The Week in Review: 10/21/2024

“We can no longer afford to be second best. I want people all over the world to look to the United States again” – John F Kennedy

Good Afternoon ,

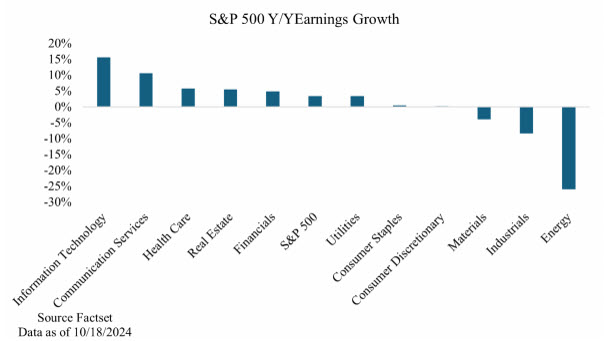

The stock market closed out another winning week with the S&P 500 and Dow Jones Industrial Average at fresh record highs.

The Russell 2000 (1.9%) pacing index gains, the S&P 500 settled 0.9% higher, the Nasdaq Composite jumped 0.8%, and the Dow Jones Industrial Average rose 1.0%. Gains were relatively broad based, driven by ongoing momentum as stocks continue to hit new record highs. The equal-weighted S&P 500 settled 1.1% higher than last Friday.

Semiconductor stocks were a pocket of weakness in a mostly upbeat tape.

The PHLX Semiconductor Index dropped 2.4% this week in response to a Bloomberg report that the Biden administration is looking at curbing sales of advanced AI chips to certain countries, with a focus on Persian Gulf countries, and in response to ASML's Q3 results.

The semiconductor equipment maker's results were released early and disappointed investors due to below-consensus EPS, revenues, and net bookings. The company also issued weaker-than-expected FY25 revenue guidance saying, "While there continue to be strong developments and upside potential in AI, other market segments are taking longer to recover."

Taiwan Semiconductor Manufacturing Company reported pleasing Q3 results, along with better-than-expected Q4 guidance, which stirred some buy-the-dip interest in the space by the end of the week.

A lot of the earnings news last week was well received, contributing to the overall positive bias. Dow component UnitedHealth was an exception, registering a sharp decline after reporting its third quarter earnings, which featured an increase in its medical care ratio, and issuing some tepid FY25 earnings guidance.

This price action impacted the S&P 500 health care sector's performance. It was one of two sectors to close lower this week. The only other sector to log a decline was energy (-2.6%), which was reacting to a drop in oil prices. WTI crude oil futures settled Friday at $68.62/bbl.

The financial sector was a top performer as investors digested a slate of earnings news from the space. Morgan Stanley and Goldman Sachs were some of the standouts in that respect.

Market participants were also weighing the notion that the Fed won't be as aggressive as previously thought after more solid economic data. Last week's releases included September retail sales, which were stronger than expected, and initial jobless claims, which were not as bad as feared.

Looking ahead…

We get Existing Home Sales on Wednesday, Initial Clams on Thursday, and Durable Goods Orders on Friday, all important economic numbers.

Roughly 20% of the S&P 500 has reported earnings for the Q, with 80% beating expectations This week we will hear from another 20% of the S&P. Notable names are GM, Kimberly Clark, Lockheed Martin, Texas Instruments, AT&T, & Coca Cola to name a few.

Lastly, we have a few events coming up of rather significant importance… Election November 5th and FOMC Meeting on the 6th & 7th.

Have a wonderful week!!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The S&P 500 is an unmanaged index of widely held stocks that is generally representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs and other fees, which will affect investment performance. Individual investor’s results will vary. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The NASDAQ-100 (^NDX) is a modified capitalization-weighted index. It is based on exchange, and it is not an index of U.S.-based companies. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks

U.S. government bonds and Treasury notes are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return, and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury notes are certificates reflecting intermediate-term (2 - 10 years) obligations of the U.S. government.

The companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapit obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.

If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.