The Week in Review: 03/10/25

“Common sense is the most widely shared commodity in the world, for every man is convinced that he is well supplied with it.” – René Descartes

Good Morning ,

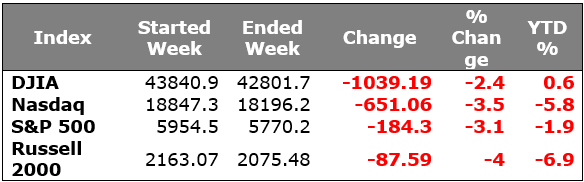

What a week of carnage, let’s call it a “Tariff Tantrum” … and our economic news last week didn’t help. Investors are fearful.

The trade war has heated up after 25% tariffs for Canada and Mexico went into effect and tariffs on China increased by 10% to 20%, and the countries announced subsequent retaliatory measures.

President Trump later backed off his harsh tariff talk with some concessions for Canada and Mexico. The ambiguity of solid policy on trade has investors concerned.

Economic news hasn’t helped of late… Nonfarm payrolls were up 151,000; the unemployment rate ticked up to 4.1% from 4.0%; average hourly earnings were up 0.3%; and the average workweek stuck at 34.1 hours.

Growth concerns were further stoked by some soft earnings and guidance from the likes of Target and others. Target warned that price increases are likely, which may impact consumer demand and lead to lower growth in earnings and in the economy. Target's CEO also highlighted that the consumer has been cautious already.

Technicals were under pressure last week after the S&P 500 briefly dipped below its 200-day moving average. The Russell 2000 and Nasdaq Composite dropped further below their respective 200-day moving averages and further into correction territory.

Last week's economic releases also played into worries about the economy. The February ISM Manufacturing PMI showed a mix of decelerating activity, rising prices, and weakening employment for the manufacturing sector.

The ADP Employment Change Report for February was weaker than expected, yet the ISM Services PMI for February was stronger than expected.

Also, the February employment report was neither hot nor cold, but at the same time it wasn't just right for a market that needed to see stronger growth. Goldilocks, where are you?

The markets digested a preponderance of mediocre to poor news last week.

With all the pessimism, we do see some positives…

- The 10 Yr. Treasury yield has fallen from 4.81% in January to 4.304%, after seeing 4.21%.

- This has some experts now calling for 3 Fed cuts in 2025.

- Short term investors were enjoying 5.5% on the cash equivalents, now they are getting returns in the 3% range.

- There is a bunch of cash on the sidelines!

- We have endured a 10%+ correction in the Nasdaq, many high-flying popular stocks have been cut in half.

- Many of the excesses we saw in December and January have been alleviated.

- Market breadth has expanded to more than just the “Magnificent 7”.

- Fear is at a historical high with the swift sell off, Bears dramatically outnumber Bulls in the latest AAII Survey.

- Bulls are only 19.3% vs. a historical average of 37.5%.

- Bears are at 57.1%... the consensus is usually wrong.

- Tariffs have been implied to have some margin and not likely to be as harsh as first threatened.

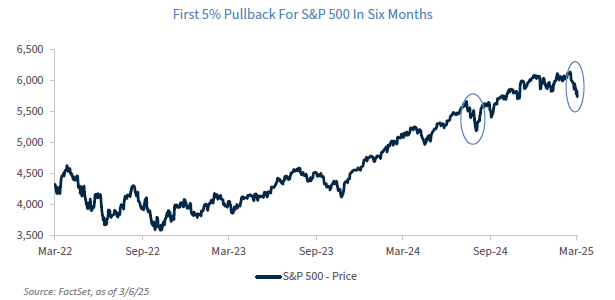

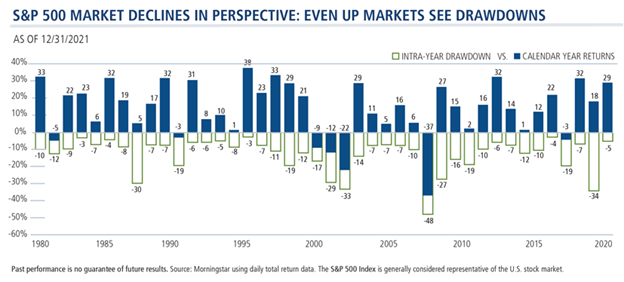

Every year we see a significant market drawdown, often 10% or more.

Corrections are needed and can be healthy for the long-term trend of the Bull Market.

Rarely however, do we see such drawdowns with this velocity? Only 6 weeks ago we were celebrating new all-time highs in the markets.

Most interesting is what follows drawdowns as we look back in history… meaningful opportunities and recovery.

Source: Calamos Wealth Management

Corrections are painful, but necessary.

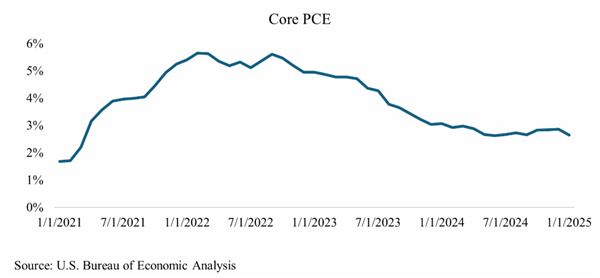

The tariffs have investors fearful of the return of inflation, growth deceleration, and at worst a recession. We believe the downtrend in inflation will accelerate into 2H25.

We are making progress on the inflation front, albeit slower that the Fed would like. We get more critical data in the CPI & PPI this week.

Some areas could see growth slow, but many will not, and others should still prosper. It has always been about being invested in the right sectors for growth.

In our view… the economy remains strong, and earnings are solid.

Looking at the week ahead…

Have a wonderful week!

Michael D. Hilger, CEP®

Managing Director

Senior Vice President, Wealth Management

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The S&P 500 is an unmanaged index of widely held stocks that is generally representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs and other fees, which will affect investment performance. Individual investor’s results will vary. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The NASDAQ-100 (^NDX) is a modified capitalization-weighted index. It is based on exchange, and it is not an index of U.S.-based companies. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

The Nasdaq-100 Index includes 100 of the largest domestic and international non-financial companies listed on The Nasdaq Stock Market based on market capitalization. The Index reflects companies across major industry groups including computer hardware and software, telecommunications, retail/wholesale trade and biotechnology. It does not contain securities of financial companies including investment companies.

U.S. government bonds and Treasury notes are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return, and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury notes are certificates reflecting intermediate-term (2 - 10 years) obligations of the U.S. government.

The companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapit obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.

If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.