Long-Term Care Insurance

-

The most pressing financial concerns of many people tend to revolve around providing for their families, assuring adequate retirement income and preserving their estates for the future. However, few people consider what would happen to their families, themselves and the assets they have worked so hard to accumulate over the years if they were to require long-term care due to a prolonged illness or disability.

Consider the following facts. According to the San Diego Daily Transcript, approximately 70% of all people over 65 will require some form of long-term care during their lifetime. The average annual cost of nursing home care for one person is more than $66,000. Medicare pays for less than 2% of all long-term care cases – including nursing home care, assisted living and custodial care – for a maximum of only 100 days. Medicaid pays for long-term care only after an individual has spent almost his or her entire estate, qualifies as impoverished and is admitted into a nursing home that accepts Medicaid.

Fortunately, there is a solution to assist in paying for these expenses and leaving more of an individual’s estate intact – long-term care insurance. Without long-term care protection, expenses associated with assisting in the activities of daily living can drain – and sometimes even deplete – a person’s entire estate, potentially putting family members into debt.

Everyone can benefit

Many people often think of long-term care as something for “old people,” telling themselves, “We don’t need that now. We’ll consider that later when we’re older and get closer to needing it.”

Unfortunately, this is far from the truth. While certainly appropriate for care of the elderly who require it, long-term care is not something reserved exclusively for older individuals. One third of all 700,000 stroke victims are under 65, and one eighth of all Alzheimer’s patients are diagnosed before the age of 65. In fact, 30% of all those who are receiving home health care, and almost 10% of those receiving nursing home care are pre-retirement age adults, ranging in age from 18 to 64. Their needs were created by accidents, strokes, brain injuries or tumors, mental conditions, AIDS, multiple sclerosis, muscular dystrophy, or even early onset of Alzheimer’s and Parkinson’s diseases.

When younger people need care, it is often truly financially devastating. For example, the average length of stay in a nursing home for a male younger than 59 is 3,840 days – that’s more than 10 years and far longer than the benefits provided by conventional group or individual health insurance, including HMOs.

Moreover, a recent Prudential Research Report showed that 58% of Americans believed that they would never need long-term care – no nursing homes, no assisted living facilities, no adult day care or home care. Yet the facts tell us that almost half of us will spend some time in a nursing home when we are older, while 72% of us will use home healthcare services. Even worse is that 46% of those with health insurance believe that their insurance would cover the majority of the long-term care costs. In other words, long-term care protection is important for everyone. When considering the purchase of this benefit, individuals should keep in mind that the best long-term care policy is one that provides comprehensive benefits – covering all types of care, including at-home or adult day care, or care in an assisted living facility or nursing home. Benefits should be available for the care that is most appropriate for the individual’s long-term needs.

Selecting a policy

A long-term care policy should be adequate to cover the potential need, considering the daily amount and how long benefits may need to be paid.

As with any type of insurance, the purpose of long-term care protection is to safeguard individuals and their assets against catastrophe. Therefore, while the average length of a stay in a nursing home is only almost two-and-a-half years, when we consider only those nursing home stays that are for chronic conditions – those lasting more than one year – then the average length of the stay is more than six years. That makes a policy with unlimited, lifetime benefits the most desirable.

The policy should also provide protection against inflation. Individuals should think about those benefits that might need to be available in 10, 20 or even 30 years. Perhaps just as important, it is critical to contemplate what the costs could be at that time compared to the costs today.

Give yourself one less thing to worry about by taking steps now to protect your hard-earned assets and your independence in the future.

For more information about making long-term care insurance part of your comprehensive investment plan, consult your financial advisor.

These policies have exclusions and/or limitations. The cost and availability of Long Term Care insurance depend on factors such as age, health, and the type and amount of insurance purchased. As with most financial decisions, there are expenses associated with the purchase of Long Term Care insurance. Guarantees are based on the claims paying ability of the insurance company.

-

A Plan for Your Future

If you're seeking to secure your financial future beyond your working years, you have many options for saving and investing your money. But when it comes to long-term planning, certain investments let you save on a tax-deferred basis.

Combine tax deferral with the long-term growth potential inherent in stock and bond investments and you have an alternative that can help you build the retirement assets you'll need – a variable annuity.

Variable annuities offer a remarkable combination of tax-advantaged growth opportunities and protection including:

- Tax deferral. You pay no current income tax on earnings or other taxable amounts until you make a withdrawal. At that time, it's important to be aware that withdrawals of taxable amounts are subject to income tax and, if taken prior to age 59 ½, a 10% federal tax penalty may apply.1

- Potential for long-term growth of your money. You're able to invest in professionally managed investment portfolios.

- Valuable guarantees. These include protection for beneficiaries and choices for income you cannot outlive.

The questions and answers that follow will help you understand more about the valuable role variable annuities can play in your retirement planning.

1Tax-qualified contracts such as IRAs, 401(k)s and others are tax-deferred regardless of whether they are funded with an annuity. However, annuities do provide other features and benefits including, but not limited to, a guaranteed death benefit (based on the claims-paying ability of the issuer) and income choices, for which a mortality and expense risk is charged.

What is a Variable Annuity?

A variable annuity is a contract between you – the annuity owner – and a life insurance company. In return for your purchase payment, the insurance company agrees to provide either a regular stream of income or a lump-sum payout at some future time, generally when you retire.

How Does it Work?

A variable annuity has an accumulation phase and an income phase. The accumulation phase begins as soon as you invest. Your purchase payment(s) can be invested in the securities portfolios and fixed interest options that are available in your contract. Unlike a mutual fund, where interest, dividends and/or capital gains are taxed each year, any growth in an annuity accumulates on a tax-deferred basis. Of course, your investment can also lose value.

When you are ready to take distributions, typically at retirement, you can choose to have your principal and interest paid out in the form of income payments – called annuitization – or you can take systematic withdrawals or receive a lump sum payout.

What Do I Receive for my Purchase Payments?

For each purchase payment you make, you receive "accumulation units" in the insurance company's separate account. The separate account purchases shares in professionally managed investment portfolios. The performance of your investment does not depend on the performance of the insurance company's assets. Only the performance of the investment options you have chosen will affect your results. Each unit's value or "price" is determined by the value of the investment portfolio, less any insurance charges, divided by the number of units outstanding.

Some annuities now credit investors with payment enhancements on their purchase payments, putting more dollars to work for you up front. Generally, in exchange for the payment enhancement, you'll accept a higher surrender charge and/or a longer period of time over which the surrender charge applies. These enhancements are generally based on a certain percentage – such as 2%, 3% or 4% of a premium – and are normally added as earnings to the contract. Details of these features are found in each annuity's prospectus.

How Will Tax Deferral Affect My Investment?

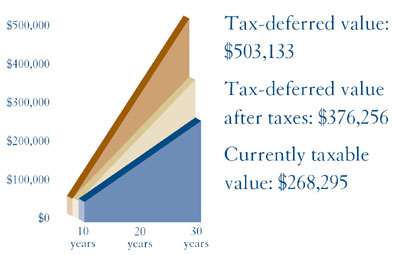

Tax deferral can allow the value of your annuity to potentially grow faster than that of a comparable taxable investment. This graph shows the advantages of tax-deferred compounding, assuming a $50,000 investment at an 8% rate of return over 30 years, and a 28% marginal tax bracket.

This chart does not reflect the fees and charges associated with any particular investment. Such expenses would lower overall returns. Although annuities typically include a mortality and expense risk charge of 1.25%, an asset based administration fee of .15%, a contingent deferred sales charge which starts at 7% in the first year and decreases 1% each year until it reaches 0%, and an annual contract charge of $30, these charges are not reflected in the hypothetical performance. If they had been reflected, the ending values of the tax-deferred investment would be lower. Gains in the taxable investment may be taxed at a lower capital gains tax rate. Lower maximum tax rates on capital gains and dividends would make the investment return for the taxable investment more favorable, thereby reducing the differences in performance between the accounts shown. You should consult with your tax advisor regarding your particular tax responsibilities and circumstances. This chart is for illustrative purposes only and is not intended to imply or represent a guarantee of any specific return on any particular investment. Please see your financial advisor for performance information of specific investments. Investment results fluctuate and can decrease as well as increase. Withdrawals of taxable amounts are subject to income tax and, if taken prior to age 59 1/2, a 10% federal tax penalty may apply. Early withdrawals may be subject to withdrawal charges. Partial withdrawals may also reduce benefits available under the contract as well as the amount available upon a full surrender.

What is the Difference in Taxation for Taxable and Tax-Deferred Investments?2

When you invest in a currently taxable investment, like a mutual fund, any dividends or interest you earn during the year are taxable, even if you reinvest the dividends. Mutual funds can earn money for an investor in several ways, which can be taxed at different rates. Capital gains may be taxed at a capital gains tax rate that is lower than the income tax rate; dividends and interest are generally taxed at income tax rates.

Many investors may not realize that if you sell an investment that has had any gains, or if the mutual fund money manager sells a security that results in a distribution to you, you may owe capital gains taxes.

Variable annuities are insurance alternatives whose gains accumulate tax-deferred and are taxed as ordinary income when withdrawn. When you invest in a variable annuity, any growth is credited to your account but is not taxed until you take distributions, at or near retirement.

In a variable annuity, when you make a withdrawal, you'll owe income taxes at your then current tax rate on any portion of the withdrawal that is considered earnings. For tax purposes, interest is always considered to be withdrawn first, so unless you begin to exhaust principal, you may owe taxes on the full amount of your withdrawal. In addition, because the IRS set up tax-deferral rules in order to encourage Americans to save for retirement, if you make a withdrawal before age 59 1/2, you're likely to owe a 10% federal tax penalty on the amount withdrawn.

With an annuity, if the contract owner dies the beneficiary will owe income taxes only on the taxable portion of the death benefit. Special rules apply to spousal beneficiaries, allowing for continuation of the tax-deferred status of the contract in addition to other settlement options.

The beneficiary of a currently taxable investment does not pay income taxes on the earnings received. If you purchase your annuity in a traditional qualified plan such as an IRA or Keogh account, different tax rules apply. Generally, the full amount of any withdrawal, even an amount attributed to principal, is taxable because in a qualified plan the contributions to the annuity are made on a pre-tax basis. Please consult with your tax advisor for additional information.

2 There are many distinctions between mutual funds and variable annuities. For instance, mutual funds serve various short- and long-term financial needs, while variable annuities are designed specifically for long-term retirement savings. Unlike mutual funds, variable annuities include insurance features for which you pay certain fees and charges, including mortality and expense charges and a contract administration fee. Mutual funds and variable annuities each have unique features, benefits and charges, and you should discuss the appropriateness of any investment for your particular situation with your financial advisor.

Why is it Called a "Variable" Annuity?

"Variable" refers to the fact that the contract value and/or income generated by the underlying investment options is not fixed. Your return will vary due to market conditions and prevailing interest rates.

What Types of Securities do the Portfolios Contain?

The majority of variable annuities let you choose among portfolios of stocks, bonds and money market alternatives. You can allocate your money among different portfolios, depending upon how aggressive or conservative you wish to be.

Who Decides Exactly What I Invest in?

You choose the investment options in which you will invest from among those offered in your contract. The insurance company issuing the annuity develops relationships with one or more professional money managers, who decide which specific stocks and bonds will be a part of each investment option. Most variable annuities offer you several different money management firms and multiple investment options within one alternative.

Why Should I Invest in Securities Through a Variable Annuity?

- Diversification. A variable annuity offers you the opportunity to diversify your portfolio across a broad range of investment options, asset classes and money management styles, all within a single investment alternative.

- Switching privileges. Most variable annuities permit you to reallocate your money among the investment options. Transfers among investment options within the annuity are not taxable, but they may be subject to a transfer charge.

- Insurance guarantees:

- Guaranteed death benefit. The insurance company generally guarantees that in the event of death before the income phase (annuitization) begins, your beneficiary will receive the greater of (a) the entire amount of your premiums less an adjustment for withdrawals, charges and fees, or (b) the current contract value. Some companies offer more generous benefits that allow for a guaranteed increase in the premium amount, a step-up in the guaranteed death benefit value at certain contract years or the opportunity to potentially increase your death benefit value by a percentage of earnings at the time of the owner's death. There may be an additional fee for these benefits. Read the prospectus for the variable annuity you choose to find out exactly what type of death benefit the alternative offers, as well as its associated costs.

- Fixed-interest options. Most annuities also let you allocate funds to one or more fixed-interest options in which the insurance company guarantees your interest rate.

- Income for life. If you chose to "annuitize," you can be guaranteed an income that lasts as long as you live.

- Minimum guaranteed income. Some variable annuities guarantee a minimum level of income during retirement – no matter what happens in the financial markets. This minimum level is usually based on the amount of your contributions less an adjustment for withdrawals. Income protection features such as these can give you the confidence to invest in the higher growth potential of equities, knowing that when you annuitize your contract your retirement income will never go below the minimum level. If your investments have performed well, you receive the higher income based on your actual contract value.

- Return of principal amount. Some annuities provide a special program in which the insurance company guarantees return of an amount representative of your premium regardless of the actual performance of the underlying investments. The principal may be returned in a lump sum at some future time or through systematic withdrawals lasting a specified period. Please note that these features do not guarantee the performance of any variable options in the contract and may require that you hold your contract a minimum number of years before you may take advantage of the guarantee. Withdrawals also reduce benefits and values. There may be an additional fee for these benefits.

Can I Have Access to My Money Before I'm 59½?

Yes. Most variable annuities provide for withdrawal of a specified amount during the accumulation phase, free of company-imposed charges.

Withdrawals in excess of the amount specified are possible, but may trigger surrender charges. Again, all withdrawals of taxable amounts are subject to income tax, and if you are younger than age 59 ½, the IRS may also impose a 10% federal tax penalty.

You may also encounter a "market value adjustment," or MVA, if you take money out of fixed-interest options before the end of the interest-rate guarantee period.

The MVA reflects any difference in the interest rate environment between the time you place your money in the fixed account option and the time when you withdraw the money. This adjustment can increase or decrease your contract value.

Finally, be aware that some annuities allow you to make systematic withdrawals from your contract, which can provide you a regularly scheduled income during the accumulation phase. Systematic withdrawals are generally subject to the same tax rules as other withdrawals and must cease upon annuitization.

What Does "Annuitize" Mean?

A contract is "annuitized" when it converts from an accumulation phase to an income phase, and the owner or other payee(s) receive(s) periodic annuity payments. Most companies offer several annuity payment options, based primarily on how long you want the income to last.

How is the Amount of My Payment Determined if I Annuitize?

The amount of each payment will depend on where your money is allocated – for example, funds in a fixed account will generate a fixed payment; funds in a variable portfolio will generate a variable payment – what annuity option is selected, and your age and gender. Meanwhile, the undistributed portion of your investment can continue to compound, tax-deferred.

Am I Taxed Differently on Annuity Payouts Than on Withdrawals?

Yes. Once you have annuitized, each payment is structured as a partial return of principal and part interest. If you have only contributed after-tax money to the annuity, only the interest portion of the payment is taxable. You should consult your financial advisor and/or tax advisor before deciding to annuitize. See above for a discussion of taxation rules on withdrawals made before you annuitize.

What Should I Consider When Selecting a Variable Annuity?

- Historical performance of the portfolios. While not a guarantee of future results, historical performance should tell how well the annuity's investment managers have done in both positive and adverse markets.

- Fees and charges. Carefully review details on the fees and charges of the contract, and available benefits. These are provided in the annuity's prospectus.

- Soundness of the insurance company. All guarantees, such as death benefits, income protection, among others, are backed by the insurance company's claims-paying ability. Most companies are rated by independent industry analyst A.M. Best Company and may also be rated by Standard & Poors and Moody's Investors Service. Your financial advisor can give you information on the ratings of companies whose annuities he or she is recommending.

How Can I Find Out Whether an Annuity is Right for Me?

Ask your financial advisor to review your circumstances and determine if an annuity is appropriate for you. Consider the annuity's unique advantages:

- Tax deferral

- Professional management

- Diversification

- Retirement income you cannot outlive

- No cap on how much you can invest

- Death benefits

You'll see why variable annuities can be a valuable alternative in today's economic and tax environment.

Investors should consider the investment objectives, risks, and charges and expenses of variable annuities carefully before investing. The prospectus contains this and other important information. Prospectuses for both the variable annuity contract and the underlying funds are available from your Raymond James financial advisor and should be read carefully before investing.

Variable annuities are long-term investment alternatives designed for retirement purposes. Withdrawals of taxable amounts are subject to income tax, and if taken prior to age 59 ½, a 10% federal tax penalty may apply. Early withdrawals may be subject to withdrawal charges. Partial withdrawals may also reduce benefits available under the contract as well as the amount available upon a full surrender. An investment in the securities underlying variable annuities involves investment risk, including possible loss of principal. Your contract, when redeemed, may be worth more or less than the total amount invested. Past performance is no guarantee of future results.

The purchase of a variable annuity is not required for, and is not a term of, the provision of any banking service or activity. Variable annuities are not federally insured by the Federal Deposit Insurance Corporation (FDIC), Federal Reserve Board or any other government agency and are not a deposit of, guaranteed by, endorsed by, or an obligation of any federal banking institution.

Not FDIC or NCUA/NCUSIF insured • No bank or credit union guarantee • May lose value

Information on this page is provided courtesy of AIG SunAmerica, one of the nation's largest annuity providers.

For advice concerning the tax treatment of variable annuities and for complete, up-to-date details on tax law, consult a qualified tax advisor. For additional information and the variable annuity prospectus(es) of your choice, please contact us today.

-

Mutual Fund, Annuities and UIT Disclosures

A Guide to Mutual Fund Investing at Raymond James Financial

On this page:

Related sites:

A Client Disclosure Document

Raymond James[1] offers clients a wide range of investment alternatives and services, including a variety of variable annuities. Deciding which variable annuity to purchase can be complex. It is important for you to work with your financial advisor to evaluate how a particular variable annuity and its features fit your individual needs and objectives. An important component of any variable annuity screening and selection process includes carefully reading the variable annuity product prospectus and the variable annuity investment sub account prospectuses before making a purchase decision. Each prospectus contains important information that will help you make an informed choice. Your financial advisor will gladly provide you with the variable annuity product prospectus and literature containing the variable annuity investment sub account prospectuses. Your financial advisor will also answer your questions such as how the variable annuity investment sub accounts are priced, your questions regarding the guaranteed benefits and optional riders available, and questions regarding the initial and ongoing compensation your financial advisor and Raymond James may receive.

For a more detailed description of variable annuities, purchase considerations, and the product related expenses, please visit the National Association of Securities Dealers’ website at www.finra.org and click on the “Investor Information” tab.

Compensation Paid to Raymond James When You Purchase a Variable Annuity

Raymond James receives compensation from a variety of sources and for a variety of services. The forms of compensation are directly associated with the type of account that you maintain with Raymond James, fee-based or commission-based, or the specific investments in your account. Other forms of compensation may not be as apparent since they do not directly affect the amount that you pay or that you are charged. These other forms of compensation include payments from the insurance and annuity companies or their affiliates that sponsor, manage and/or promote the sale of certain products offered to you by a Raymond James financial advisor. The payments from these companies to Raymond James are intended to cover a variety of expenses, including expenses associated with marketing products to new investors, educating Raymond James financial advisors, and expenses associated with servicing existing client accounts. The insurance company that issues your variable annuity contract recoups the marketing and distribution expenses, including commissions, over time from your annuity contract expenses.

Commission schedules and amounts vary by insurance company and annuity product. How Raymond James and your financial advisor are compensated when you purchase a variable annuity depends on the type of annuity you elect to purchase and the insurance company issuing the annuity. A portion of the commission payment is paid to your financial advisor. However, the commission paid by the insurance company will not impact the compensation formula used to determine the payment received by your Raymond James financial advisor.

You should also be aware that different share classes of variable annuities will usually have different associated ongoing expenses. Your financial advisor may receive more or less initial and ongoing compensation depending on the variable annuity share class you elect.

Feel free to discuss with your financial advisor how he/she is compensated prior to and following your annuity purchase. This document explains in general terms how the compensation arrangements work.

Please be aware that Raymond James does not provide cash or non-cash compensation incentives to financial advisors or branch managers for recommending certain variable annuities or share classes. However, insurance companies that promote and issue the variable annuities may provide various forms of non-cash compensation to Raymond James financial advisors (discussed in more detail below).

Contingent Deferred Sales Charges

As previously described, Raymond James receives a commission from the insurance company issuing your annuity contract. Your financial advisor receives a significant percentage of the annuity commissions paid to Raymond James. The commissions paid by the issuing company are not deducted from your initial or subsequent purchase payments. However, if you surrender your annuity during the contingent deferred sales charge period specified in the product prospectus and the annuity contract, a “surrender charge” will be deducted from the annuity value returned to you.

Contingent deferred sales charge periods, also known as surrender charge periods, vary by annuity contract but typically last from three to nine years. The surrender charge amount may partially or completely reimburse the insurance company for its costs associated with marketing the annuity product -- including the commission paid.

How Your Financial Advisor Receives Commissions

Your financial advisor typically has a choice of variable annuity commission options regarding the timing and structure of commissions paid to Raymond James. In most cases, the structure of the commission selected by your financial advisor will have no impact on your annuity contract expenses. Annuity products may offer the following commission options:

- A single, lump sum commission based on your purchase amount

- A slightly reduced lump sum commission and asset-based trail commissions paid quarterly during the years your contract remains in force

- A further-reduced lump sum commission and higher asset-based trails paid quarterly during the number of years your contract remains in force

Other Compensation Paid to Raymond James by Insurance Companies

Raymond James distributes annuities from at least 20 insurance companies and receives additional compensation from them in the form of sales and asset-based education and marketing support payments. The additional compensation is not paid directly from the assets of your variable annuity. Additionally, no portion of the payments received by Raymond James are paid to or shared directly with your financial advisor or his or her respective branch office. The payments are paid directly from the insurance companies to Raymond James and are not deducted from the separate accounts that hold the variable annuity assets.

Education and Marketing Support Payments. Raymond James provides a variety of marketing and other sales support services to insurance companies related to their annuity products. These services include, but are not limited to:

- providing detailed product information to financial advisors

- assisting insurance companies with strategic planning and sales support

- providing presentation opportunities during professional development workshops, study groups, and other Raymond James events and conferences

- distribution support for sales literature and other promotional materials relating to their annuity products

The marketing service and support fees come in a variety of forms, including payments which are sometimes referred to as “revenue sharing” fees and 12b-1 fees. This compensation may not be disclosed in detail in a variable annuity’s prospectus or contract language. At Raymond James, these fees do not provide placement on any preferred or recommended product lists. The following schedule gives you an idea of the potential level of marketing support or revenue sharing fees that Raymond James may receive from a particular insurance company or distribution affiliate:

- up to .15% on variable annuity purchases (e.g., $15 for a $10,000 purchase)

- up to .05% per year on assets totaling less than $500 million

- up to .04% per year on assets totaling $500 million to $1 billion

- up to .03% per year on assets totaling $1 billion to $2.5 billion

- up to .02% per year on assets totaling $2.5 billion or greater

The actual amounts that Raymond James may receive will vary from one insurance company to another and investments in certain variable annuity share classes and/or investment sub account options may be excluded from the above formulas.

General Promotional Activities. Marketing representatives of insurance companies or their affiliated distributors, who are often referred to as “wholesalers,” work with Raymond James financial advisors and their branch office managers to promote their annuity products. Consistent with applicable laws and regulations, these insurance companies and their wholesalers may pay for or provide training and education programs for Raymond James’ financial advisors and their existing and prospective clients. Insurance companies may also pay for due diligence meetings, conferences, relationship building events, occasional recreational activities, and/or provide promotional items that are intended to result in the promotion and sale of their annuity products. This could cause our financial advisors to focus on, and recommend to clients, the variable annuities issued by these insurance companies.

Other Services. The subsidiary companies of Raymond James provide a wide variety of financial services to individuals, corporations and municipalities. For these services, Raymond James receives compensation. As a result, Raymond James can be expected to pursue additional business opportunities with companies whose annuity products Raymond James financial advisors make available to their clients. Consistent with industry regulations, these services could include (but are not limited to) banking and lending services, sponsorship of deferred compensation and retirement plans, investment banking, securities research, institutional trading services, investment advisory services, and execution of portfolio securities transactions. Raymond James professionals who offer variable annuities to their clients may introduce insurance company officials to other services that Raymond James provides.

Please contact your financial advisor with any questions regarding insurance-related products and services, your specific annuity contract(s), or regarding the insurance company relationships with Raymond James.

Investors should consider the investment objectives, risks, and charges and expenses of variable annuities carefully before investing. The prospectus contains this and other important information. Prospectuses for both the variable annuity contract and the underlying funds are available from your Raymond James financial advisor and should be read carefully before investing.

Variable Annuities, issued by insurance companies are long-term investment alternatives designed for retirement purposes. Withdrawals of taxable amounts are subject to income tax and, if made prior to age 59 ½, may be subject to a 10% federal tax penalty. An investment in variable annuities involves risk, including possible loss of principal. The contracts, when redeemed, may be worth more or less than the original investment.

Raymond James Financial, Inc. (NYSE: RJF) is a leading diversified financial services company providing private client group, capital markets, asset management, banking and other services to individuals, corporations and municipalities. The company has 7,200 financial advisors serving approximately 3 million client accounts in more than 2,900 locations throughout the United States, Canada and overseas. Total client assets are $658 billion. Public since 1983, the firm has been listed on the New York Stock Exchange since 1986 under the symbol RJF. Additional information is available at www.raymondjames.com.