The Week in Review: 11/25/2024

“Quality is not an act; it is a habit.” ~Aristotle

Good Morning ,

The stock market returned to its winning ways last week after taking a breather the previous week, as investors digested post-election gains.

“Buy-the-dip” trading contributed to the upside bias following some consolidation.

The small cap Russell 2000 and S&P Mid Cap 400 benefitted from a capital rotation last week, gaining 4.5% and 4.2%, respectively.

|

Index |

Started Week |

Ended Week |

Change |

% Change |

YTD % |

|

DJIA |

43444.99 |

44296.51 |

851.52 |

2 |

17.5 |

|

Nasdaq |

18680.12 |

19003.65 |

323.53 |

1.7 |

26.6 |

|

S&P 500 |

5896.56 |

5969.34 |

72.78 |

1.2 |

25.1 |

|

Russell 2000 |

2303.84 |

2406.67 |

102.83 |

4.5 |

18.7 |

The S&P 500 and Nasdaq Composite moved higher 1.7% and 1.2% respectively and the Dow Jones Industrial Average settled 2.0% higher.

Losses in some mega cap names, specifically Alphabet, limited index performance.

Alphabet (Google’s parent company) shares dropped 4.2% last week after news that the DOJ is pushing for a forced sale of Chrome and potentially Android.

Subsequent reports indicated that Microsoft-backed and ChatGPT owner OpenAI is considering developing its own browser, which could represent a viable competitive threat that provides Google with some firepower in its antitrust case.

Target was another notable loser last week, dropping 17.8% (and 20% during Wednesday's session) after its disappointing earnings report and outlook.

Fellow retailer, and Dow component, Walmart jumped 7.4% on the week following its favorable earnings report.

The headliner on the earnings calendar was NVIDIA, which settled flat on the week.

NVDA's Q3 report garnered mixed responses due to a slight deceleration in its revenue growth rate. The report was solid overall though, and the company said demand for its Blackwell chip is "staggering."

Other story stocks included crypto-related names, which were reacting to price action in Bitcoin. The cryptocurrency reached a new high of $99,768 on Friday.

Early in the week, geopolitical angst was increased after reports that President Putin had lowered Russia's threshold for using nuclear weapons, that Ukraine had launched U.S.-made and UK-made missiles into Russia, and that Russian Foreign Minister Lavrov had called the attack on Russia an "escalation signal."

Treasuries settled mixed after last week's slate of economic reports. The 10-yr yield dropped two basis points to 4.41% and the 2-yr yield jumped seven basis points to 4.37%.

The economic lineup last week included stronger-than-expected Existing Home Sales for October, another decrease in weekly jobless claims, a U.S. S&P Global Services PMI for November that showed an acceleration in services sector activity, and a Manufacturing PMI that remained in contraction in November, but at a slower pace than what was seen in October.

The final reading of the University of Michigan's Consumer Sentiment for November showed a dip to 71.8 from 73.0 in the preliminary reading, but it was still above October's final reading of 70.5.

2024 has been a surprise to many investors as to the gains and where they came from… the top 3 sectors for 2024 are Financials, Information Technology, & Communications Services, up 36.5%, 34.7% & 32.8% respectively.

The bottom three sectors for 2024 are Healthcare, Materials, & Real Estate, up 7.1%, 11.1%, & 12.9% respectively. All decent gains as well.

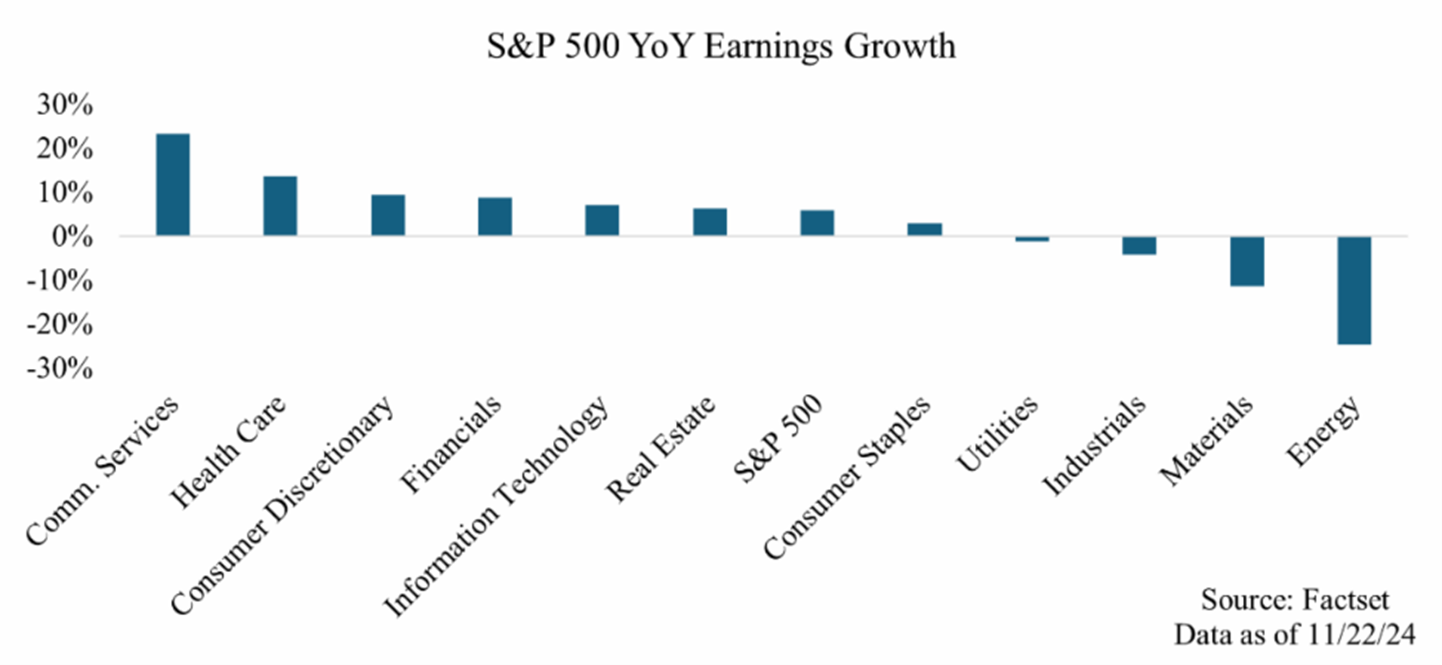

Earnings season continues in the twilight hour for the third quarter.

With 95% of S&P 500 companies having reported, the blended year-over-year earnings growth rate for the quarter is 5.8%. This is the fifth consecutive quarter of year-over-year earnings growth. Revenues are up a commensurate amount, up 5.6% over the same period (source: Factset).

There will be a handful of earnings reports. We will hear from Best Buy, Dell, HP, and J.M. Smucker to name a few.

On the economic front, we will get a second look at third-quarter GDP as well as updated housing data from New Home Sales and Pending Home Sales for the month of October.

Despite the decline in the federal funds rate, mortgage rates are back on the rise after their initial dip. We will see how this is affecting home sales and new mortgage applications. Additionally, we will receive the meeting minutes from the last FOMC meeting.

Our week will be shortened due to the Thanksgiving holiday. Markets are closed on Thursday and will close early on Friday at 1PM EST.

Have a safe and Happy Thanksgiving!

Michael D. Hilger, CEP®

Managing Director

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The S&P 500 is an unmanaged index of widely held stocks that is generally representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs and other fees, which will affect investment performance. Individual investor’s results will vary. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The NASDAQ-100 (^NDX) is a modified capitalization-weighted index. It is based on exchange, and it is not an index of U.S.-based companies. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

U.S. government bonds and Treasury notes are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return, and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury notes are certificates reflecting intermediate-term (2 - 10 years) obligations of the U.S. government.

The companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapit obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Dividends are not guaranteed and must be authorized by the company's board of directors. Diversification does not ensure a profit or guarantee against a loss. Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility. The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence. Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated. The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete. The prominent underlying risk of using cryptocurrencies as a medium of exchange is that they are not authorized or regulated by any central bank. Cryptocurrency users are not registered with the SEC, and the cryptocurrency market is currently unregulated. Bitcoin and other cryptocurrencies are a very speculative investment and involve a high degree of risk. Investors must have the financial ability, sophisticated/experience and willingness to bear the risks of an investment, and a potential total loss of their investment. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Charts are reprinted with permission, further reproduction is strictly prohibited.

If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.