The Week in Review 12/11/23

"Two things define you: Your patience when you have nothing and your attitude when you have everything." – George Bernard Shaw

Good Morning ,

After struggling earlier in the week, a bustling economy and a strong jobs report helped the markets find traction in the latter half of the week to rally back for their sixth straight weekly gain.

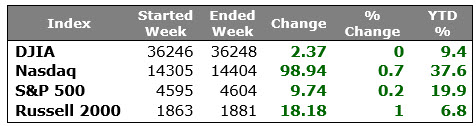

The major indices closed the week with modest gains. There was not a lot of conviction from either buyers or sellers due in part to a growing sense that the market is overbought on a short-term basis. For the S&P 500, Friday's close at 4,604 marked an 11.8% rise off its October 27 low (4,117) and set a new 52-week high for the index.

Alphabet was a winning standout from the mega-cap technology space, gaining 2.5% on the week after jumping more than 5.0% during Thursday's session following its Gemini AI model reveal.

That move helped propel the communication services sector to a 1.4% gain this week. The consumer discretionary sector was another top performer, climbing 1.1%. Meanwhile, the energy sector saw the largest decline (-3.3%) as oil prices dropped 3.5% to $71.18/bbl. The materials (-1.7%) and consumer staples (-1.3%) sectors also registered noticeable declines.

Market participants were dealing with some crosscurrents last week. Renewed concerns about global growth emerged after Moody's downgraded China's credit outlook to Negative from Stable, which was tied in part to concerns about structurally weaker growth prospects, and the October JOLTS - Job Openings Report showed the lowest number of job openings (8.733 million) since March 2021.

Other economic data, however, fit with the soft-landing narrative for the economy. That was good news for earnings, but may be bad news for rate-cut expectations. The ISM Non-Manufacturing Index for November rose to 52.7% from 51.8%, the weekly jobless claims numbers remain consistent with a robust labor market, the November Employment Situation report was deemed solid overall, and the preliminary University of Michigan Index of Consumer Sentiment for December was stronger than expected.

The fed funds futures market is no longer pricing in a rate cut in March following this week's data, but it still sees a strong likelihood of a cut in May (78.5% on Friday), according to the CME FedWatch Tool.

Treasuries settled the week with losses, largely in response to the release of the jobs report on Friday. The 2-yr note yield climbed 18 basis points to 4.74% and the 10-yr note yield rose two basis points to 4.25%. This price action put some renewed pressure on the 2s10s spread, which tightened by 16 bps to -49 bps.

In other news, cryptocurrencies made big moves higher this week, leaving Bitcoin at $44,241.

Market Snapshot…

- Oil Prices – Oil prices rallied but notched their seventh straight week of losses amid production and demand worries. West Texas Intermediate crude futures (WTI) rose $1.89, or 2.73% to close at $71.23 a barrel. Brent crude gained $1.79, or 2.42%, to close at $75.84 a barrel.

- Gold– Gold prices retreated under $2,000 as the dollar and treasury yield strengthened. Spot Gold fell 1.3% to $2,002.80 per ounce while U.S. gold futures also settled 1.3% lower to $2,019.1. Silver closed out the week at $23.276.

- U.S. Dollar– The dollar rose on job growth news and the drop in unemployment. The dollar index was up 0.4% and was at 103.99. Euro/US$ exchange rates are now 1.075.

- U.S. Treasury Rates– Treasury yields jumped on Friday after news that the unemployment rate unexpectedly fell. The yield on the 10-year Treasury note was up by 10 basis points to 4.233%.

- Asian shares were higher in overnight trading.

- European markets are trading mixed.

- Domestic markets are trading mixed this morning.

This week will feature several important economic reports, including November’s inflation CPI and PPI reports, Retail Sales, Industrial Production, and Manufacturing Production. However, the highlight of the week will be the Fed’s last FOMC meeting of 2023.

Barring any major surprises from those inflation reports, the Fed will in all likelihood maintain the federal funds rate at its current level. More attention will be spent on the release of its updated economic projections. Updated quarterly, the report provides a fresh view of how FOMC participants view various aspects of the economy, including projections for inflation, economic growth, and interest rates in the short term and long term.

Fed narrative has been holding to “higher for longer,” but this report may shine additional light on how long. According to CME’s FedWatch tool, the market believes rate cuts will begin in either March or May next year, while the Fed has been guiding toward the second half of the year.

Have a wonderful week!!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

The prominent underlying risk of using cryptocurrencies as a medium of exchange is that they are not authorized or regulated by any central bank. Cryptocurrency users are not registered with the SEC, and the cryptocurrency market is currently unregulated. Bitcoin and other cryptocurrencies are a very speculative investment and involve a high degree of risk. Investors must have the financial ability, sophisticated/experience and willingness to bear the risks of an investment, and a potential total loss of their investment.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.

If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.