The Week in Review: 9/16/2024

“If you only have a hammer, you tend to see every problem as a nail” ~ Abraham Maslow

Good Morning ,

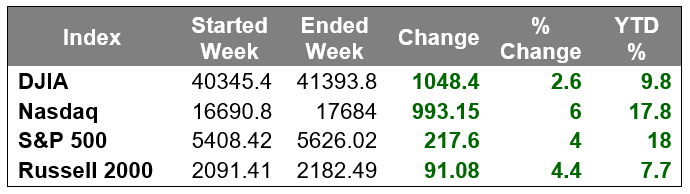

After the worst week of the year, markets rebounded last week with their strongest showing to date.

Buy-the-dip interest was a support factor, along with upside momentum acting as its own catalyst by the end of the week. Many stocks participated, but mega caps and semiconductor shares had a major impact on index gains.

The PHLX Semiconductor Index surged 10.0%. NVIDIA was a standout performer, bouncing 15.8% following the previous week's slide.

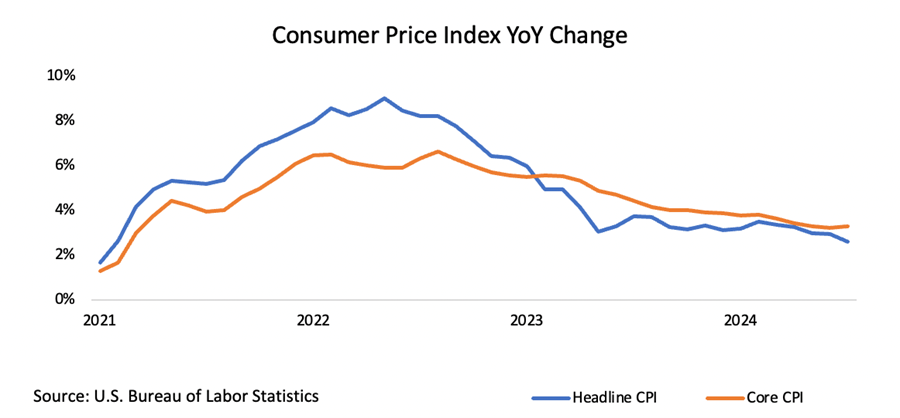

Things looked a little shaky on Wednesday after the August Consumer Price Index stoked selling interest due to the understanding that core-CPI, which excludes food and energy, remained above the Fed's 2.0% target at 3.2% year-over-year.

But stocks quickly recovered, when the S&P 500 held above the previous Friday's low (5,402) on Wednesday's initial retreat. The strength in NVIDIA also helped get stocks back on a winning track.

Other data last week garnered muted responses from stocks and bonds. Initial jobless claims were little changed and remain below recession-like levels at 230,000 and the August Producer Price Index reflected moderating inflation at the wholesale level.

Selling interest in recent weeks was partially based on concerns about economic growth, but this week's price action signaled a shift in that thinking. Small and mid-cap stocks outperformed their larger peers by the end of the week, reflecting the belief that the U.S. economy will enjoy a soft landing and that the Fed will cut rates to secure that soft landing.

Market participants also see a higher likelihood of a 50 basis points rate cut at next week's FOMC meeting compared to one week ago. The fed funds futures market now shows a 45.0% probability of a 50 basis points rate cut in September, up from 30.0% last Friday, according to the CME FedWatch Tool.

The 2-yr yield, which is most sensitive to changes in the fed funds rate, dropped seven basis points this week to 3.58% and the 10-yr yield dropped six basis points to 3.65%.

Only one S&P 500 sector settled lower -- energy (-0.7%) -- while the information technology sector led the pack by a wide margin, climbing 7.3%.

Market Snapshot…

- Oil Prices – Oil prices dropped on Friday as crude production resumed post Hurricane Francine. West Texas Intermediate crude was down 32 cents or 0.5% to settle at $68.65 a barrel, while Brent crude futures was down 36 cents, or 0.5% to $71.61 a barrel.

- Gold– Gold prices went higher on Friday on optimism that the Fed is ready to trim interest rates. Spot gold was up 0.9% to $2,582.05 per ounce. U.S. gold futures rose 1.2% to $2,610.30. Silver finished the week at $31.074.

- S. Dollar– The dollar fell to its lowest level in nearly nine months on speculation the Fed could deliver a super-sized interest rate cut. The dollar was down 0.66% to 140.855 while the dollar index was 0.8% lower to 101.08. Euro/US$ exchange rate is now 1.114.

- S. Treasury Rates– The U.S. 10-year Treasury yield fell about 2 basis points at 3.661% as investors eye interest rate outlook.

- Asian shares were mostly higher in overnight trading.

- European markets are trading lower.

- Domestic markets are trading in the green this morning.

The Fed’s long awaited September meeting will be held Tuesday and Wednesday this week with the expected rate cut decision being announced on Wednesday. It is more or less a foregone conclusion that a rate cut will be announced.

Additionally, the Fed will release its updated Summary of Economic Projections, a report which shows the participants outlook on interest rates in addition to other economic factors. The report could indicate how aggressive of a cutting cycle we might expect in the coming months.

Investors believe the Fed is torn between a 25 bps. (0.25%) and 50 bps. (0.50%) rate cut... A 50 bps. cut now could push back subsequent rate cuts, while a 25 bps. cut could start a more gradual pace.

Other central banks will also be making interest rate decisions this week, including the Bank of England and Bank of Japan. The last Bank of Japan decision instigated a global sell off. With over a dozen central banks making interest rate decisions this week, it could prove to be a volatile one.

Have a wonderful week!!

Michael D. Hilger, CEP®

Managing Director

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The S&P 500 is an unmanaged index of widely held stocks that is generally representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs and other fees, which will affect investment performance. Individual investor’s results will vary. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The NASDAQ-100 (^NDX) is a modified capitalization-weighted index. It is based on exchange, and it is not an index of U.S.-based companies. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

U.S. government bonds and Treasury notes are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return, and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury notes are certificates reflecting intermediate-term (2 - 10 years) obligations of the U.S. government.

The companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapit obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.

If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.