What are our thoughts?

March CPI Inflation Report: Shakes the Market!

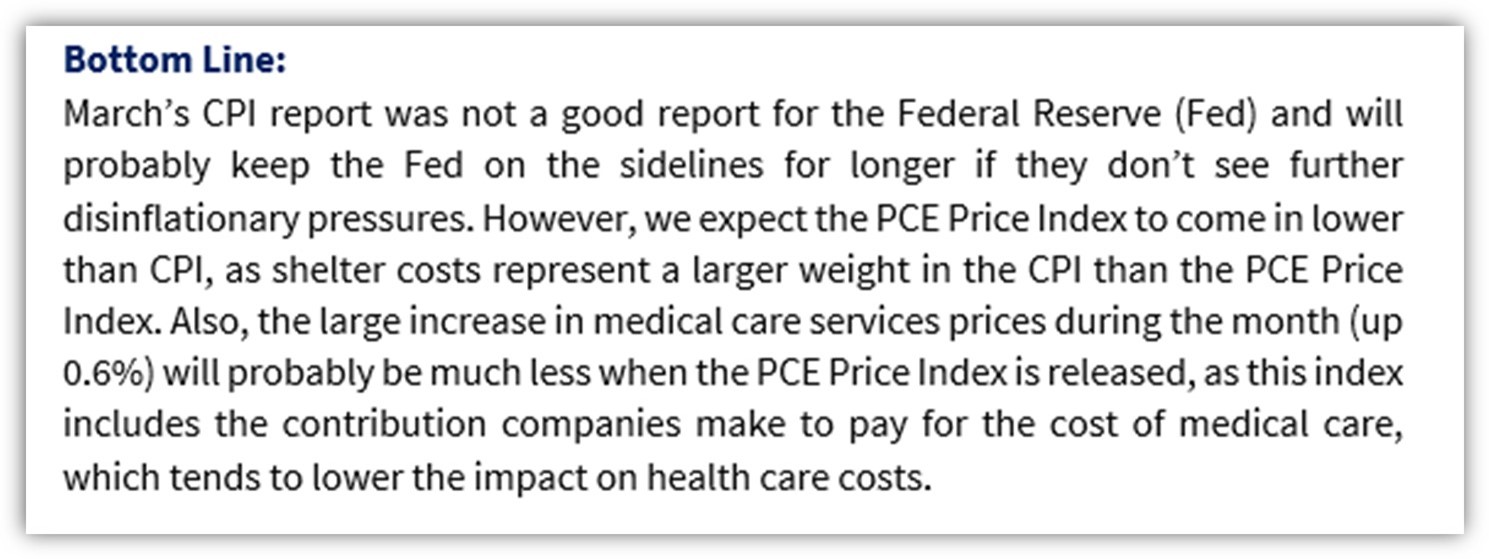

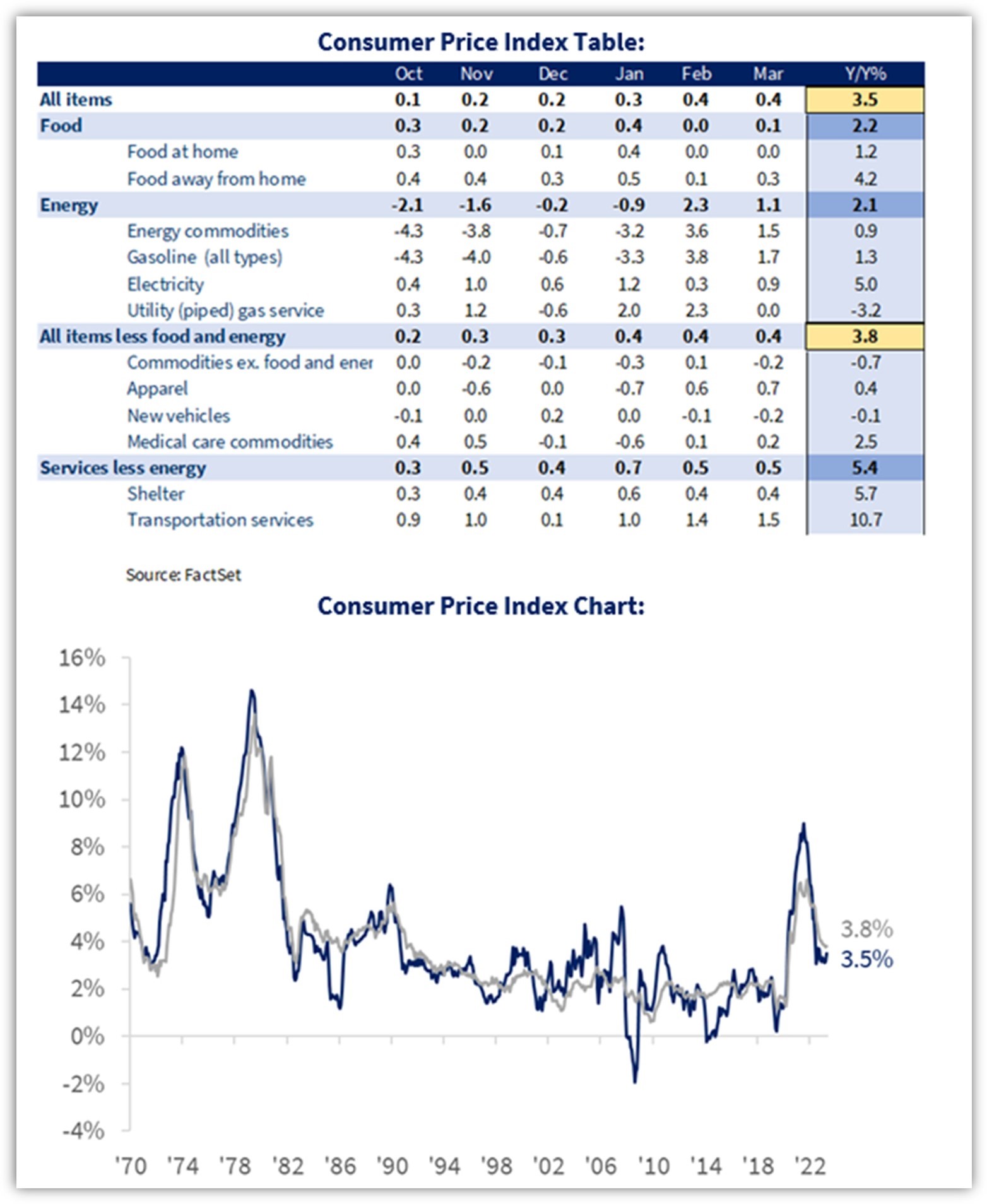

The March CPI inflation report was released on Wednesday April 10th, and it ended up hotter than expected. This pushed the stock market down and bond yields higher. The market is now expecting two rate cuts for the year instead of three.

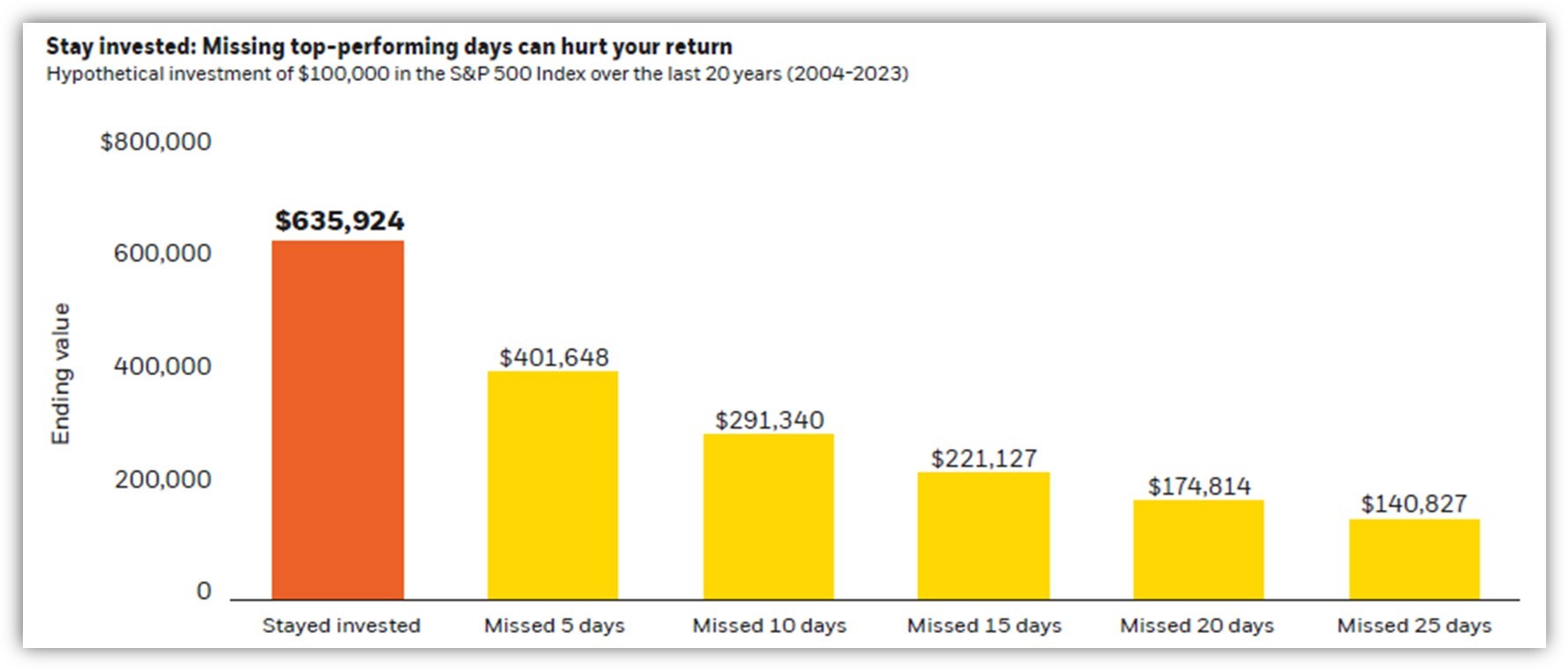

Strategies for Volatile Markets – By BlackRock

This piece by BlackRock is a great reminder to stay invested during Volatile Markets. Attempting to time your exit and re-entry is a fools errand, as your letting emotions dictate your investing strategy. Look at what missing the top performing days can do to your overall long term performance.

Monday Morning Outlook with Brian Westbury.

Brian Westbury had a piece out this week suggesting the current level of rates may not be restrictive enough. Its tough to know, because this time last year we had multiple banks collapse because of the sudden raise in rates. I believe we would have been in trouble had the fed taken rates higher.

This information was developed by First Trust, an independent third party. The opinions of First Trust are independent from and not necessarily those of RJFS or Raymond James.

Andrew M. B. Kritikos

Financial Advisor, CFP©

Kritikos Wealth Management of Raymond James

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members.

Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional.