Business Sale Tax Savings (Direct Indexing)

How to customize your investments with direct index strategies

Combines the benchmarked approach of index investing with the benefits of a customized separately managed account

Direct indexing is designed not only to provide index-like returns through direct ownership of underlying stocks in a separately managed account (SMA) but also to enable you to personalize your portfolio while harvesting capital losses to offset gains.

THE DIRECT INDEXING DIFFERENCE

With direct indexing, you are investing in the actual securities that make up an index. This differs markedly from investing in mutual funds and exchange traded funds (ETFs) that package securities into a single vehicle you can buy, but not modify.

Direct indexing allows you to own select securities that make up an index. It gives you the same market exposure as the index but with the opportunity to truly customize your portfolio. You can avoid stocks that don’t align with your goals, needs or values or increase your exposure to others that do – for example, investments that reflect your environmental, social and governance (ESG) values. Direct indexing also provides a solution for the investor seeking to diversify a portfolio while building a plan that will fit into their personal tax situation.

Here, we’ll discuss three direct indexing strategies vetted by Asset Management Services (AMS) that offer tax and customization benefits, delivering the benefits of individual stock ownership, including tax-loss harvesting, industry screening and the ability to gift capital gains.*

MORE CONTROL ALLOWS MORE CUSTOMIZATION

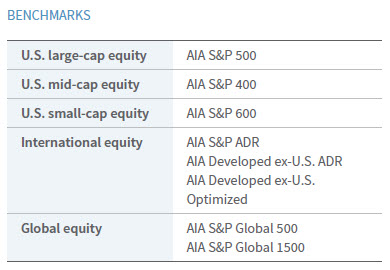

NATIXIS ACTIVE INDEX ADVISORS CUSTOM CORE INDEX STRATEGIES

MINIMUM INVESTMENT: $100,000

Trade Frequency:* Quarterly

Natixis Active Index Advisors (AIA) Custom Core Index strategies combine the diversification and return potential of indexing with the enhanced tax efficiency and personalized portfolio construction of an SMA. AIA’s managers select a subset of stocks from the index while seeking sector-neutral weights and diversification across market capitalization. The final portfolio is designed to closely track the index on a pretax basis.

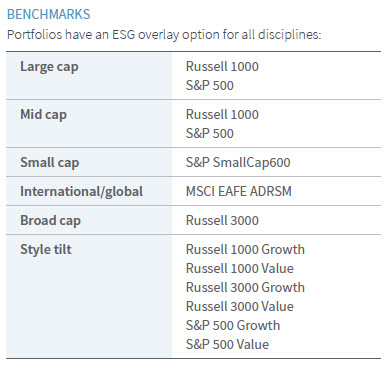

PARAMETRIC CUSTOM CORE

MINIMUM INVESTMENT: $250,000

Trade Frequency:* Monthly

Parametric Custom Core manages portfolios with an eye toward tax efficiency, a potentially useful strategy for clients with appreciated securities. The strategy’s tax-management aspect seeks to add to total performance, after taxes. The investor selects a target benchmark and Parametric constructs a portfolio with similar exposures to your selected benchmark. Portfolio holdings are selected from a broad universe of eligible securities reflecting the desired overall exposure.

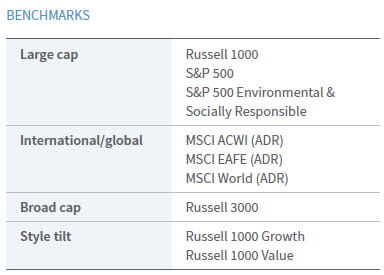

GOLDMAN SACHS TAX-ADVANTAGED CORE

MINIMUM INVESTMENT: $250,000

Trade Frequency:* Intra-monthly

Goldman Sachs Tax Advantaged Core seeks to provide tax-efficient participation in the equity markets. Portfolios are designed to have style and sector exposure similar to the selected index, seeking to earn a pretax return similar to that of the benchmark while aiming to earn an after-tax return greater than that of the benchmark through realized losses. The team offers a high level of customization, including value aligned customizations, enabling the team to match personalized portfolios to your needs.

To learn more about investing with direct index strategies, contact your advisor.

The foregoing content reflects the opinions of Raymond James Asset Management Services and is subject to change at any time without notice. Every investor’s situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Separately managed accounts (SMAs) may not be appropriate for all investors. SMA minimums are typically from $100,000 to $250,000, may be style specific, and may be more appropriate for affluent investors who can diversify their investment portfolio. Investing involves risk, and you may incur a profit or a loss. Past performance is no guarantee of future results. There is no assurance that any investment strategy will be successful.

Tax-loss harvesting involves certain risks, including, among others, the risk that the new investment could have higher costs than the original investment and could introduce portfolio tracking error into your accounts. There may also be unintended tax implications. Prospective investors should consult with their tax or legal advisor prior to engaging in any tax-loss harvesting strategy. Factor investing is subject to investment style risk, which is the chance that returns from the types of stocks selected will trail returns from U.S. stock markets. Factor investing is subject to the risk that poor security selection will cause underperformance relative to benchmarks or funds with a similar investment objective. Though some clients will benefit from personalized equity portfolios, many may also find that pooled products such as mutual funds and ETFs meet their needs.

Natixis Active Index Advisors (AIA), an affiliate of Natixis Global Asset Management, is a Boston-based investment manager. For Raymond James Consulting Services (“RJCS”), the firm invests primarily in index-based tax management strategies.

Parametric Portfolio Associated, LLC, is a Seattle-based investment manager. For Raymond James Consulting Services (“RJCS”) SMA accounts they primarily run index-based tax management strategies.

Goldman Sachs Asset Management, L.P. (GSAM), is a New York-based investment manager. For Raymond James Consulting Services (“RJCS”) SMA accounts they primarily run index-based tax management strategies.

Raymond James fact sheets are available upon request for further information regarding any of these specific strategies, as well as additional index definitions.

Important information regarding managers that trade away: The wrap fee assessed by Raymond James covers the cost of brokerage commissions on transactions effected through Raymond James within the RJCS program. In the event this manager elects to use brokers or dealers other than Raymond James to effect a block order in a recommended security (“trade away” from Raymond James), brokerage commissions and other charges may be assessed by the executing broker or dealer which will be in addition to the wrap fee assessed by Raymond James. Gross and net composite performance presented by AMS reflects these additional costs. Additional information related to why the manager may choose to trade away, best execution guidelines, the frequency of such trades, and average additional costs related to investing in this discipline is available via the public website at https://www.raymondjames.com/legal-disclosures/disclosure-trading-practices.

In a fee-based account, clients pay a quarterly fee, based on the level of assets in the account, for the services of a financial advisor as part of an advisory relationship. In deciding to pay a fee rather than commissions, clients should understand that the fee may be higher than a commission alternative during periods of lower trading. Advisory fees are in addition to the internal expenses charged by mutual funds and other investment company securities. To the extent that clients intend to hold these securities, the internal expenses should be included when evaluating the costs of a fee-based account. Clients should periodically reevaluate whether the use of an asset-based fee continues to be appropriate in servicing their needs. These additional considerations, as well as fee schedules, are listed more fully in the Client Agreement and the Raymond James & Associates Wrap Fee Brochure.

*Raymond James does not offer any tax or legal advice, please speak with your appropriate professional.

ESG/sustainable investing may incorporate criteria beyond traditional financial information into the investment selection process. This could result in investment performance deviating from other investment strategies or broad market benchmarks. Please review any offering or other informational material available for any investment or investment strategy that incorporates sustainable investing criteria, and consult your financial professional prior to investing.

All investing is subject to risk, including loss.

*There will be periods of exception where trading may occur more frequently.

Indices are not available for direct investment. A person who purchases an investment product which attempts to mimic the performance of an index will incur expenses such as management fees, transaction costs, etc. which would reduce returns. Asset allocation and diversification does not ensure a profit or protect against a loss. There is no assurance that any investment strategy will be successful.

NOT Deposits • NOT Insured by FDIC or any other government agency • NOT GUARANTEED by the bank • Subject to risk and may lose value