The Week in Review: 9/30/2024

"What we learn from history is that people don't learn from history." – Warren Buffett

Good Morning ,

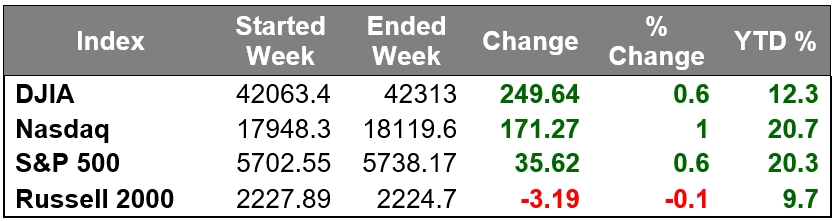

Last week left the markets modestly higher apart from small caps…our markets have advanced for 3 straight weeks.

The market's attention was largely focused on China during the past week, as the country's officials announced a raft of measures aimed at boosting consumption, property demand, and stock market liquidity.

The People's Bank of China lowered its reserve requirement ratio, the repurchase rate, the medium-term lending facility rate, and hinted at a potential cut to the loan prime rate.

A flood of fiscal spending was also announced with upcoming bond issuance expected to reach roughly half of the amount spent to counter the Great Financial Crisis.

Chinese equities soared in response jumping 13.0% for the week while risk assets in Europe and the U.S. also showed strength, though ongoing pressure on the price of crude kept growth concerns at the back of the market's mind.

There was also renewed strength in semiconductor names after Micron beat quarterly expectations and issued strong guidance. The stock rallied to a two-month high, taking the PHLX Semiconductor Index for the ride (+4.3% for the week).

Longer-dated Treasuries ended the week with slight losses, while the 2-yr note eked out a gain as rate cut expectations increased.

At the end of the week, the fed funds futures market was pointing to a 54.8% implied likelihood of another 50-basis point cut in November, up from 50.4% a week ago.

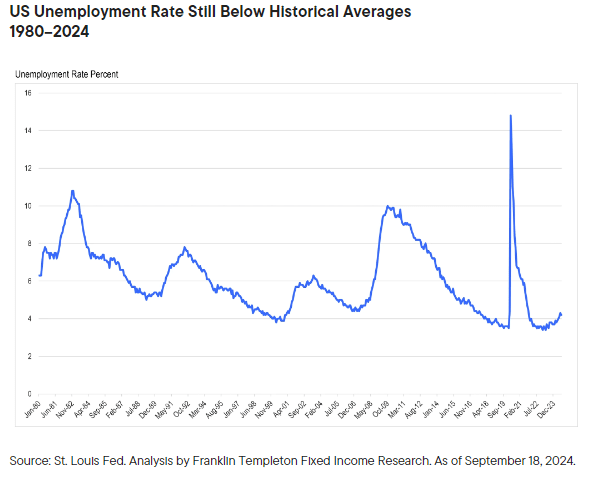

It is important to keep things in perspective regarding interest rates… historically, the Unemployment Rate is not that high.

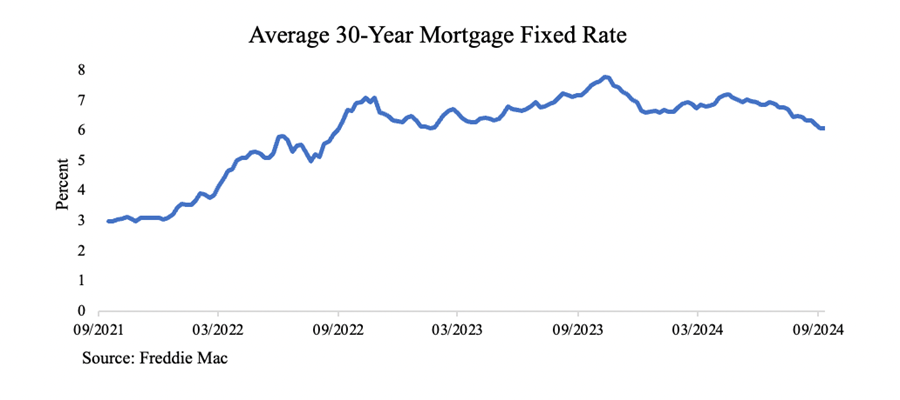

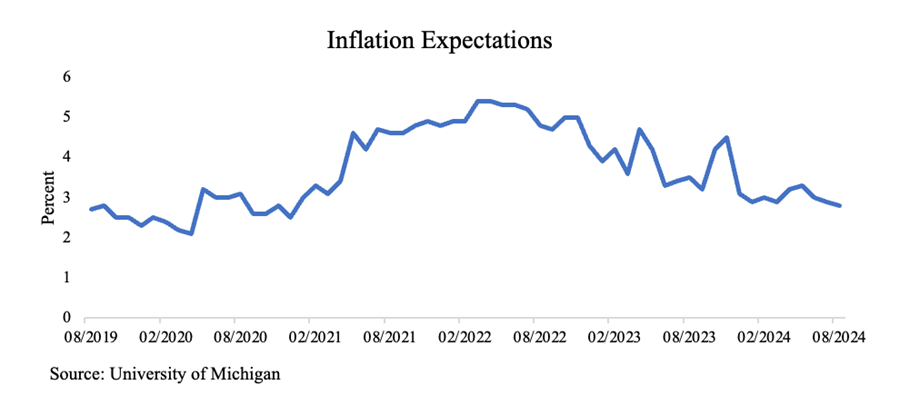

Mortgage rates are falling, and Inflation is in check… that is why the Fed is comfortable lowering rates…

Mortgage refinancings jumped 20% since April 2022.

Market Snapshot…

- Oil Prices – Oil prices suffered a weekly loss with the prospect of growing supplies coming from Saudi Arabia. West Texas Intermediate crude was down 51 cents or 0.5% to settle at $68.18 a barrel, while Brent crude futures were down 38 cents, or 0.4% to $71.98 a barrel.

- Gold– Gold prices were heading for their best quarter in more than eight years. Spot gold was down 0.7% to $2,651.88 per ounce. U.S. gold futures rose 1.2% to $2,643.30. Silver finished the week at $31.816.

- U.S. Dollar– The dollar fell to 100.3 last week after the inflation readings signaled price pressures continued to fade. The dollar index was down 0.17% at 100.43. Euro/US$ exchange rate is now 1.119.

- U.S. Treasury Rates– The U.S. 10-year Treasury yield fell about 3.5 basis points at 3.756% after inflation data showed the rate of price increases is near the Fed’s target rate.

- Asian shares were mixed in overnight trading.

- European markets are trading lower.

- Domestic markets are mixed this morning.

This week’s feature will be Friday’s nonfarm payrolls report, which will be the first of two such reports before the Fed’s next policy meeting in November. The Fed’s shift to the labor market focus will lend weight to the importance of this report as it contemplates whether to implement another 50 bps. cut, or a 25 bps. cut at its next meeting. In addition, we will also receive the ISM Manufacturing and Non-Manufacturing reports for September.

Have a wonderful Week!

Michael D. Hilger, CEP

®Managing Director

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The S&P 500 is an unmanaged index of widely held stocks that is generally representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs and other fees, which will affect investment performance. Individual investor’s results will vary. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The NASDAQ-100 (^NDX) is a modified capitalization-weighted index. It is based on exchange, and it is not an index of U.S.-based companies. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks. The Shanghai Stock Exchange Composite Index, is a market composite made up of all the A-shares and B-shares that trade on the Shanghai Stock Exchange. The Nasdaq-100 Index includes 100 of the largest domestic and international non-financial companies listed on The Nasdaq Stock Market based on market capitalization. The Index reflects companies across major industry groups including computer hardware and software, telecommunications, retail/wholesale trade and biotechnology. It does not contain securities of financial companies including investment companies.

U.S. government bonds and Treasury notes are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return, and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury notes are certificates reflecting intermediate-term (2 - 10 years) obligations of the U.S. government.

The companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapit obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.

If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.