What are our thoughts?

Principles of Long-Term Investing

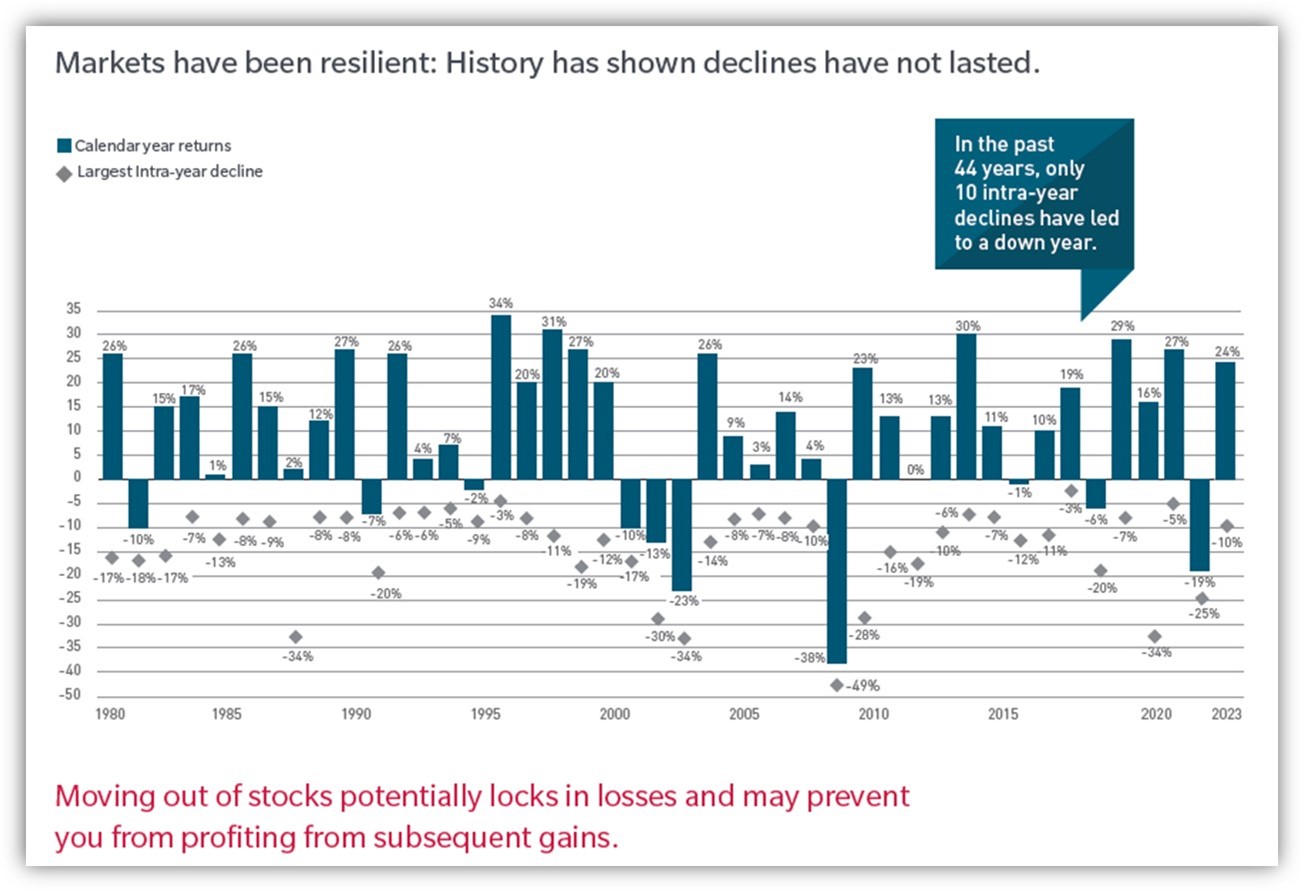

Market volatility is back! If you’ve turned on CNBC recently you’ll have noticed that the market is currently pulling back from its recent all time highs. This may concern you, but lets put everything in perspective. Attached is a full piece by MFS Investments, about the principles of long term investing, below I have grabbed just one piece I believe is relevant to our current market environment.

Review the Intra-Year Declines. You’ll notice there are a many years that end up with double digit returns, that have intra-year declines of double digits. Think back and take a look at the most recent year 2020 or 2009.

Economic Release – Retail Sales

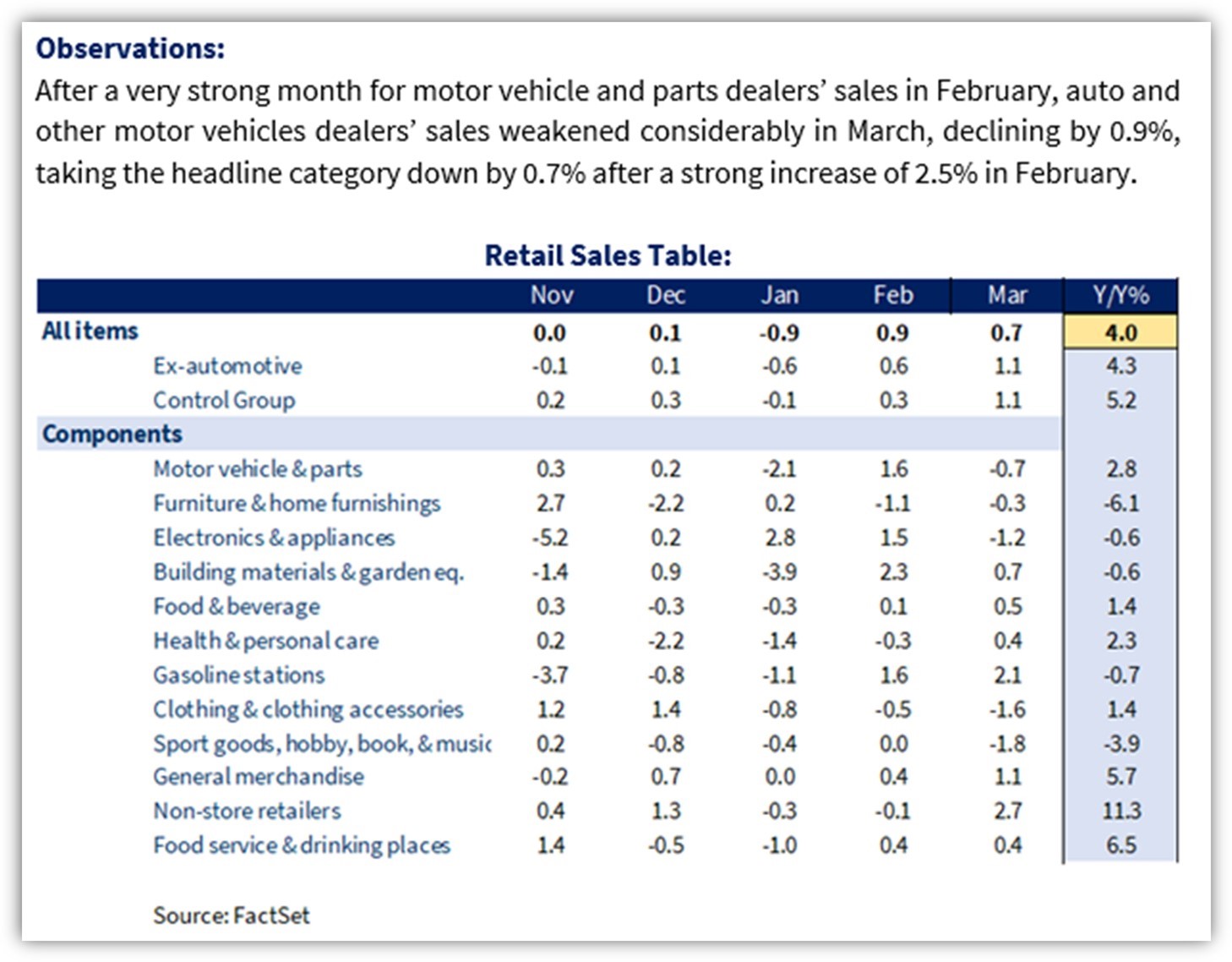

Retail sales were higher than expected in March, up 0.7% compared to expectations of 0.4%. This continues to support the narrative that GDP is stronger then expected and that the economy is in much better shape then previously forecasted.

Monday Morning Outlook with Brian Westbury.

Brian Westbury had a piece out this week suggesting the current level of rates may not be restrictive enough. Its tough to know, because this time last year we had multiple banks collapse because of the sudden raise in rates. I believe we would have been in trouble had the fed taken rates higher.

This information was developed by First Trust, an independent third party. The opinions of First Trust are independent from and not necessarily those of RJFS or Raymond James.

Andrew M. B. Kritikos

Financial Advisor, CFP©

Kritikos Wealth Management of Raymond James

Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional.