The Week in Review: 10/14/24

A champion is someone who gets up when he can’t.” – Jack Dempsey

Good Morning ,

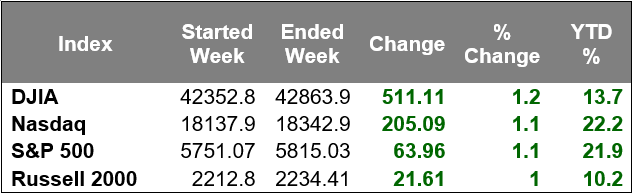

It was a choppy week for stocks. The major indices continued volatility, ultimately rallying on Friday.

The S&P 500 and Dow Jones Industrial Average set record highs.

The market placed geopolitical worries, along with concerns about Hurricanes Milton and Helene, on the backburner and focused on economic releases and Fed policy instead.

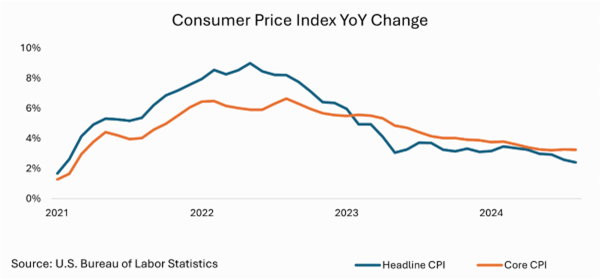

The September Consumer Price Index report was hotter-than-expected at the headline (actual 0.2%; expected 0.1%) and core (actual 0.3%; expected 0.2%) level. The year-over-year growth rate of core-CPI increased to 3.3% from 3.2% in August and the growth rate of headline CPI slowed to 2.4% from 2.5% in August.

Some positive news from the report was that the shelter component, which has been the biggest driver of core inflation, saw its smallest increase (+0.2%) since June. Investors also received weekly jobless claims, which totaled 258,000 versus last week's count of 225,000.

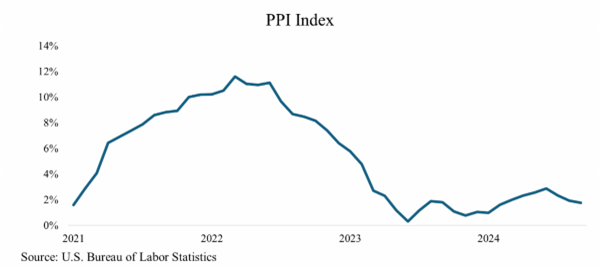

Other data included the September Producer Price Index and preliminary consumer sentiment data from October, which also supported the idea that the Fed will continue cutting rates.

The market didn't react much to the minutes for the September 17–18 FOMC meeting, which didn't contain any surprises. The minutes showed that almost all participants saw upside risks to the inflation outlook as having diminished, while downside risks to employment were seen as having increased.

By the end of the week, market participants were digesting some earnings results from influential names in the financial space. JPMorgan Chase, Wells Fargo, and BlackRock all received positive responses to their good earnings results.

The third quarter earnings season kicked off last week with initial results coming out better than expected. With 6% of S&P 500 companies reporting, the index’s blended growth rate for the quarter is 4.1% (Source: Factset).

The better-than-expected results last week came on the back of several large banks: JPMorgan Chase, Wells Fargo, and BNY Mellon.

Earnings season will continue this week with a little under 10% of S&P 500 companies reporting. We will receive reports from Bank of America, Johnson & Johnson, United Airlines, Walgreens, Goldman Sachs, Netflix, and Procter & Gamble among others.

On the economic front, the Retail Sales and Industrial Production reports will be released on Thursday.

Have a wonderful week!!

Michael D. Hilger, CEP®

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The S&P 500 is an unmanaged index of widely held stocks that is generally representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs and other fees, which will affect investment performance. Individual investor’s results will vary. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The NASDAQ-100 (^NDX) is a modified capitalization-weighted index. It is based on exchange, and it is not an index of U.S.-based companies. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

U.S. government bonds and Treasury notes are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return, and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury notes are certificates reflecting intermediate-term (2 - 10 years) obligations of the U.S. government.

The companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapit obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.

If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.