we continue to believe market pullbacks should be purchased and investors positioned for the start of a new bull market.

Two questions that have been asked by clients recently have been concerning Covid 19 and the upcoming election. We have listed two charts below that visually show past pandemics and elections and market returns.

The chart below shows market returns during each of the viral outbreaks that have occurred over the last twenty years. The historical pattern of an initial market sell off followed by a strong recovery is fairly consistent. The market has managed to power through the uncertainty.

The outcome of presidential elections has not mattered as much as staying invested. Though volatility remains elevated, the market tends to increase regardless of the party in power.

The Team

George, Shannon, Scott, Iris, and Shelby got out of the office to support a client owned business for a Segway team building exercise in Yorktown. Everyone survived unscathed and it was nice to get out and enjoy a little fresh air!

New Office Coordinator

Lauren Marrs joined our firm in June. She will take care of all front desk responsibilities, including scheduling appointments and directing everyone to the correct person on our team. Lauren brings many years of industry experience to the position…We are very excited to have her on team Legacy!

Did you Know Trivia

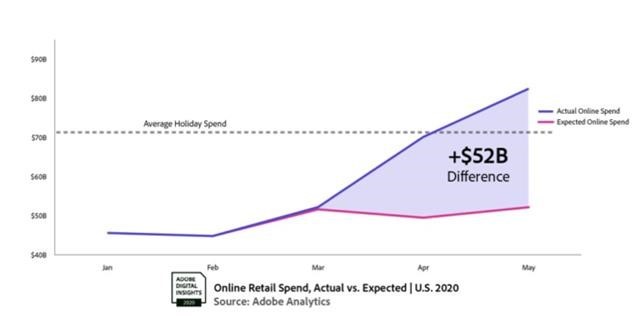

Online shopping during pandemic exceeds 2019 holiday season levels-

Covid 19 has accelerated the trend of online shopping. With stay at home orders and social distancing rules in place many more consumers have decided to shop online. Consumers spent over $153 billion in April & May of 2020. This is 7% higher than online holiday shopping for November/December of 2019!

Office operations & Client Online Access

We are open, have remained open, and are essential personnel. Due to Covid 19, we are offering client reviews by Zoom or phone. We have upgraded our technology for video conference & teleconference meetings and can provide the reports through Raymond James Vault on Client Access. With our upgraded technology, we now have the ability to share our screen and review documents together. We encourage clients to utilize Raymond James Vault, this service is free and the most secure way to store and share important documents with our team. Just signing up for Client Access can really improve your experience as a client with instant statement and tax report access, live views of accounts, balances, and changes. We plan to return to in person client meetings as soon as prudent for the health concerns for our staff and you.

We have listed a link to the most recent quarterly market data for your review. Raymond James’ Capital Markets Review reflects current market and economic conditions. You can access the report by clicking on the link http://www.raymondjames.com/pdfs/capital_markets_review.pdf.

Client Reviews

We follow a fiduciary standard… As such we need to conduct an annual review to review your accounts, changes to your life and goals, and provide advice and expertise. Our staff will reach out to schedule a review well in advance of your normal review month. While we know everyone leads super busy lives and we greatly appreciative the trust in managing your assets, to ensure your accounts are invested properly, we must conduct an annual review. Of course, we will accommodate your preferred time, place, and mode (phone, in person, Teleconference, etc.).

We hope you have a safe and fun Summer!

Thank you for your interest and as always please do not hesitate to contact us if you have any questions or comments.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal. The MSCI is an index of stocks compiled by Morgan Stanley Capital International. The index consists of more than 1,000 companies in 22 developed markets. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise. Investing involves risk and you may incur a profit or loss regardless of strategy selected. One cannot invest directly in an annex. Past performance is not indicative of future results.